If you’re planning to import your dream car from overseas, you need to be extra mindful of the unique insurance challenges that importing can present. Registering and insuring an imported car in Canada comes with its own set of steps, costs, and considerations.

Does insuring an imported car cost more? Can you import cars from anywhere? How do you lower auto insurance premiums for imported cars? Read on to learn all you need to know about insuring an imported car.

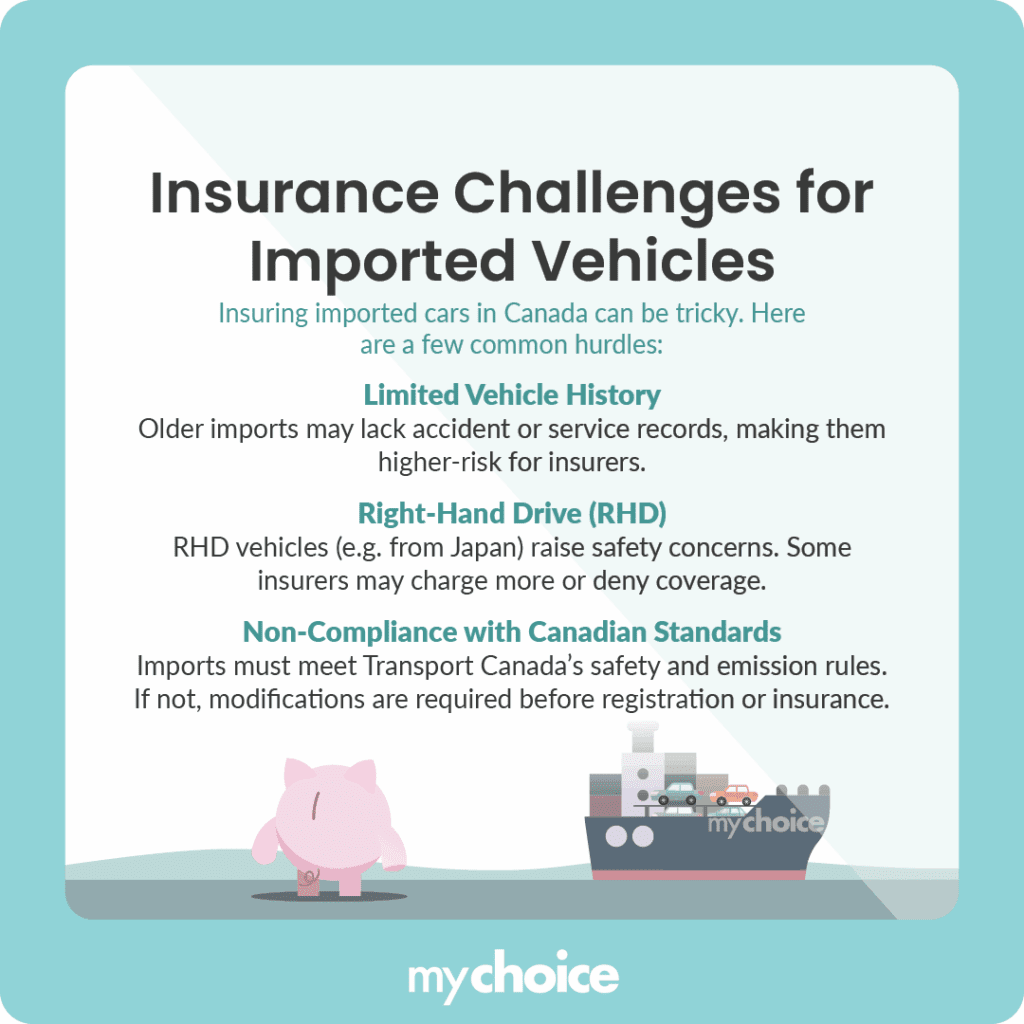

Unique Insurance Hurdles for Imported Vehicles

Imported cars can be seen as a greater liability for insurers to cover. Here are a few challenges you might run into when looking to insure an imported vehicle:

How to Register & Insure an Imported Car Step-by-Step

The process of registering and insuring your imported vehicle depends a bit on where it’s coming from. Here’s a step-by-step guide to registering and insuring your newly imported car:

Are Imported Cars More Expensive to Insure?

Yes, imported cars are typically more expensive to insure. Most imported vehicles fall into higher-risk categories, even if they’re in good condition. Here are some factors that play a part in the higher insurance premiums of imported cars:

- Repairs may be delayed or cost more due to the limited availability of parts.

- Some imports lack advanced safety features that lower premiums in domestic cars.

- Imported cars may be more prone to theft.

- If the model isn’t sold in Canada, insurers may not have sufficient actuarial data to estimate risks, resulting in a high-risk classification.

Advanced Tips to Lower Premiums on Imported Cars

Imported cars may typically cost more to insure, but there are a few ways to lower those premiums:

Key Advice from MyChoice

- Compare insurance quotes using MyChoice’s online insurance comparison tool. Not every insurer is willing to cover imports, but those that do may offer vastly different quotes, so shop around for the best deal.

- Disclose all information about your imported car upfront. Hidden modifications or missing paperwork can void your policy or cause a delay in processing a claim.

- Keep all records related to your imported vehicle. Having a complete paper trail handy, from the bill of sale to RIV inspection results, can help you with registration and insurance approval.