MyChoice Study Reveals a 7.66% Home Insurance Rates Increase in Canada in 2024

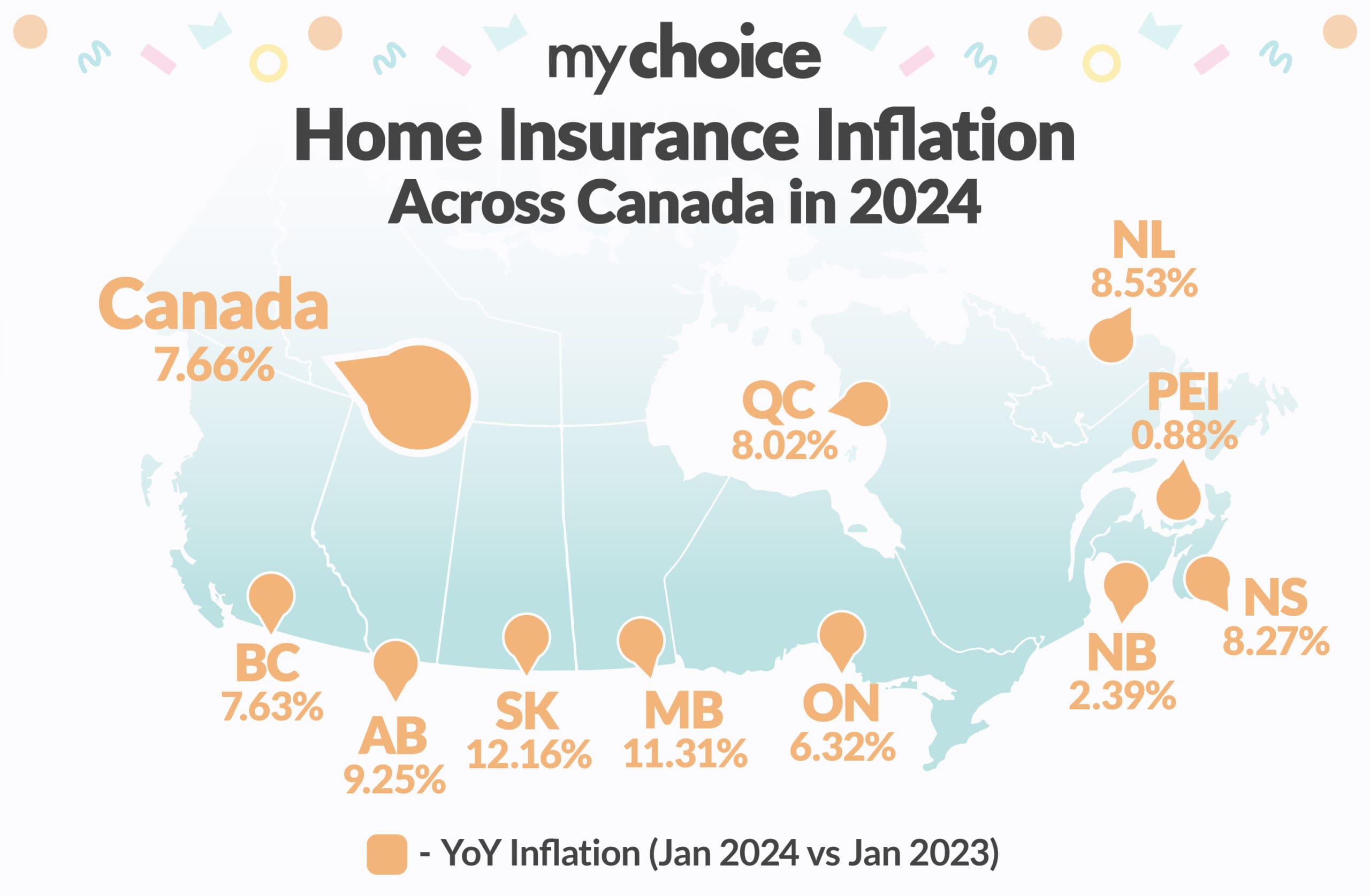

As we move into 2024, the landscape of home insurance in Canada is poised for a significant shift, paralleling the challenges and trends observed in the auto insurance sector. The high inflation witnessed in 2023 is a precursor to the anticipated developments this year. Even though inflation is expected to return to the 2% target in 2025, high claims costs, soaring repair and replacement expenses and increased climate-related disasters have set the stage for this inevitable price recalibration. According to internal data from MyChoice, a leading insurance comparison website, Canadians should brace for increased home insurance prices in 2024 as they have already increased 7.66% YoY in Canada since the beginning of the year.

The ripple effects of home insurance price increases will be felt unevenly across Canada, with certain provinces bracing for more substantial impacts. The MyChoice analysis of the Shelter Consumer Price Index data reveals a nuanced narrative where the correlation between replacement cost inflation and home and mortgage insurance inflation defies straightforward expectations. While traditionally seen as a primary driver, replacement costs alone do not dictate the trajectory of insurance premiums across provinces. For example, Manitoba’s anticipated 11.31% home insurance inflation rate starkly contrasts with a -1.52% change in replacement costs. Similarly, Saskatchewan’s 12.16% insurance rate increase alongside a modest 1.35% rise in replacement costs further exemplifies this complexity.

| Country/Province | Replacement Costs YoY Inflation (January 2024) | Home Insurance YoY Inflation (January 2024) |

|---|---|---|

| Canada | 4.69% | 7.66% |

| Newfoundland | 6.89% | 6.89% |

| Prince Edward Island | 4.78% | 0.88% |

| Nova Scotia | -0.83% | 8.27% |

| New Brunswick | -1.11% | 2.39% |

| Québec | 7.12% | 8.02% |

| Ontario | 4.92% | 6.32% |

| Manitoba | -1.52% | 11.31% |

| Saskatchewan | 1.35% | 12.16% |

| Alberta | 6.86% | 9.25% |

| British Columbia | 2.82% | 7.63% |

The undeniable influence of climate change on the frequency and severity of natural disasters in Canada serves as a critical backdrop for the projected increases in home insurance rates. Each year, the insurance industry grapples with the growing challenge of covering losses from wildfires, floods, and other climate-related events, necessitating a recalibration of rates to keep pace with this escalating risk. According to the latest report from the Insurance Bureau of Canada, severe weather conditions in 2023 caused over $3.1 billion in insured damage across the country.

Regions with higher insured damages, such as BC with $720 million and Ontario & Quebec combined with $710 million, likely contribute to the broader trend of increasing insurance rates due to the higher risk and cost of claims associated with these events.

| Country/Province | Total Insured Damage Due to Severe Weather Events in 2023 |

|---|---|

| Canada | 3.1 billion |

| Atlantic Canada | 455 million |

| Ontario & Quebec | 710 million |

| Prairies & Central Canada | 180 million |

| Alberta & Saskatchewan | 250 million |

| British Columbia | 720 million |

| Northwestern Territories | 60 million |

The federal government committed $31.7 million toward the national flood insurance program in its 2023 budget to combat the rise in insurance premium calls. The program aimed to reduce the socio-economic impact of floods, which have historically been a big problem for Atlantic Canada, notably with Hurricane Fiona causing significant damage to the region in 2022.

The ongoing rise in home insurance costs is set to compound financial pressures for homeowners, particularly in cities identified in the recent Equifax/CMHC study as having the highest mortgage delinquency increase. Cities like Toronto and Victoria, with alarming mortgage delinquency increases of 66.67%, exemplify the acute financial strain on homeowners. This is particularly concerning given that 52% of Canadians are $200 or less away from financial insolvency, according to MNPs recent consumer index reports. A 7.66% average increase in home insurance rates could add further pressure to this phenomenon and push homeowners out of the following cities most at risk for mortgage delinquencies:

| City | YoY Mortgage Delinquencies Increase (%) |

|---|---|

| Barrie | 100.00% |

| London | 83.33% |

| Toronto | 66.67% |

| Windsor | 66.67% |

| Victoria | 66.67% |

| St. Catharines-Niagara | 62.50% |

| Hamilton | 60.00% |

| Guelph | 60.00% |

| Abbotsford-Mission | 57.14% |

| Oshawa | 33.33% |

In today’s ever-changing landscape, conducting thorough research to identify the best available options on the market has become more crucial. The rate for your home insurance is not predetermined by any single provider, meaning the path to discovering the most cost-effective rate necessitates exploring offerings from multiple insurers.

MyChoice’s CEO, Aren Mirzaian, offers a perspective that acknowledges the challenges ahead and emphasizes the company’s proactive approach to navigating these complexities. “At MyChoice, our dedication to offering our customers a wide range of home insurance options stands firm, even amidst these evolving challenges,” affirms Mirzaian. “We are committed to providing our users with extensive choices, ensuring they receive affordable coverage. As we navigate these turbulent waters, our focus on transparency, education, and support has never been more critical.”