Getting into a car accident can happen anytime, and when it does, it can be a very stressful situation. To make things even more overwhelming, you might find yourself thinking, “Am I at fault here?” Fault determination rules can be confusing, but they cover many common accident scenarios.

If you’re from Ontario, knowing the provincial fault determination rules can help you prepare for an otherwise intimidating and stressful situation. Let’s break down how fault is decided according to these rules after a crash.

How is Fault Determined in Ontario?

In Ontario, fault in a car accident is assigned on a scale from 0% to 100%. Once you report an accident, your insurance company will likely gather evidence from police reports, witness statements, and photos to find out who’s at fault. You may be found:

- No fault at all – 0%

- Partially at fault – 25%

- Equally at fault – 50%

- Mostly at fault – 75%

- Fully at fault – 100%

These percentages also reflect how much your insurance company and the other driver’s insurer have to pay. If you’re found to be at 50% or more at fault, there’s a good chance that your insurance premium will go up when you renew your policy.

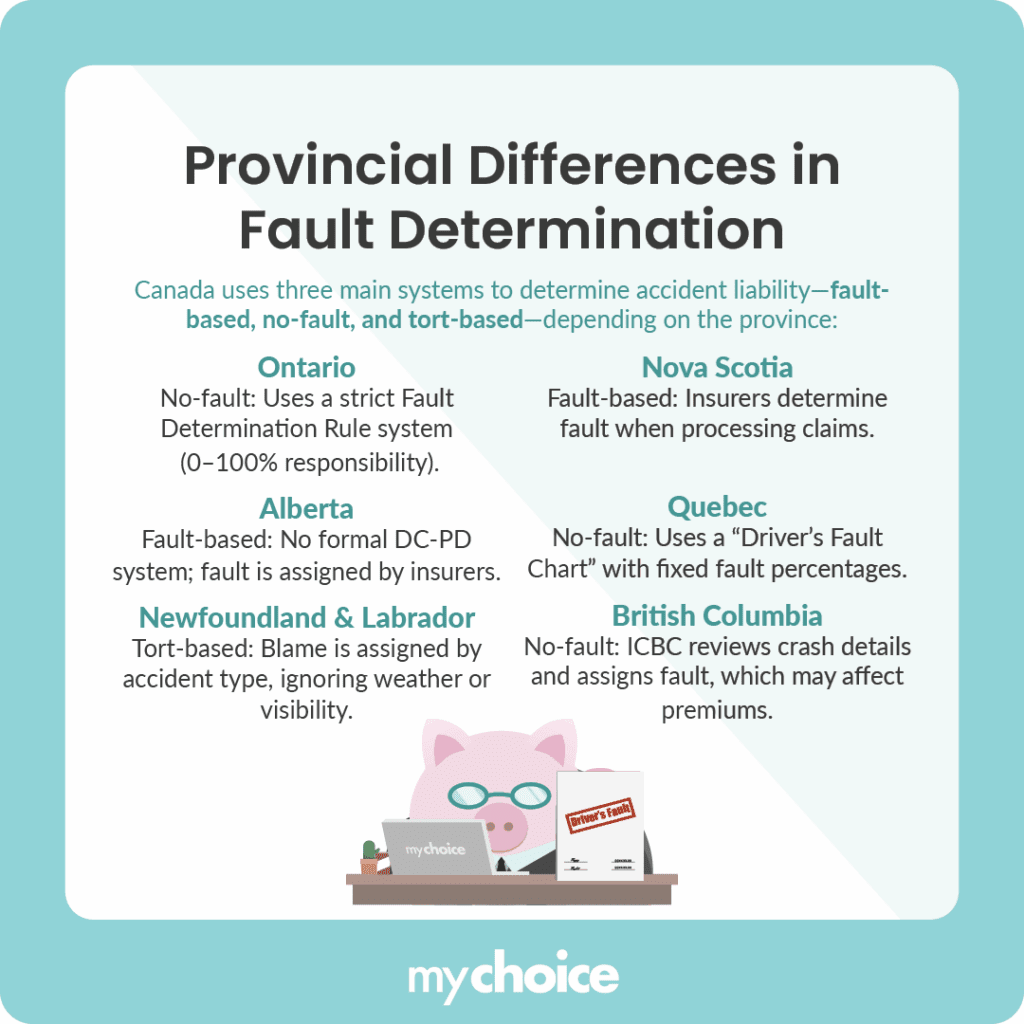

Provincial Differences in Fault Determination

Each province has its own fault determination rules, with Ontario’s system being clearly defined. It’s important to check the fault rules in other provinces across Canada.

When it comes to car insurance, there are three main systems for deciding who pays after an accident: fault-based, no-fault, and tort-based.

- In a fault-based system, the driver found at fault for the accident is responsible for paying damages.

- In a no-fault system, each driver’s insurance covers their own damages, regardless of who caused the accident.

- In a tort-based system, the at-fault driver is liable for the damages to others, and their insurance is used to cover the costs.

| Provinces | Fault Determination System Type | How Fault is Assigned |

|---|---|---|

| Ontario | No-fault | Ontario’s Fault Determination Rules are used to decide who’s at fault and assign a score between 0% and 100%. |

| Alberta | Fault-based | Alberta’s fault determination rules still apply, but there is no specific Direct Compensation for Property Damage (DC-PD) system for fault; it’s about compensation for property damage. |

| Newfoundland and Labrador | Tort-based | Insurers assign each driver’s share of blame using rules based on accident types, without considering weather, visibility, or other conditions. |

| Nova Scotia | Fault-based | Fault determination in Nova Scotia claims is handled by the driver’s own insurers, and the insurer still determines fault for claims processing. |

| Quebec | No-fault | Fault is assigned using a standardized “Driver’s Fault Chart,” similar to Ontario, which matches accident scenarios to fixed fault percentages regardless of speed, weather or visibility. |

| British Columbia | No-fault | The Insurance Corporation of British Columbia (ICBC) assigns fault by carefully reviewing crash details to determine each driver’s degree of responsibility, which can affect future insurance premiums. |

Each system works a bit differently, so it’s important to know which one applies in your province or territory.

The Tech Factor: How Dashcams, Telematics & AI Are Changing the Game

Dashcams have been changing what it means to be a car owner. Initially, these devices simply recorded footage, but now some dashcams have advanced features like machine learning and advanced algorithms to process their surroundings in real time.

Installing dashcams and telematic devices gives drivers and insurers better visibility in the event of an accident. Additionally, insurers can review dashcam footage to settle claims faster, helping to cut down on fraud and investigation costs.

As technology gets smarter and better, telematics apps and devices are tracking even more things like speed, braking, and location in real time. These data points can then show you and your insurers exactly what happened in case of a crash. AI is also stepping in, with some companies developing tools that automatically review dashcam footage and telematics data to recreate how an accident unfolded.

All of these developments make figuring out who’s at fault faster and much clearer. If you want an extra layer of security on the road, consider equipping your car with a dashcam. Having one can make it easier to prove your side of the story in case of an accident.

Key Advice From MyChoice

- Stay updated on fault determination rules to take the guesswork out of sticky situations and feel more confident during the claims process.

- Remember that what applies in one province may not in another, as fault determination rules vary by province.

- Use technology to your advantage by investing in dashcams. They can provide clear proof and backup for your side of the story.