As a driver in Ontario, you’re required to have car insurance to drive legally. In addition to the required car insurance coverage options, you also have optional car insurance coverage that you can get to round out your protection. One of the more popular ones is comprehensive car insurance.

What Exactly Does Comprehensive Auto Coverage In Ontario Include?

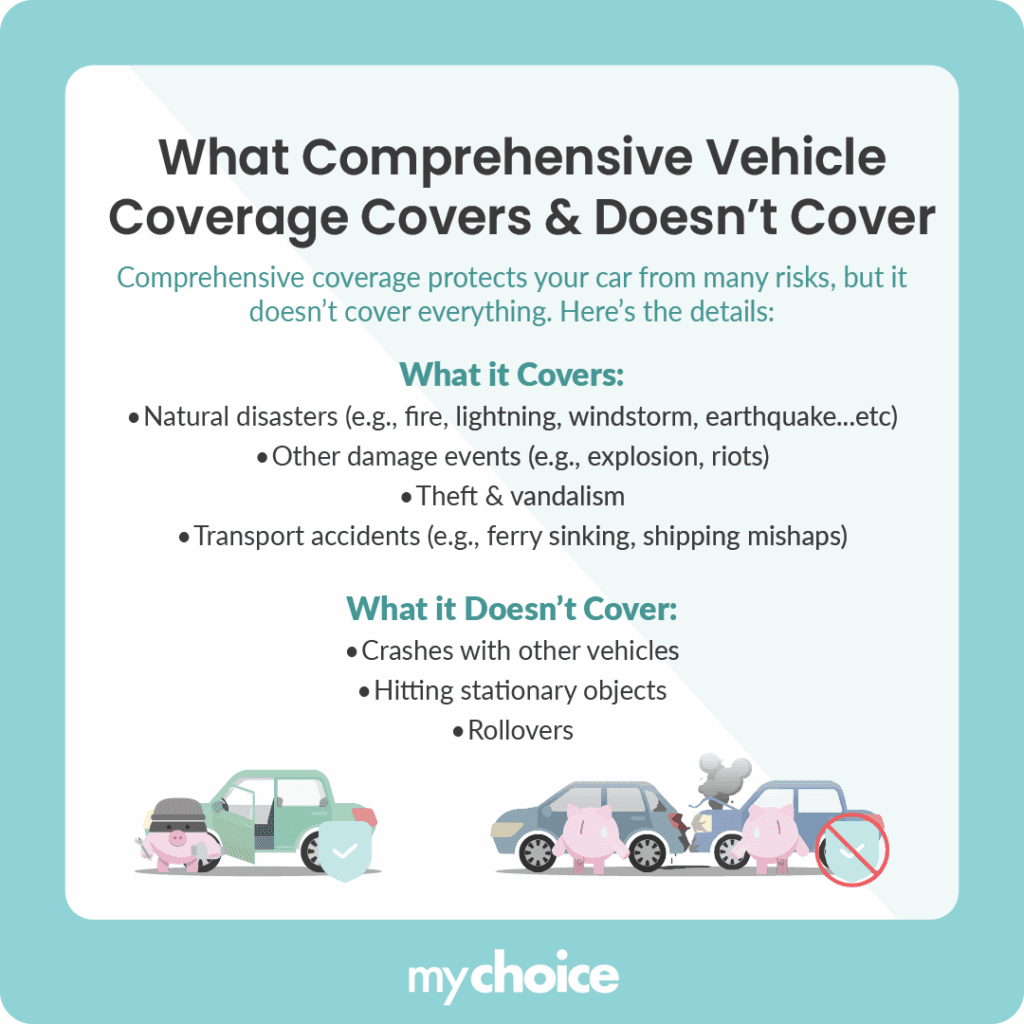

As per the FSRA’s definition, comprehensive vehicle coverage in Ontario pays for losses that aren’t covered by collision or upset coverage. Comprehensive vehicle coverage also protects your car from perils listed under specified perils coverage.

For a more detailed look at what’s covered by comprehensive car insurance and what’s not, check the table below:

| Incident | Covered by Comprehensive Insurance? |

|---|---|

| Fire | Yes |

| Lightning | Yes |

| Windstorm | Yes |

| Hail or water | Yes |

| Earthquake | Yes |

| Explosion | Yes |

| Riots | Yes |

| Theft or vandalism | Yes |

| Land or water accidents involving a vehicle on which your car is carried on, like ferry sinkings or car shipping accidents | Yes |

| Collisions with other vehicles | No, covered by collision coverage |

| Collisions with stationary objects | No, covered by collision coverage |

| Car rollovers | No, covered by collision coverage |

How Much Does Comprehensive Coverage Cost in Ontario?

The average annual cost of comprehensive car insurance in Ontario is approximately $202 per year. If you purchase comprehensive coverage with other mandatory insurance coverages (i.e., third-party liability, accident benefits, and uninsured automobile), your total annual insurance costs in Ontario would be around $1,000.

However, your comprehensive car insurance cost may vary due to various risk factors, such as your accident record and previous driving violations. Different companies may also offer different car insurance premiums.

Comprehensive vs. Collision vs. Specified Perils: Know Your Options

In terms of optional car insurance coverage, most drivers in Ontario have three options: Comprehensive, collision, and specified perils coverage. Each coverage type protects you from different dangers to your car, which we outline in the table below.

| Event | Comprehensive | Collision | Specified Perils |

|---|---|---|---|

| Theft | ✓ | ✓ | |

| Animal collision | ✓ | ||

| Car collision | ✓ | ||

| Falling trees | ✓ | ✓ | |

| Vandalism | ✓ | ✓ |

For specified perils coverage, ensure that the damaging event is listed on your policy first. If not, you may not be covered. You can also opt for all perils coverage (a combination of collision and comprehensive coverage) for more complete insurance protection.

Common Comprehensive Car Insurance Mistakes Ontario Drivers Make

While comprehensive car insurance can be beneficial, certain factors can make it more expensive or less effective than it should be. Let’s take a look at some of the more common mistakes made by drivers:

When Comprehensive Coverage is Critical

Since comprehensive coverage is optional, you can skip it if you don’t think you can benefit a lot from it. However, there are some scenarios where it’s better to opt for comprehensive coverage. Here are some key situations where taking comprehensive coverage is highly recommended:

- Your car is still new.

- You live in an area with a high risk of severe weather.

- You live in an area with high theft or vandalism risk.

- You drive in animal-frequented areas.

- Your parking space sits under a tree.

Naturally, this isn’t an exhaustive list of scenarios where comprehensive coverage can be essential. Many other risk factors can be compelling reasons to opt for comprehensive coverage.

Key Advice from MyChoice

- You can take comprehensive coverage if you want to protect your car from perils and unpredictable incidents that aren’t covered by collision insurance.

- Comprehensive coverage can be critical if your car is new and you live in areas with a high risk of severe weather, theft, and vandalism.

- If you want well-rounded protection from traffic incidents and non-traffic hazards, consider taking all-perils insurance.