How to Transfer Your Insurance to a New Car

If you are buying a new car, contact your current insurance company and let them know you will be purchasing a new vehicle.

You’ll want to speak with your broker, who can guide you through the process and help you inquire about any additional coverage you may want to add to your new vehicle.

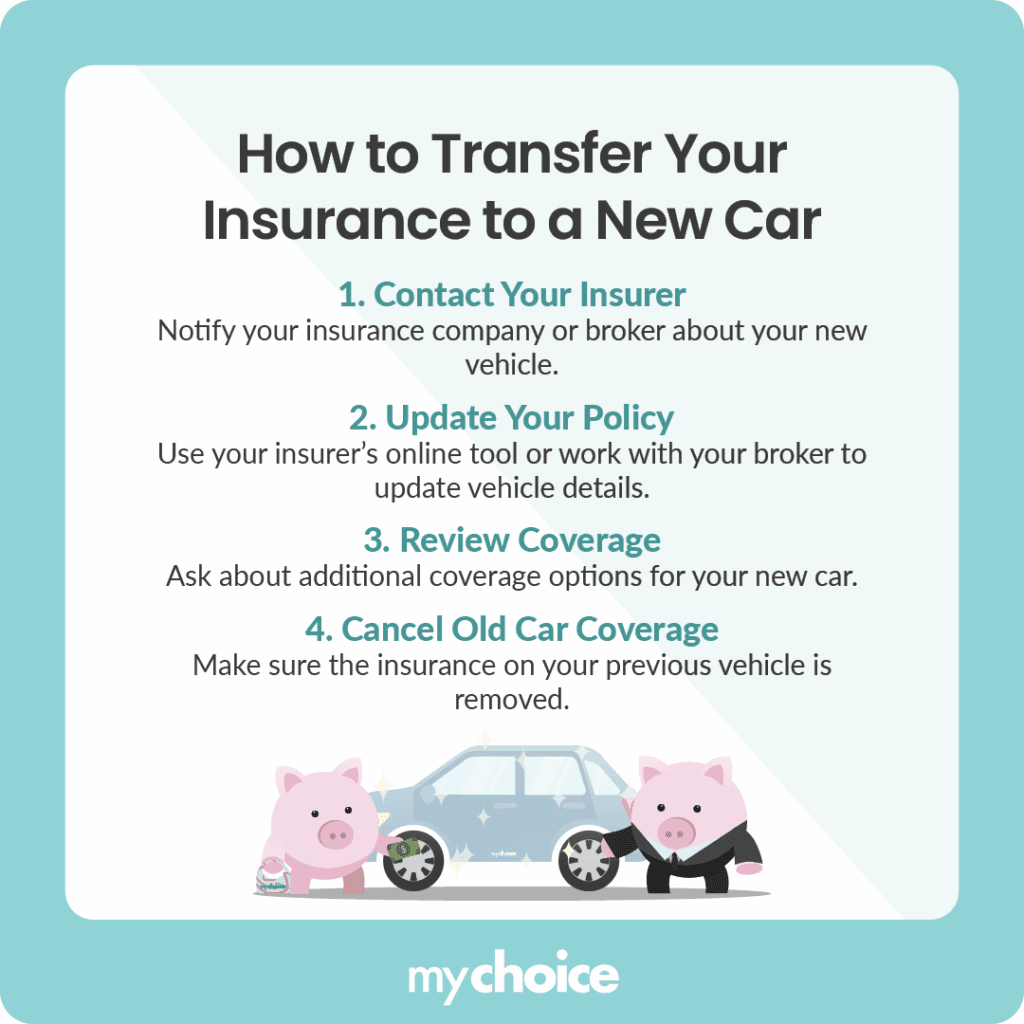

Here’s a step-by-step process of how to transfer your insurance to a new car in Ontario:

- Step 1: Contact your insurance company or broker

- Step 2: Update your policy and recalculate premiums

- Step 3: Review your coverage to avoid gaps

- Step 4: Cancel coverage for your old car

Do I Need to Fill Out an Insurance Transfer Form?

There is no ‘transfer of insurance form’ used by both buyers and sellers in Canada. While the seller must sign the Application for Transfer on the back of the vehicle ownership permit to transfer the car’s title, this is a Ministry of Transportation requirement and does not affect the insurance policy itself.

The buyer must provide their own separate proof of insurance to the MTO to complete the ownership transfer.

How Long Can I Remain Covered Under My Old Policy?

In Ontario, under the standard OAP 1 policy, a ‘Newly Acquired Automobile’ is automatically covered for a grace period of only 14 days. You must notify your insurer within this 14-day window to ensure your coverage extends to the new vehicle and to pay any necessary premium adjustments.

Documents Insurers Require to Transfer Coverage

While maintenance records and warranty information are important for the buyer’s peace of mind, they are not used as legal proof for an insurance transfer. Insurance companies require the vehicle’s VIN, purchase price, and proof of ownership to add a new car to your existing policy.

Can I Transfer My Auto Insurance Policy to Another Company?

You have the right to switch your insurance provider at any time, but doing so requires careful timing to avoid financial penalties.

Steps to Switch Providers:

- Shop and Compare: Review your current renewal notice to match your existing coverage limits and deductibles exactly when getting new quotes.

- Set Up the New Policy First: Always ensure your new policy is active and the “pink slips” are in hand before cancelling your old one.

- Align the Dates: To avoid a coverage gap or paying for two policies simultaneously, your new policy start date and your old policy end date should be identical.

- Notify in Writing: Proactively notify your current insurer of the cancellation in writing to ensure you aren’t continued to be billed, which could impact your credit score.

Key Advice from MyChoice

- Contact your insurer before driving your new vehicle whenever possible. Do not rely solely on the 14-day grace period.

- Confirm that your new vehicle has been officially added to your policy, and request updated proof of insurance.

- Review your coverage when upgrading vehicles. A newer or financed car may require higher limits, collision coverage, or replacement cost protection.