Vehicle theft has been a problem in Canada for many years. In 2023 alone, Canadians reported 70,475 stolen vehicles, according to the Équité Association’s 2024 auto theft report. As a result, insurance companies have had to deal with spikes in claim payouts, which have cost them millions and forced them to charge customers with higher premiums. View MyChoice’s study on the correlation between car thefts and insurance premiums here.

One of the best ways you can keep yourself safe is to invest in effective anti-theft devices that alert you about attempted break-ins and deter thieves. Keep reading to learn about the top 10 anti-theft devices that can help you steer clear of becoming a victim of car theft and lower your car insurance premiums.

The Top 10 Anti-Theft Devices to Lower Your Car Insurance

There’s a lot to consider before buying an anti-theft device for your car, and seeing dozens of options on the market can get overwhelming. So, we’ve narrowed it down to a list of some of the most effective car anti-theft devices that are worth investing in.

How Do Anti-Theft Devices Lower Your Car Insurance?

As mentioned, insurance companies give discounted rates on premiums for customers who have anti-theft car devices installed. Fewer car thefts mean fewer payouts for insurers, so it benefits them when their customers are proactive in reducing the risks of their cars being stolen.

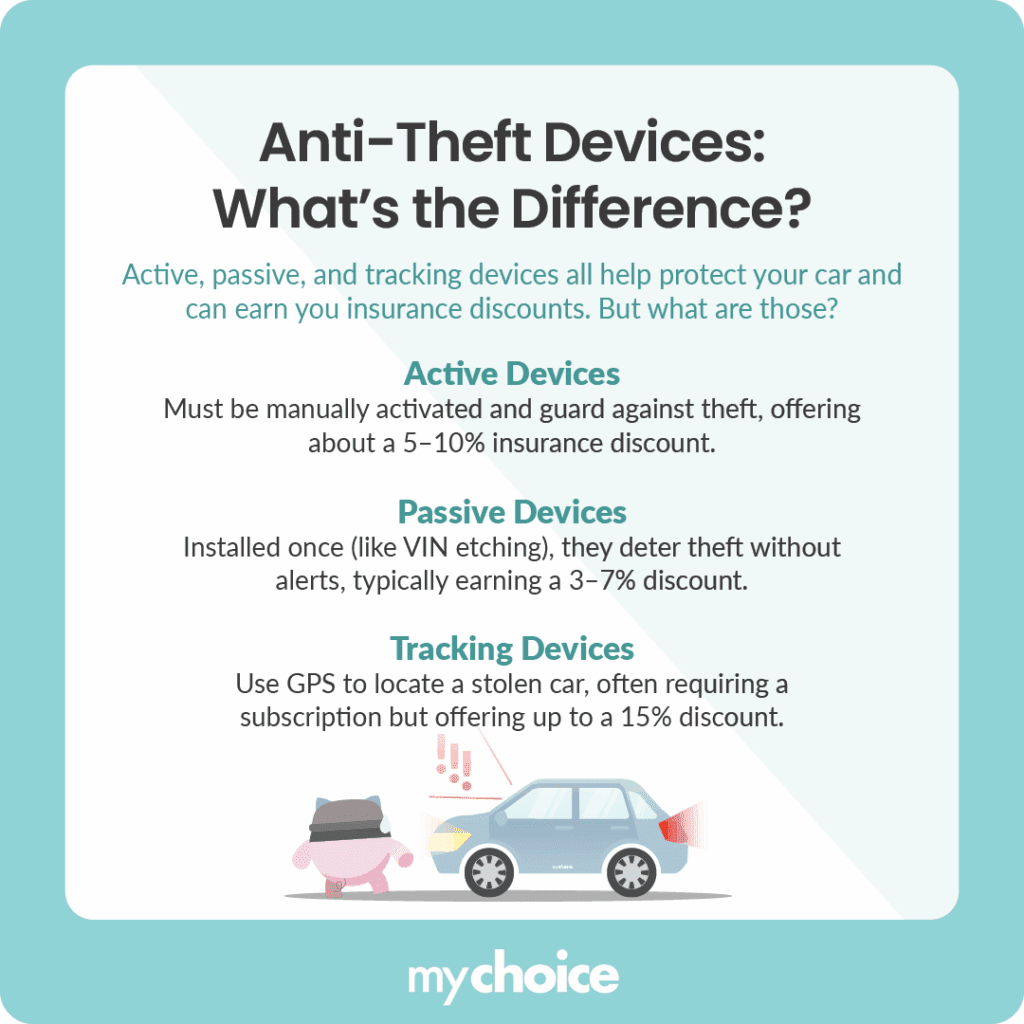

Active, Passive, and Tracking Anti-Theft Devices: What’s the Difference?

Active, passive, and tracking anti-theft devices all serve different purposes in keeping your car safe. Here’s a quick rundown of how each of them is designed to protect you and the discounted rates you can receive from your insurance company.

Car Thefts Have Slowly Been Declining Nationwide

With the collective effort of national agencies and increased public vigilance, auto theft crime rates decreased in 2024 by 18.6%. Read our opinion piece on what this means for car insurance premiums.

Key Advice from MyChoice

- Remain vigilant about where you park and avoid keeping unprotected valuables visible in the car, especially if you’ll be gone for a while. Parking in a well-lit area with security cameras or along a busy street helps decrease the chances of thieves targeting your car in the first place.

- Invest in more than one anti-theft device to create multiple layers of security. This will also help you get the highest discount possible on your car insurance fees. Consult your insurance provider to clarify how you can max out stacked discounts to get the car insurance rates with the best security for your car.

- Make sure that your anti-theft tracking device is registered with the police so that you are verified as the owner of the car, and they are automatically notified if your car has been stolen. This will also help you validate your claims with your insurer to get your payout more easily.