When you get behind the wheel of someone else’s car, you still need to be insured to be protected. Being listed as an occasional driver on someone else’s policy can help you stay protected in case of an accident, whether you’re driving the family car, borrowing a friend’s truck for the weekend, or driving a company car for work.

Why do occasional drivers need car insurance? Are there other benefits to being listed as an occasional driver on a policy? In what situations does one need to be listed as an occasional driver? Read on to learn who is considered an occasional driver and what insurance options are best for different scenarios.

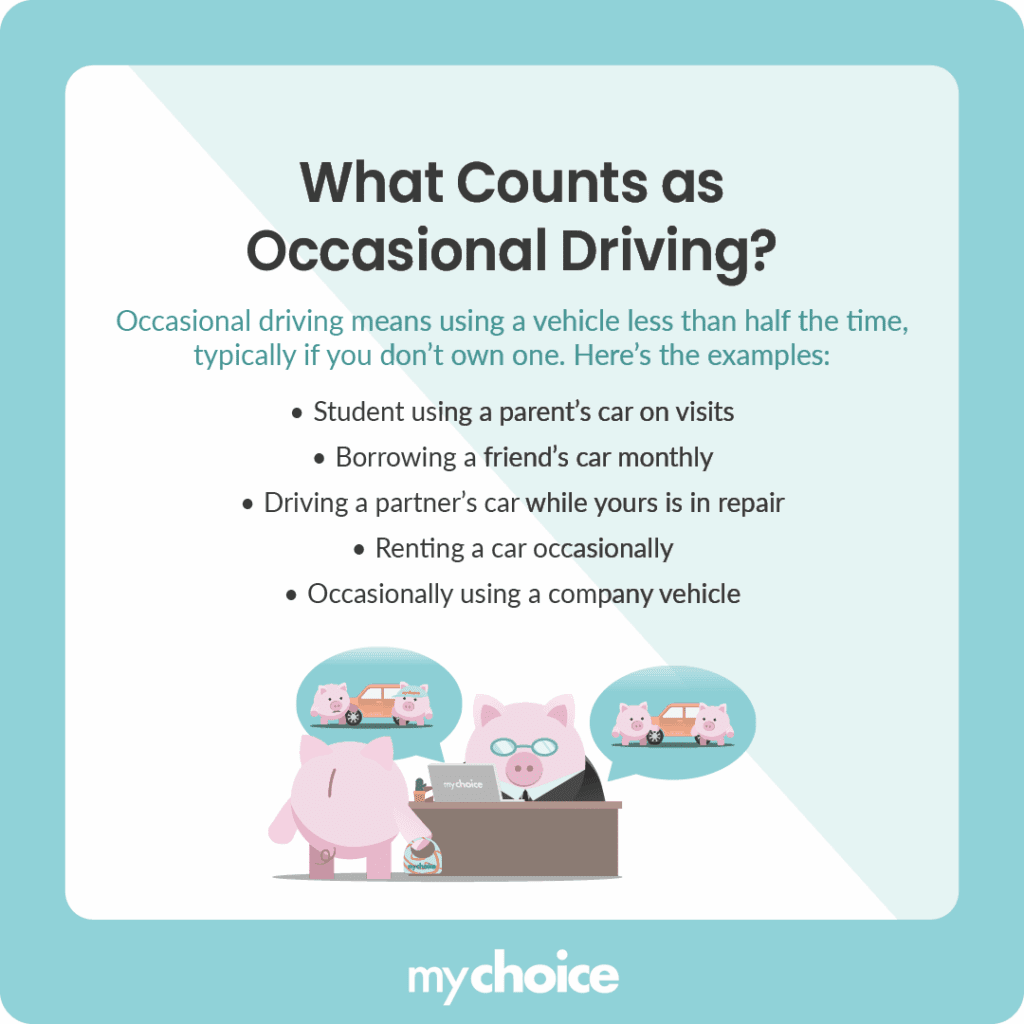

What Counts as “Occasional Driving”?

Occasional driving doesn’t have a one-size-fits-all definition across Canada, but it generally refers to someone who drives a vehicle less frequently than the principal driver of a car, usually under 50% of the time. If you occasionally borrow a vehicle but don’t own one yourself, this likely applies to you. Read about the differences between primary and occasional drivers here.

Common examples of occasional drivers include:

- University students driving their parents’ vehicle when coming home for the summer

- A person borrowing their friend’s car once a month to run errands

- A person who drives their partner’s car only when theirs is in the shop

- A person who doesn’t own a car but needs to rent one out from time to time

- A worker who sometimes needs to drive a company vehicle for work.

Insurance Options Available for Occasional Drivers in Canada

For occasional drivers, the frequency of driving, the relationship to the vehicle owner, and whether you live in the same household all influence the type of insurance strategy that best suits your needs. Here’s a table of common scenarios and the corresponding occasional driver insurance options:

| Scenario | Insurance Option | Details |

|---|---|---|

| You live in the same household and need to borrow the car from your parent | Add to existing policy as an occasional driver | Required in most Canadian provinces. Your parent must notify their insurer. |

| You occasionally drive a friend’s car and don’t live with them | Permission-based use (no policy change needed) | Allowed in most provinces for infrequent use. Owner’s insurance covers you as a permissive driver. |

| You regularly borrow a roommate’s or partner’s car | Add to existing policy as an occasional driver | Most provinces will require secondary drivers in the same household to be added as occasional drivers. |

| You rent a car a few times a year | Non-owner car insurance or rental coverage | Purchase through a rental company or as a standalone policy. Ideal for those without personal auto insurance. |

| You don’t own a car, but sometimes drive a company vehicle or others’ cars | Non-owner car insurance | Covers liability when driving a borrowed or rented car. Doesn’t cover the car itself. |

| You’re a student returning home for summer and driving the family car | Add to family policy temporarily as an occasional driver | Notify insurer of the time period. Can sometimes be paused when not in use. |

| You drive someone else’s vehicle for a ridesharing or delivery service | Non-owner car insurance | Covers liability when driving a borrowed or rented car. Doesn’t cover the car itself. |

| You don’t currently own a car, but want to minimize insurance gaps while waiting for a new car | Non-owner car insurance | Covers liability when driving a borrowed or rented car. Doesn’t cover the car itself. |

When adding an occasional driver on your policy in Alberta, your insurance company may assign the driver to the highest-rated vehicle, usually the one with the highest insurance cost, as outlined by Alberta’s Insurance Rate Board.

Pitfalls to Avoid as an Occasional Driver

Being an occasional driver doesn’t mean you’re off the hook when it comes to insurance details. Here are some common mistakes you’ll want to avoid:

What Happens to My Insurance History as an Occasional Driver?

Even as an occasional driver, your time behind the wheel counts towards your insurance history. If you’re listed as an occasional driver on someone else’s policy, many insurers will maintain a record of your driving activity. This helps you build a history, which can lead to lower premiums later when you get your own policy. However, if you’re always driving under someone else’s policy without being listed, this history may not follow you.

Conversely, if you’re found at fault for an accident while you’re listed as an occasional driver, this will go on your driving record and may lead to higher premiums in the future. To make sure a history of good driving habits follows you, make sure that you’re listed as an occasional driver under someone else’s policy.

When Non-Owner Car Insurance Is a Better Move

Non-owner car insurance is a type of auto insurance designed for drivers who frequently rent out or borrow other people’s cars. This type of policy generally covers bodily injury and property damage you cause to others. It does not cover damage to the vehicle you’re driving, but it does fill a significant gap in liability protection.

Non-owner auto insurance is particularly useful if:

- You regularly rent cars for work or travel

- You’re between cars but still drive

- You occasionally drive a company vehicle

- You drive for a rideshare or delivery service using someone else’s car

- You use car-sharing services like Zipcar or Turo

- You need to borrow a car from friends or family sometimes

You can also explore temporary car insurance options in Canada as an alternative.

Key Advice from MyChoice

- Check your provincial laws to determine whether you need to be added to a policy as an occasional driver, purchase a non-owner insurance policy, or are allowed to use the vehicle permissively.

- Being listed as an occasional driver helps you build a clean insurance record, potentially lowering your future premiums.

- If you don’t own a car but still need to drive from time to time, purchasing a non-owner insurance policy can be a good option to fill an insurance gap.