When buying a new car, home, or other large purchase, you’d generally need to have an insurance policy in place frame one – but sometimes this can be difficult because of the underwriting process. That’s where insurance binders come in.

While different from an official certificate of insurance (COI), these placeholder documents serve as hard proof of your upcoming insurance policy.

Let’s break each point down and get a little deeper.

Insurance Binder: The Basics

An insurance binder is a short, simple document that serves as legal proof of an existing insurance policy – usually distributed as an interim measure while the specifics of your plan are ironed out. Simply put, it’s a substitute contract you can use to prove that you have proper insurance coming through soon.

But why would you need an insurance binder when you’re a month or so away from receiving official documentation of your policy?

The answer is simple: lots of big money moves (like auto loans or home mortgage applications) require proof of insurance in Canada, and it’s often best to start processes as early as possible. This sometimes means your insurance policy may still be in the underwriting phase, but the insurance binder can serve the same legal purpose.

Key Features

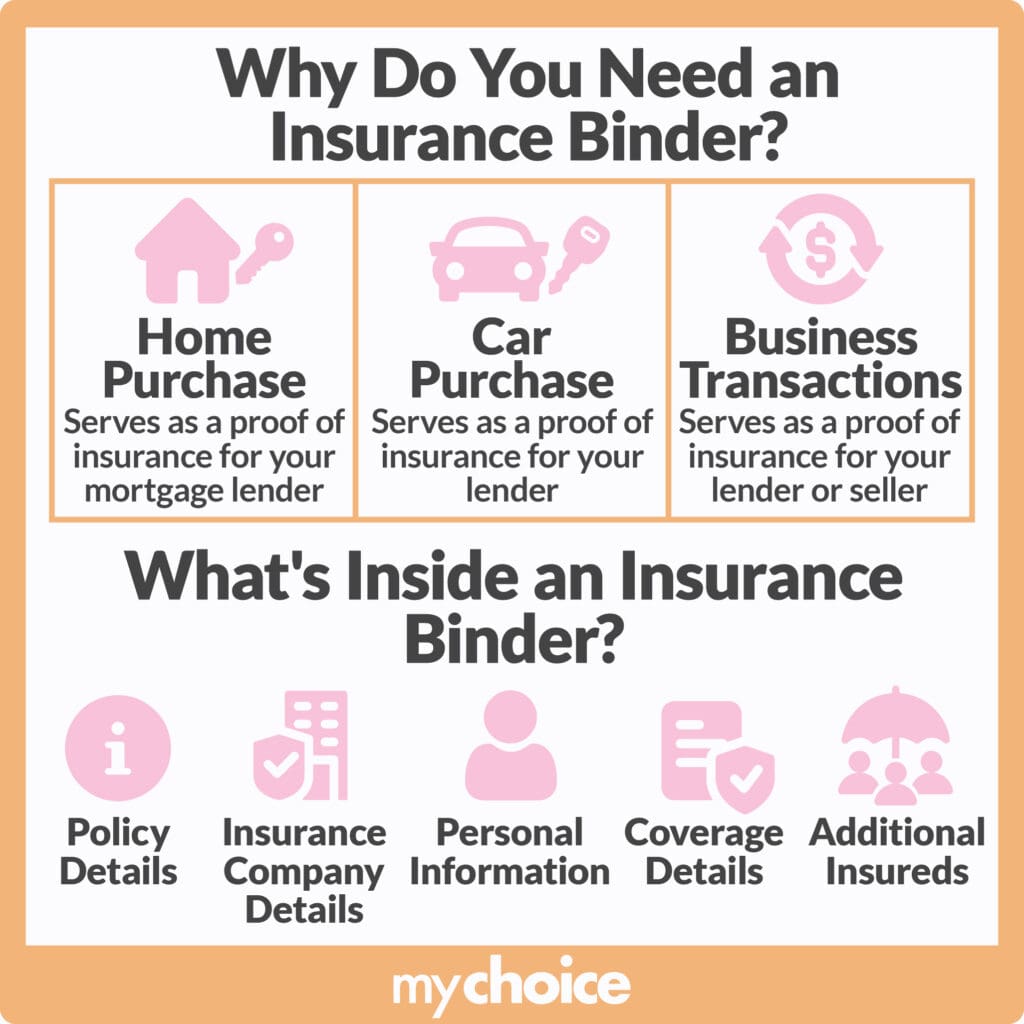

While every insurance policy is a little different, the binders they produce are usually quite boilerplate. Here are a few things you can expect to find in your insurance binder:

- A validity period of 30-90 days, indicated in the document

- Any deductibles and limitations

- The insured individual

- Insured individual’s personal details

- Any dependents also covered by the policy

- The policy’s total coverage amount

How to Get an Insurance Binder

Once you’ve paid the initial fees on your insurance policy, requesting a binder for the meantime is fairly straightforward.

Some companies will offer the document outright and send you proof of your coverage through email or physical copy. If not, you can shoot off an email to ask for a binder. We recommend keeping a printed out version on your person, just in case.

Types of Insurance Binders

Different policies mean different binders, but they all serve the same general purpose with some differences. Here are the most common types of insurance binders and the purpose each serves:

Why Would I Need an Insurance Binder?

More often than not, every large purchase involves a little bit of debt. Homes, cars, boats, commercial spaces – these are all big-ticket purchases that are more manageable when their value is broken down into monthly payments. However, the process of achieving these monthly rates requires getting in touch with a lender and negotiating a good price.

On the lender’s side, there’s a bit of risk involved with entering a payment contract with you, and this is usually where insurance policies come in to bridge the gap. However, the processes involved in taking out an insurance policy can be arduous and time-consuming – which may mean you don’t get the actual insurance policy fast enough to finance your purchase.

This is where insurance binders are helpful. Because lenders usually require some kind of coverage for liability and risk, insurer-provided binders prove that you already do have the necessary coverage for financing on the way.

Beyond this, there are other practical reasons you may need an insurance binder. Canadians, in particular, need to be particularly mindful when it comes to their cars. If you find yourself in a vehicular accident without proof of coverage, you could be paying large fines on top of potentially losing driving privileges – a pretty hefty price to pay for not having a binder on you.

All of this said, insurance binders are less common than ever in Canada – mostly because insurance companies streamline their processes to produce ironed-out policies for clients faster than ever. If your specific insurer has long turnover periods, though, you may want to ask them if they provide binders for the time being.

Things to Consider About Insurance Binders

While insurance binders really only serve as a placeholder for your actual policy, there are a few things you need to note before relying on them for your applications and daily use. Here are a few specific factors to keep in mind, though this isn’t an exhaustive list:

Key Advice From MyChoice

Insurance binders are helpful, though not essential for every policyowner. When they are, though, they can save you lots of time and hassle.

- When making big purchases like cars or houses, lenders often require proof of insurance before approving a loan – and binders represent coverage while the official policy is being processed.

- Binders are not a substitute for a formal insurance policy and are subject to approval by the insurance company.

- In the meantime, keep a copy in your car or any accessible spot just in case.