Your car knows a lot more about you than you think. Every time you take a sharp turn, start the engine, or even answer a call, your car could be silently collecting and sharing that information without your consent to third parties.

While this may not seem like a big deal, sensitive data about your personal life could fall into the hands of employers, marketers, or even criminals. It can also affect your auto insurance rates if your driving data is sold to auto insurers.

What Is Telematics and Why Does It Matter

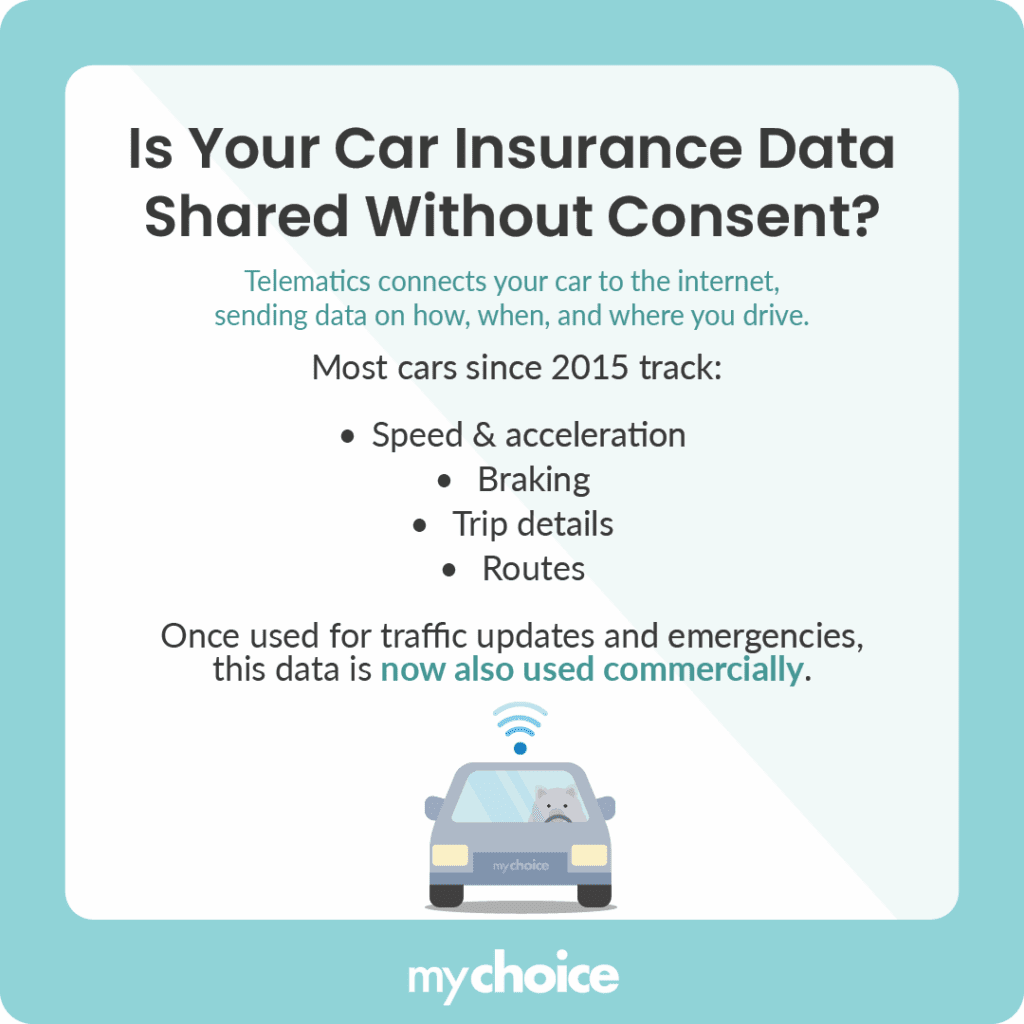

Telematics is the technology that connects your car to the internet, allowing it to transmit data about your driving. Think of it as the way your car “phones home”, giving updates on your activities behind the wheel.

Most cars manufactured after 2015 will have some kind of telematics system. These systems can track an impressive array of information, such as:

- How quickly you accelerate

- Where and when you travel

- How long your trips take

- How hard you brake

This technology was originally developed to provide real-time traffic updates or help with immediate connectivity for situations like emergency responses after a car accident. However, because manufacturers have realized that this information is commercially valuable, the scope of modern cars’ data collection has since expanded dramatically.

Is Your Car Insurance Data Being Shared Without Consent?

Recent investigations suggest that major automakers have been gathering driving data and sharing it directly with data brokers or insurance companies. Unfortunately, many manufacturers do this without getting drivers’ explicit consent, simply by burying the knowledge in the terms and conditions of their lease or purchase.

Let’s say you bought or leased a new car. In many cases, you may be asked to sign up for various connected services, such as roadside assistance and maintenance reminders. Somewhere in the terms for those services may be clauses that allow the auto manufacturer to share your driving data with third parties.

Because many drivers may not read these terms thoroughly, they may not be aware of what they just agreed to, leading their data to be collected and sold or shared. While auto insurers collect some personal information from you during your sign-up process, they’re also legally allowed to collect information from sources like motor vehicle agencies.

If you’ve noticed a sudden increase in your insurance premiums after upgrading to a new car, check your car’s deed of sale. You may have unwittingly given your manufacturer (and potentially, your insurer) access to telematics data that can show “risky” driving behaviour like hard braking or driving late at night.

What Canadian Law Says

While much of the data gathered by telematics isn’t legally considered “personal information” under U.S. federal privacy laws, Canadian privacy laws are generally more protective of consumers. Under Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA), companies need to obtain “meaningful consent” before collecting, using, or sharing your personal information.

“Meaningful consent” isn’t just a checkbox to tick off: it means consumers must understand:

- What data is being collected

- How it will be used

- Who it might be shared with

Meaningful consent typically requires opt-in approaches, which means companies should explicitly ask for your permission before collecting your data. They can’t just assume drivers agree to it unless they explicitly object.

Quebec is even stricter when it comes to privacy protection, with steep fines of up to $25 million or 4% of global revenue for companies (whichever value is higher) that violate their rules.

These huge penalties are intended to make corporations think twice before doing anything with personal data. However, the challenge is that many Canadian drivers don’t know their data privacy rights at all, so they can’t exercise them effectively.

What Could Go Wrong?

The risk of unauthorized data consent targets something apart from your privacy: your wallet. Insurance companies are becoming increasingly interested in telematics data because it lets them assess risk on an individual basis, instead of relying on broad demographics.

This sounds fair on the surface: good drivers could potentially get lower rates. But the reality is more complicated, as your premiums could increase based on data you didn’t even know you were sharing and could be misinterpreted.

Take these situations:

- Braking hard to avoid someone running into the road

- Driving late at night to pick a family member up from the airport

- Suddenly accelerating to avoid a tailgater

- Frequent short trips for school drop-offs or caring for elderly family members nearby

All of these could be flagged as “risky” behaviour, even though they actually represent responsible driving. Because systems don’t understand the causes behind those actions, the lack of context can lead to unfair risk assessments and higher premiums.

What You Can Do to Protect Your Privacy

Now that you know more about your rights to data privacy, there are practical steps you can take to protect your personal information:

Key Advice from MyChoice

Be mindful about connecting your phone to your car. Some features sync highly sensitive information like your location history, contacts, and messages. overall difference between these two brands is negligible, so choosing which one you want to purchase depends on which factor matters more to you.

Disable features that aren’t essential to prevent unauthorized data collection. For example, you can keep emergency services and collision detection active, but you may want to disable location tracking for features like finding nearby restaurants.

Audit your current connected services and go through your car’s connected features. You may have multiple data-sharing agreements active without even realizing it.