Here are five important tips for seniors in Canada.

1. Ask for a Senior Citizen Discount

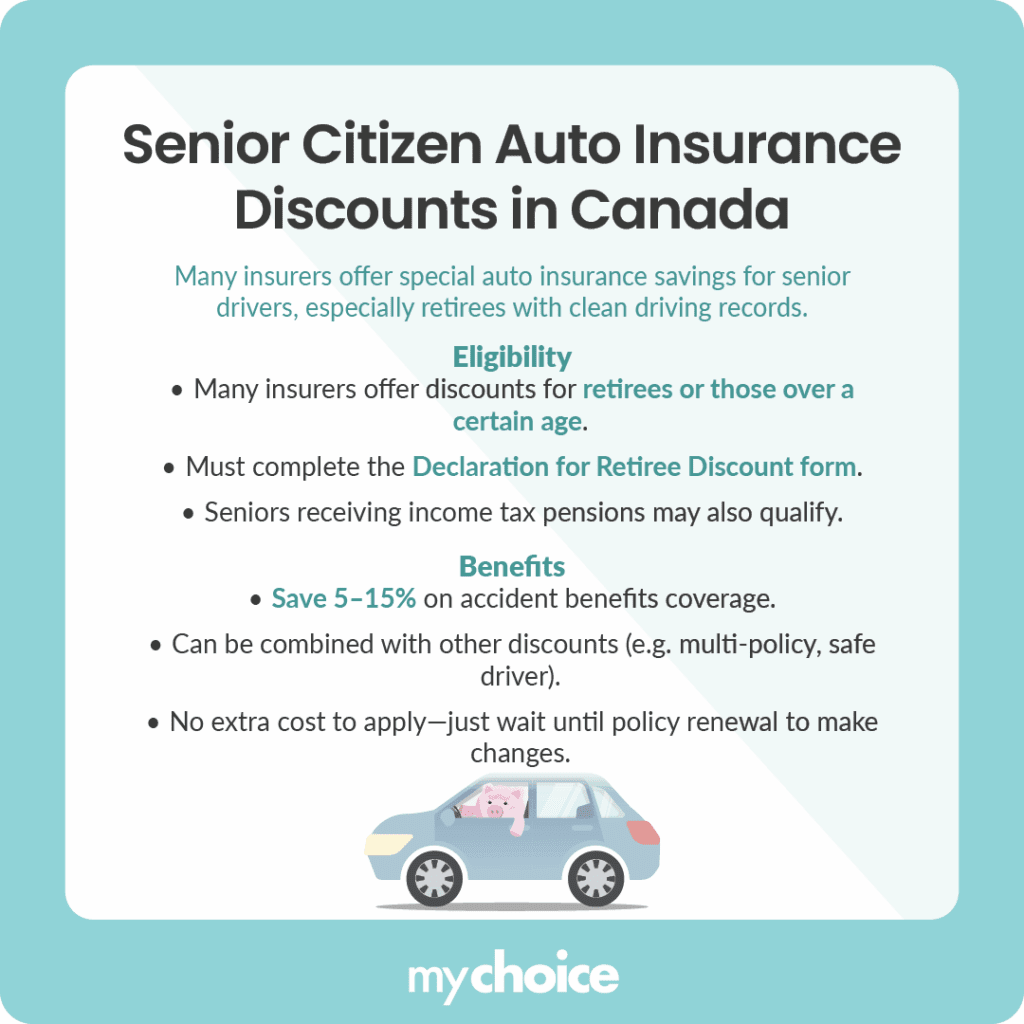

Many Canadian insurers offer discounts based on age or retirement status, but these are not automatic. If you are retired or receive pension income, ask your insurer or broker about senior or retiree discounts.

To get the discount, you usually need to fill out a Declaration for Retiree Discount form. This form shows your employment status and how often you drive. Seniors who receive income tax pensions usually qualify and need to submit this form.

If you haven’t filled out this form, assume the discount is not being applied.

How the Retiree Discount Works

Senior and retiree discounts usually lower your premiums by 5% to 15%, mainly on accident benefits coverage. There is no extra cost to add the discount, and you can often combine it with other savings, such as safe driving, multi-policy, or low-mileage discounts.

Pro Tip: Ask for the discount now, but make the change when your policy renews. Changing your policy before renewal can lead to a short-rate penalty.

2. Question Any Rate Increases

Some seniors, especially those over 80, notice their premiums go up even with a clean driving record. Insurers often use general risk models to explain this, but age alone does not mean someone is unsafe or uninsurable.

If you have a good driving record, ask your insurer to review your policy. Many companies will look at your claims history, mileage, and driving habits if you ask. Seniors who drive safely often have more influence than they think.

If your rate goes up but your driving has not changed, ask your insurer for an explanation.

3. Reassess Your Mileage After Retirement

Many retirees drive far less but never update their policy. Lower mileage can unlock meaningful savings, sometimes more than the retiree discount itself. Consider inquiring about usage-based or pay-as-you-go insurance options with your broker/insurer.

4. Check Your Mileage After Retirement

Many seniors keep collision or comprehensive coverage on cars that are not worth much. If your premiums and deductible are close to your car’s value, you might be overinsured. Keeping collision coverage on an older car is often not worth it.

5. Bundle Your Insurance Policies

Seniors can get bigger discounts by bundling auto insurance with home, condo, or tenant insurance. These savings can be combined with senior and retiree discounts.

Key Advice from MyChoice

- Always ask about senior or retiree discounts. Do not assume they are applied automatically.

- Update your yearly mileage when your driving habits change.

- Check your collision and comprehensive coverage as your car gets older.

- Ask about any rate increases if you have not had accidents or tickets.

- When your policy renews, use MyChoice’s comparison tool to make sure your price is still competitive.

At MyChoice, we often notice that seniors pay too much for car insurance because they have not reviewed their coverage since retiring. A quick comparison can show if your coverage and price still fit your needs. Try our comparison tool today to find savings.