Driving a car comes with a lot of uncertainty. For example, you never know when your car can break down while driving on a highway. Your battery might die unexpectedly, and you don’t know how to boost a car battery. In these situations, a roadside assistance plan can really help you out.

A roadside emergency can be a very stressful experience. Thankfully, having a roadside assistance plan can minimize that stress and get you out of some sticky situations. If your car breaks down during a snowstorm or in other extreme circumstances, a roadside assistance plan can even save your life.

Keep reading to learn more about roadside assistance and the best programs in Canada.

What Is a Roadside Assistance Program?

A Roadside Assistance Program helps drivers who experience problems with their vehicles while driving. These problems can include things like a flat tire, a dead battery, running out of gas, or even getting locked out of the car. You can avail of roadside assistance from your insurer, a separate roadside assistance provider, or your car manufacturer.

Unlike mandatory insurance, you don’t need to have a road assistance program to be able to drive. However, it’s very useful to have roadside assistance, as you never know when you’ll encounter an emergency on the road.

Why You Should Get Roadside Assistance

You should get roadside assistance for your peace of mind. It’s a great comfort to know that you can get help quickly in the event of an emergency or unexpected issue while on the road. Additionally, it can help drivers save money, as the cost of towing or other services can be expensive without a roadside assistance plan.

Roadside assistance is especially useful if you plan on going on a long road trip. Driving longer distances exposes you to more risk, so it’s important to make sure that you’re protected from anything that can potentially happen to you or your vehicle.

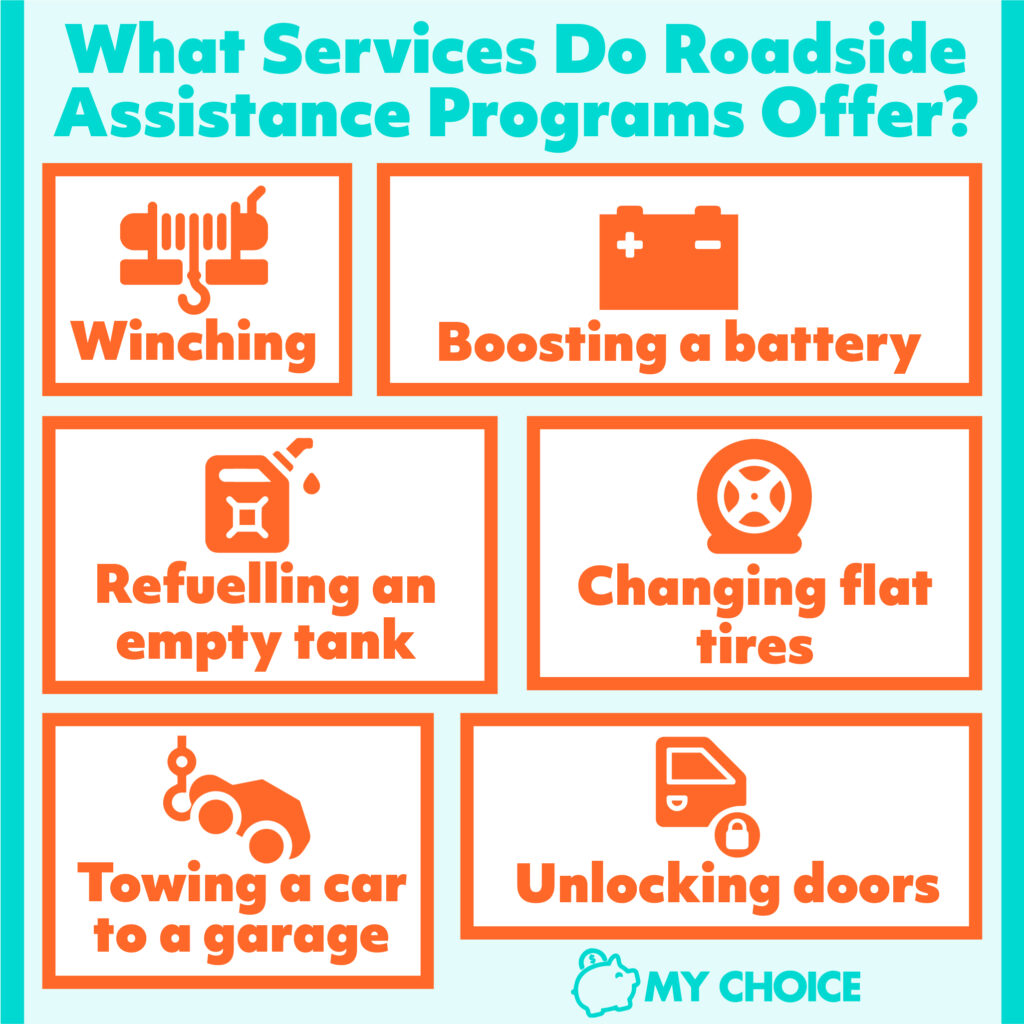

What Services Do Roadside Assistance Programs Offer?

Roadside assistance programs typically offer the following services:

- Changing flat tires

- Unlocking doors

- Refuelling an empty tank

- Winching

- Boosting a battery

- Towing a car to a garage

You can only avail of these services a certain number of times per year. The number of times you can call for these services depends on your roadside assistance provider.

There may also be other limits to these services. These limits include the distance your car can be towed to a garage and the maximum amount of fuel that can be delivered to you.

The Best Roadside Assistance Programs in Canada

Depending on your needs, some programs might be better for you than others. To choose the right Ontario roadside assistance program, consider how much you can afford to pay, where you plan to go, and what kinds of services you think you’ll need.

To help you choose the best roadside assistance plan for you, we’ve compiled some of the best roadside assistance in Canada below.

The Best Roadside Assistance Programs From Insurers

Many insurers offer roadside assistance plans with a coverage plan. Here are some of the best roadside assistance plans offered by insurers and independent roadside assistance programs offered by other companies.

Below is a table breakdown of the features of each insurer, based on their basic or entry-level plans:

| Criteria (Basic plan) | Canadian Tire | CAA | Access Roadside Assistance | Desjardins Roadside Assistance | Intact Insurance | Allstate Roadside Assistance | Beneva |

|---|---|---|---|---|---|---|---|

| Cost per year | $69.95 | $75 | $69.95 | $98.89 | Varies | Varies | $35 |

| Service calls per year | 3 | 4 | 5 | 5 | 4 | 4 | 4 |

| Towing limit per call | 10 km | 10 km | 7.5 km | 10 km | 50 km | 50 km | 50 km |

| Battery service | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Lockout service | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Emergency fuel delivery | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Free fuel | N/A | N/A | N/A | N/A | Up to 10 L | Up to 10 L | Up to 10 L |

| Flat tire changes | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Winching and recovery service | ✔ | N/A | Add-on | ✔ | ✔ | ✔ | N/A |

| Exclusive member discounts | ✔ | ✔ | N/A | N/A | N/A | N/A | N/A |

Canadian Tire

Canadian Tire has a reputation for being one of the leaders in road safety. It offers a few different plans with varying levels of coverage.

| Criteria (Basic plan) | Canadian Tire | CAA |

|---|---|---|

| Cost per year | $69.95 | $99.95 |

| Service calls per year | 3 | 5 |

| Towing limit per call | 10 km | 200 km |

| Unlimited tows to Canadian Tire Auto Service Center | Up to 25 km | Up to 200 km |

| Battery boost service | ✔ | ✔ |

| Flat tire changes | ✔ | ✔ |

| Winching & extraction service | 1 tow truck, up to 20 minutes | 2 tow trucks, up to 60 minutes |

| Lockout service | ✔ | ✔ |

| Emergency fuel delivery | Free delivery, cost of fuel is extra | Free delivery w/ $5 free fuel |

| Exclusive member discounts | ✔ | ✔ |

CAA

CAA is an automotive club that has a yearly membership. It offers three levels of membership, each with varying levels of roadside assistance coverage.

| CAA Plans | Basic | Plus | Premier |

|---|---|---|---|

| Cost per year | $75 | $119 | $149 |

| Service calls per year | 4 | 4 | 5 |

| CAA Car coverage | ✔ | ✔ | ✔ |

| CAA Bike coverage | ✔ | ✔ | ✔ |

| CAA Motorcycle coverage | N/A | ✔ | ✔ |

| Towing limit per call | 10 km | 200 km | 320 km for 1 call, 200 km for 4 calls |

| CAA Mobile battery service | ✔ | ✔ | ✔ |

| CAA Bike Assist | ✔ | ✔ | ✔ |

| CAA Road Trip Accident Assistance | ✔ | ✔ | ✔ |

| CAA Road Trip Interruption Assistance | N/A | N/A | ✔ |

| Vehicle return benefit | N/A | N/A | ✔ |

| Optional RV coverage | N/A | + $67/year | + $67/year |

| Emergency fuel delivery | Free delivery, cost of fuel is extra | Free delivery with free fuel | Free delivery with free fuel |

| Exclusive member discounts | On the purchase of a CAA Premium Battery | On the purchase of a CAA Premium Battery | Discounts + $20 CAA credit on the purchase of a CAA Premium Battery |

Note that Road Trip Accident Assistance and Road Trip Interruption Assistance can only be used if your trip is 200 km or more away from the CAA member’s primary residence.

Access Roadside Assistance

Whether you drive short or long distances, regularly or infrequently, Access Roadside Assistance has a variety of plans that cover almost every driver’s needs:

| Access Roadside Assistance Plans | Basic | Advantage | Premium | Elite |

|---|---|---|---|---|

| Cost per year | $69.95 | $99.95 | $249.95 | $495.95 |

| Service calls per year | 5 | 5 | 6 | 7 |

| Covers | Membership holder only | Membership holder & registered vehicles | Membership holder & registered vehicles | Membership holder & registered vehicles |

| Car coverage | ✔ | ✔ | ✔ | ✔ |

| Motorcycle coverage | Up to half-ton load capacity | Up to 1-ton load capacity | Up to 1-ton load capacity | Up to 1-ton load capacity |

| Tows to closest garage | N/A | ✔ | ✔ | ✔ |

| Battery boost service | 2, up to 7.5 km | 2, up to 140 km; or 1 up to 280 km | 2, up to 200 km; or 1 up to 400 km | 3, up to 200 km; or 1 up to 400 km |

| Flat tire changes | ✔ | ✔ | ✔ | ✔ |

| Winching & recovery | ✔ | ✔ | ✔ | ✔ |

| Lockout service | Add-on | Add-on | Add-on | Up to 1 hour |

| Optional RV coverage | Up to $50 | Up to $100 | Up to $200 | Up to $200 |

| Optional RV coverage | N/A | + $25/year | + $40/year | + $40/year |

| Emergency fuel delivery | Free delivery, cost of fuel is extra | Free delivery w/ $15 free fuel | Free delivery w/ $25 free fuel | Free delivery w/ $50 free fuel |

| Emergency cab fare | N/A | N/A | $50 | 4150 |

The Access Roadside Assistance Elite membership also includes the following special perks:

- Two emergency hotel stays a year, up to four days per stay at $250 per day

- Food allowance of $100 per day

- Two one-way airline tickets per year, worth up to $500

- Vehicle rental for up to four days, up to $120 per day

Keep in mind that, with Access Roadside Assistance, you don’t get to choose which service center your car gets towed to. It will bring your car to the nearest one available.

Desjardins Roadside Assistance

Unlike other providers, Desjardins Roadside Assistance only has one kind of membership. If you take out a roadside assistance plan with Desjardins, both you and your vehicle are covered.

This means that you can avail of roadside assistance regardless of what vehicle you’re driving. Your primary vehicle is also eligible for assistance, regardless of who is driving. This flexible option is especially useful if you drive other vehicles regularly or if your primary vehicle is driven by other people.

| Desjardins Roadside Assistance Plan | |

|---|---|

| Cost per year | $98.95 |

| Service calls per year | 5 |

| Towing limit per call | 10 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Winching & recovery service | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery, cost of fuel is extra |

Intact Insurance

When you take out a car insurance policy from Intact Insurance, you have the option to get roadside assistance as an add-on. Intact Insurance doesn’t only provide roadside assistance for cars and trucks but also for recreational vehicles, motorcycles, all-terrain vehicles, and snowmobiles.

The cost of Intact Insurance’s roadside assistance depends on your insurance plan and your primary address. Here’s what you get with Intact Insurance’s roadside assistance plan:

| Intact Insurance Plan | |

|---|---|

| Cost per year | Varies, add-on to insurance plan |

| Service calls per year | 4 |

| Towing limit per call | 50 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Winching & recovery service | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery w/ up to 10 L free fuel |

Allstate Roadside Assistance

Allstate Insurance provides roadside assistance with its vehicle insurance policies. However, the cost of roadside assistance depends on your specific policy.

Make sure to take out a policy with the roadside assistance option if you don’t intend to pick up a different roadside assistance plan from a different provider. Allstate Insurance’s roadside assistance plan covers your vehicle anywhere in Canada and the United States except for Alaska and Hawaii.

Here’s what you get with Allstate Insurance’s roadside assistance plan:

| Allstate Roadside Assistance Plan | |

|---|---|

| Cost per year | Varies, add-on to insurance plan |

| Service calls per year | 4 |

| Towing limit per call | 50 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Winching & recovery service | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery w/ up to 10 L free fuel |

Beneva

When you take out a car insurance policy from Beneva, you only need to add $35/year to avail of its roadside assistance program for your car or truck. If you take out insurance for your motorcycle, recreational vehicle, travel trailer, or mobile home, Beneva includes roadside assistance for free.

Here’s what you get with Beneva’s roadside assistance plan:

| Beneva Roadside Assistance Plan | |

|---|---|

| Cost per year | $35, add-on to insurance policy |

| Service calls per year | 4 |

| Towing limit per call | 50 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery w/ up to 10 L free fuel |

The Best Roadside Assistance Programs From Manufacturers

Some car dealerships will include a roadside assistance plan for a certain number of years when you buy a new car from them. This saves you some money for the first few years of owning a new car. However, once the manufacturer’s roadside assistance plan runs out, you’ll need to take out another plan from a different provider.

Below is a table breakdown of the top Canadian roadside assistance programs from manufacturers:

| Toyota | Honda | Hyundai | |

|---|---|---|---|

| Cost per year | 3 years | 3 years | 5 years |

| Service calls per year | 50 km | 100 km | 100 km |

| CAA Car coverage | ✔ | ✔ | ✔ |

| CAA Bike coverage | ✔ | ✔ | ✔ |

| CAA Motorcycle coverage | ✔ | ✔ | ✔ |

| Towing limit per call | Up to 5 L | N/A | N/A |

| CAA Mobile battery service | ✔ | ✔ | ✔ |

| CAA Bike Assist | ✔ | Reimbursement up to $200 | ✔ |

Toyota Roadside Assistance

If you buy a new Toyota, they include a free roadside assistance plan for up to three years. Toyota’s roadside assistance plan covers your vehicle anywhere in Canada and the United States.

If you can’t reach Toyota’s roadside assistance for any reason, Toyota may reimburse you if you need to use other emergency services. You can be reimbursed for up to $100 for emergency services and $250 for towing.

Here’s what you get with Toyota’s roadside assistance plan:

| Toyota Roadside Assistance Plan | |

|---|---|

| Length of coverage | 3 years |

| Towing limit per call | Up to 50 km to your preferred Toyota dealer or the closest dealership within 300 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Winching & recovery service | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery w/ up to 5 L free fuel |

Honda Roadside Assistance

Buying a new Honda car entitles you to three years of free Honda Plus Roadside Assistance. The Honda Plus Roadside Assistance program covers your vehicle anywhere in Canada, the United States, and Puerto Rico.

| Honda Plus Roadside Assistance Plan | |

|---|---|

| Length of coverage | 3 years |

| Towing limit per call | Up to 100 km to your preferred Toyota dealer or the closest dealership within 500 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Winching & recovery service | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery, cost of fuel is extra |

| Trip planning service | ✔ |

| Emergency message service | ✔ |

| Dealer locator service | ✔ |

| Emergency transportation fund | $200 |

| Car rental fund | $45/day for 5 days |

If your car breaks down 100 km or more away from your primary residence, you can avail of the Honda Plus Trip Interruption Assistance. With this, Honda will provide up to $500 for your accommodation, car rental, and meals.

Hyundai Roadside Assistance

Purchasing a new Hyundai car entitles you to five years of free Hyundai Roadside Assistance for 2015 and later models and three years for 2014 and earlier models. The Hyundai Roadside Assistance plan covers your new Hyundai anywhere in Canada and the United States.

| Hyundai Roadside Assistance Plan | |

|---|---|

| Length of coverage | 3 years |

| Towing limit per call | Up to 100 km |

| Battery boost service | ✔ |

| Flat tire changes | ✔ |

| Winching & recovery service | ✔ |

| Lockout service | ✔ |

| Emergency fuel delivery | Free delivery, cost of fuel is extra |

| Trip accident assistance service | ✔ |

| Minor repairs on-site | ✔ |

If your car breaks down 100 km or more away from your primary residence, Hyundai’s trip accident assistance service will reimburse you for up to $300 for your accommodation, transportation, and meals.

The Bottom Line

Driving in Canada can present many unforeseen issues, and you’ll likely need a helping hand. Fortunately, there are several roadside assistance programs that can help you out in a pinch. You can avail of emergency services, transportation, and other assistance that can get you out of a tight spot.

If you’re looking for comprehensive coverage and quality service, you can compare auto insurance options through MyChoice. We can help you find the best car insurance company with a roadside assistance plan that matches your budget.