Licence suspensions are generally very stressful and inconvenient. Unfortunately, the stress doesn’t end once your licence gets reinstated because, for most people, car insurance rates often rise after a licence suspension. While it’s a common concern, it’s not something you should overly worry about because there’s no guarantee that your rates will skyrocket after a suspension.

Will My Car Insurance Rates Go Up After a Licence Suspension?

Your car insurance rates generally will go up after a licence suspension. However, there’s a chance that it doesn’t, depending on the reason for the suspension. In Ontario, insurers can’t raise your rates if you’re not convicted of a criminal act and your licence suspension lasts less than a year.

That said, if you’ve been convicted of a criminal offence, your insurance rate will almost certainly go up after your suspension. In some cases, those convictions can cause your insurance policy to be voided outright.

Can My Licence Be Suspended If I Don’t Break Traffic Rules?

Your licence can still be suspended if you don’t break traffic rules like failing to pay fines, accumulating demerit points, or being convicted of criminal offences. Generally, drivers need to meet the Government of Ontario’s basic medical requirements to be allowed to drive. If you don’t meet these basic requirements, your licence may be suspended.

For drivers in Ontario, here are the minimum medical standards you need to meet to hold a G licence:

- No medical, physical, or emotional disability that can significantly impair driving.

- No drug or alcohol addiction makes you more likely to drive while impaired.

- A visual acuity score (based on the Snellen Rating) of over 20/50.

People with hearing impairments or hearing loss can still get a G licence, though they need to submit a medical report before testing.

If you currently hold a licence and develop a medical condition that makes you unable to meet the health standards, your doctor is legally required to report your condition, which may result in a suspension. If this happens, you’ll receive information on how to get it reinstated. Generally, reinstatement means you need to see the relevant medical professionals to address your health issue.

While getting a licence suspension because of health reasons can be frustrating, there’s some good news. Your car insurance rates won’t rise because of health-related suspensions.

Will Insurance Companies Know About My Licence Suspension?

Insurance companies will know about your licence suspension because it’s going to be reflected on your driver’s abstract. However, your insurer won’t be directly notified about your suspensions. Since insurers don’t constantly look at your driver’s abstract, your rate hike may not increase immediately.

Typically, insurers will look at your abstract if they’re specifically informed about your suspension or if they notice the change while checking your abstract for things such as claims investigations. Insurers also check your abstract if you’re applying for a new policy. So, you may not get a rate hike until your insurer actually notices that you’ve been suspended.

That said, most car insurance policies require you to take the initiative and report any changes in your driving status. That means you may be required to report your suspension, which will likely lead to a rate hike. If you fail to report your suspension, your policy may get voided, or you may receive other penalties.

What Shows Up On Your Record After a Licence Suspension?

The following details will show up on your driving record after a licence suspension:

- Updated demerit point total

- Any active fine suspensions, traffic violation convictions, suspensions, and licence reinstatements

In addition to your suspension and demerit details, your record also shows your driver identification details and other essential information about your licence.

How Long Do Suspensions Last on My Driving Record?

Generally, driving offences and suspensions in Ontario last for three years on your driving record. As long as these suspensions show up on your driving record, they may impact your insurance rates.

What to Do After Your Licence Suspension Ends

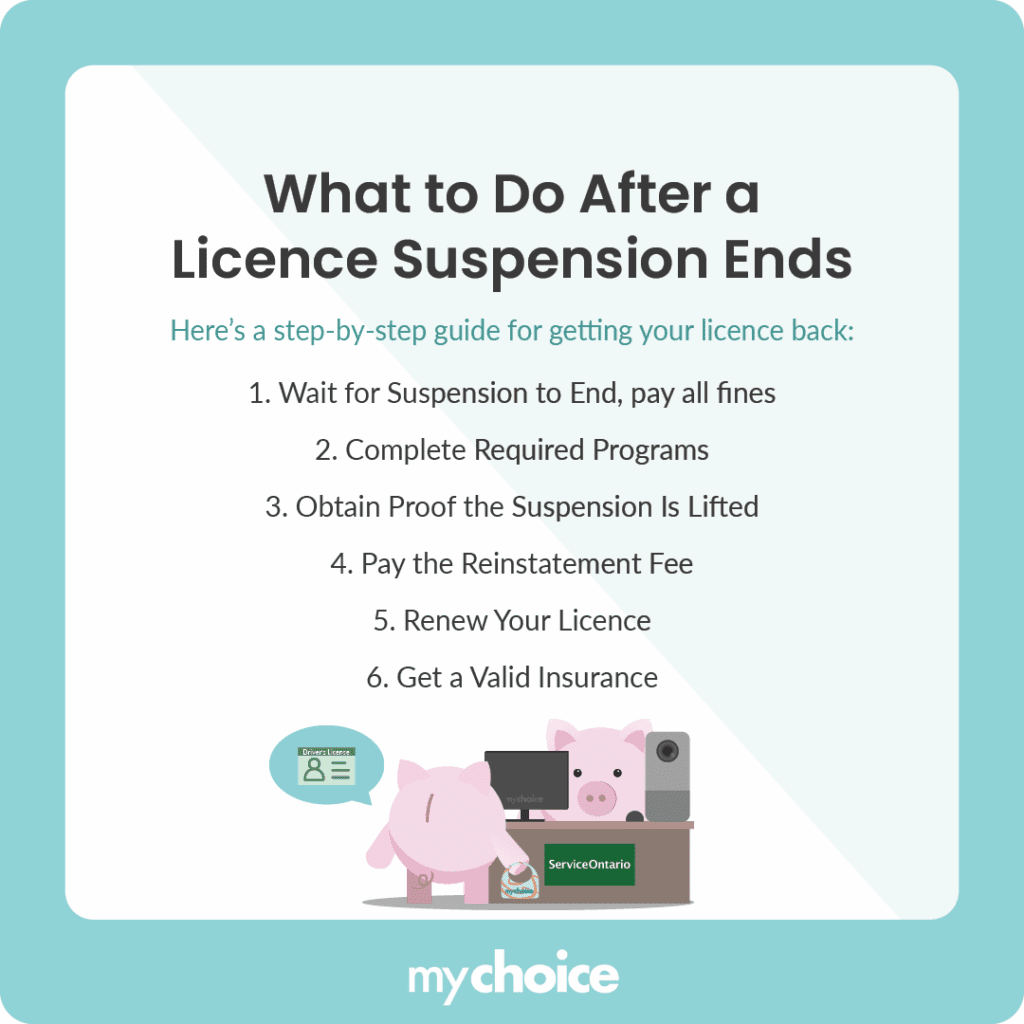

Once your licence suspension ends, you need to get it reinstated. Here’s a step-by-step guide for getting your licence back:

- Wait until your suspension period ends and pay off all the fines.

- Complete any programs or meetings required as reinstatement prerequisites.

- Gather documents that state your suspension has been lifted.

- Pay the reinstatement fee. In Ontario, the reinstatement fee is $281. You may also need to pay written and road test fees if you’re required to take them.

- Renew your driver’s licence.

- Ensure you have valid car insurance.

Once you’ve cleared all these steps, you’re ready to drive again.

However, there are some extra steps you need to take if your licence is suspended for more than a year. If your licence was suspended for one or three years, you need to take an eye test. If your licence was suspended for three to ten years, you need to take the eye test alongside a written test and two road tests. For licence suspensions over ten years, you’re treated as a new driver and need to re-apply.

If your licence suspension was caused by a dangerous driving conviction, you need to complete a driver improvement interview, complete a re-examination, and pay any applicable fees.

Reducing Car Insurance Premiums After a Suspension

So, you’ve been suspended, and after reinstatement, your car insurance premiums have risen. How do you reduce your Ontario car insurance rates? Here are some ways to do it:

Key Advice from My Choice

- Insurance companies won’t immediately know about your suspension, but most policies require you to inform your insurer about any suspensions.

- Your car insurance rate isn’t guaranteed to increase after a licence suspension, but it’s very likely to happen if you’re suspended for non-medical reasons.

- To reduce your insurance rates after a suspension, you can wait until the suspension gets taken off your record, ask about safety feature discounts, bundle home and auto insurance, and look for other insurers.

- You must not drive without a license in Ontario if it hasn’t been reinstated, as you may face severe penalties.