A car lease transfer is the process of passing a car lease between two individuals. This allows the original lessee to cleanly exit out of a car lease they may not be able to pay for and transfer the car to another person who is looking to lease a car for a shorter amount of time.

Taking over a car lease in Ontario is a great way to get out of a lease without ending it and returning the vehicle. A lease takeover is a process where a car lease is transferred between two individuals, passing the associated obligations from the previous lessee to the person buying the lease. Ending a lease early usually comes with hefty penalties for the lessee, but transferring a lease eases this burden on the original lessee and passes the vehicle on to a person who is willing to handle the terms of the lease. This is a great way to end a car lease without needing to return the vehicle and suffer the penalties associated with early lease termination.

How do you transfer a lease? What are the benefits of taking over a lease? Do you need to take out a new insurance policy on a transferred lease? Read on to find out all you need to know about transferring a car lease in Ontario.

How Much do Lease Takeover Fees Cost?

When performing a lease transfer, you’ll need to pay a transfer fee that varies depending on the make and model of your car. On average, car lease transfers can range between $400 and $700, though there are some significant outliers.

Pricier models and brands will usually command higher transfer fees, and vice versa. However, one of the brands with the lowest transfer fees on average is Lexus – with a $299 average transfer fee – followed by Chrysler, Dodge, FIAT, Jeep, Jaguar, Porsche, and RAM, with an average transfer fee of $400. The brand with the highest transfer fee is Audi, at $1,500 on average, followed by BMW at $1,200. These transfer fees don’t include tax, which you need to pay to the leasing company before finalizing the transfer. Fortunately, you may not need to pay the transfer fee on your own, as you can negotiate with your lease transfer partner to see how you can split the transfer fees.

How Does a Lease Takeover Work in Ontario?

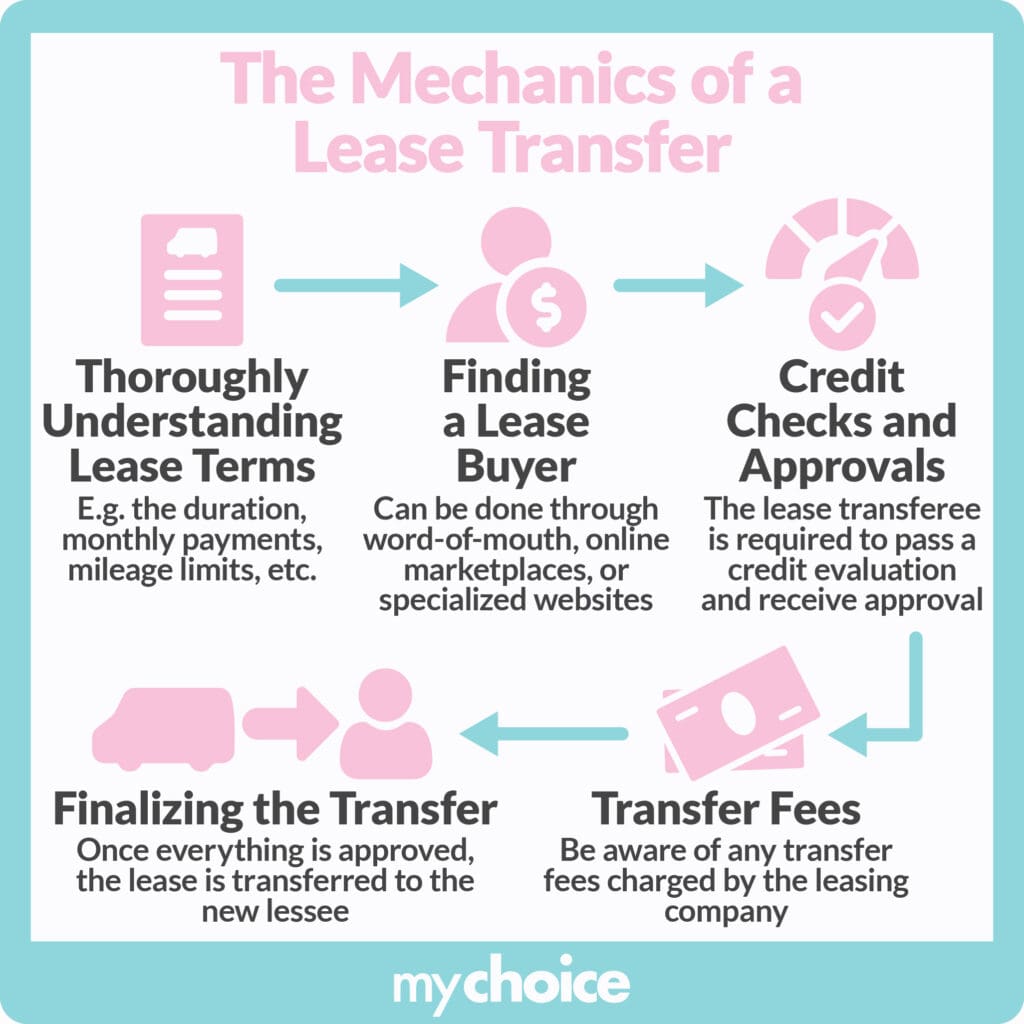

If you’re looking to transfer your lease or take over someone else’s, you need to follow a specific process before you can complete a lease transfer. Here’s a step-by-step guide:

- Understand the terms of the lease: The original lessee needs to understand the terms of the current lease completely. These terms include the lease duration, remaining monthly payments, lease transfer fees, and mileage limits. If you’re looking to take over a lease, you can check out the terms once you’ve found someone willing to transfer their lease.

- Find a lease buyer or a lease to buy: When you understand the terms of the lease, you can then start looking for a lease buyer. You can ask people you know, look around on online marketplaces, or try a lease transfer website like LeaseBusters. If you’re looking for a lease to take over, you can try the same avenues to find the ideal lease for your needs.

- Credit checks and approval: Whether you’re transferring or taking over a lease, the person taking over the lease needs to pass a credit check from the leasing company. Passing the credit check means that the new lessee is financially capable of paying the lease. A credit score of 660 to 900 is generally good, according to Equifax. Once the credit check has been initiated, you need to wait for approval from the leasing company before proceeding to the next step.

- Settle any transfer fees: After the credit check is approved, you need to settle the transfer fees and associated taxes with the leasing company. This can be negotiated between the original lessee and the lease buyer, but these fees usually average around $600. These fees can be higher or lower depending on the make and model of the car.

- Finalize the lease transfer: Once everything’s been approved and settled, the lease is transferred over to the new lessee, relieving the original lessee of any obligations related to the lease. Make sure to confirm with the leasing company that everything’s been finalized and recorded.

Advantages and Disadvantages of a Lease Takeover

A lease takeover offers some significant advantages compared to ending a lease early.

Things to Consider When Transferring a Car Lease in Ontario

Taking over a lease can lower the costs of driving a vehicle significantly. However, a lease transfer is not without its risks. Here are some things you need to understand and consider before transferring or taking over a car lease:

- Transfer fees and taxes: Lease contracts typically have a fee that needs to be paid before transferring the lease to a new lessee. These fees usually range between $300 and $500, without including tax. Fortunately, you can negotiate with your lease transfer partner to see if they’re willing to shoulder the costs.

- Vehicle condition: When transferring a lease, the new lessee needs to be extra careful to check the condition of the vehicle before finalizing the lease transfer. The new lessee should hire a mechanic to inspect the car for any hidden damage, then ask the original lessee to take care of any issues before the lease is transferred.

- Mileage limits: Lease contracts have a limit on the number of miles that the vehicle can be driven each year. The new lessee needs to check the kilometers driver before finalizing the lease and consider whether the remaining mileage is enough for them to drive the vehicle until the end of the lease.

- Insurance requirements: You are required to have car insurance even when driving a car you don’t own. When transferring a lease, make sure that the car’s insurance is properly transferred along with the lease. Consider the type of insurance and monthly premiums that you’ll have to pay before taking over a lease.

Key Advice From MyChoice

- Read through and understand the terms of a car lease completely before initiating a lease transfer.

- Have a mechanic perform an inspection of the car for any hidden damage or issues before agreeing to a lease transfer.

- The original lessee and new lessee can negotiate how much of the transfer fees should be paid by each person.

- Make sure that the car insurance transfers along with the lease. Consider the insurance plan’s coverage and monthly premiums before you decide on taking over a lease.

- Consider how many kilometers are left in the lease contract and whether that’s enough to comfortably drive the car for the remainder of the lease.