On June 17, 2025, Ontario’s Financial Services Regulatory Authority (FSRA) made a significant announcement: a new proposed Fraud Reporting Service (FRS) Rule and Guidance have been approved by the Minister of Finance and will soon be in effect. This rule will apply to all automobile insurers in the province and will require them to submit detailed information about auto insurance fraud to FSRA on an ongoing basis.

This new push could lead to more affordable car insurance rates in Ontario. Let’s break down what’s changing for insurers and what that may mean for your wallet.

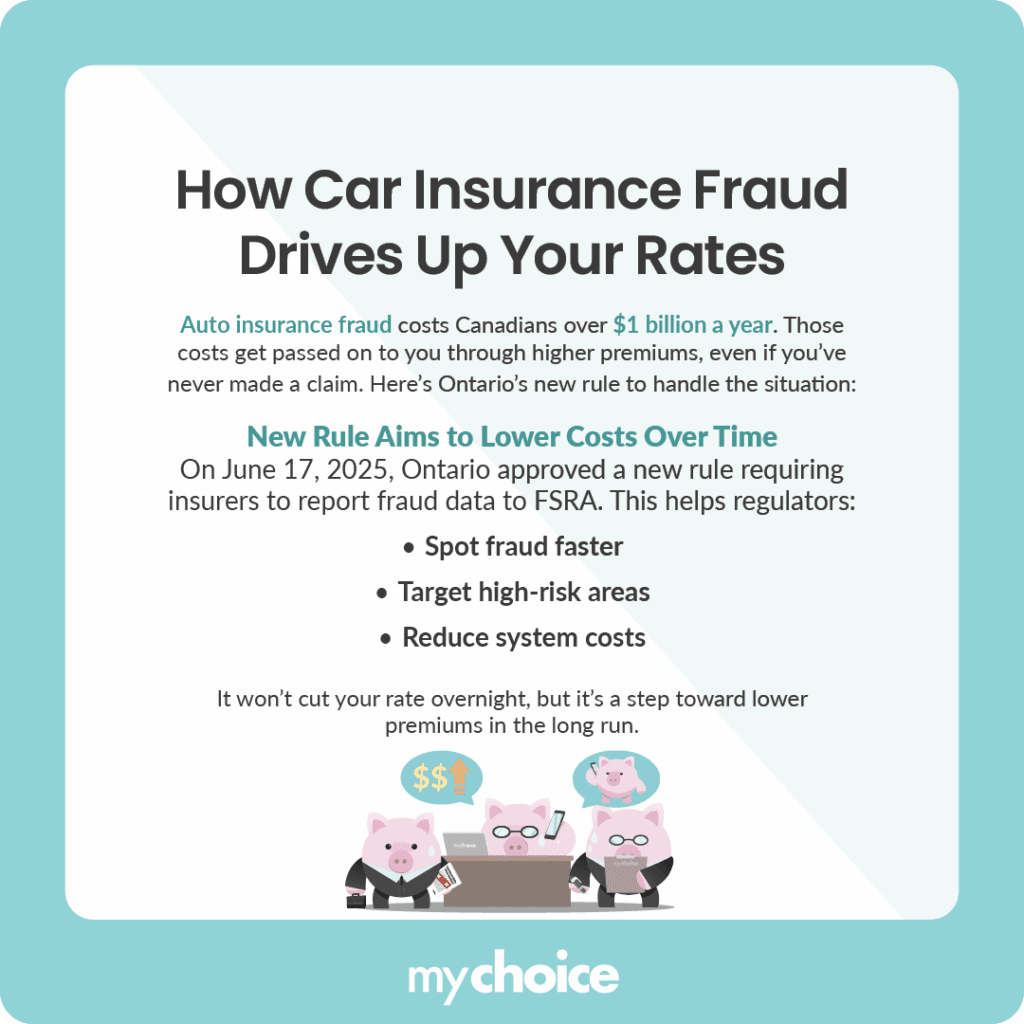

How Car Insurance Fraud Drives Rates Higher

Fraud affects every Canadian who pays for auto insurance. When scammers commit fraud through acts like fake injury claims, inflated repair costs, or staged collisions, insurance companies end up making more or bigger payouts than they should.

Those losses don’t just disappear. Instead, they’re passed along to policyholders in the form of higher premiums. The Insurance Bureau of Canada estimates that fraud costs Canadians over $1 billion annually in added insurance premiums. That’s money out of your pocket, even if you’ve never had an accident.

Will This Rule Actually Lead to Cheaper Auto Insurance?

The new fraud reporting requirements will lead to cheaper auto insurance, but not right away. These requirements are designed to help insurers and regulators get a clearer picture of where and how auto insurance fraud is happening. With improved data gathering, they’ll be able to:

- Take action faster

- Spot trends early

- Crack down on bad actors and high-risk areas.

Over time, this could lead to lower system costs and more stable (or even reduced) premiums for drivers. However, this process will take time, and it’s not an overnight fix. Once it’s officially proclaimed into force, though, the hope is that it makes fraud detection better and gradually reduces unnecessary costs.

What Might Actually Help Lower Premiums

While cracking down on fraud is a step in the right direction, there are other factors that impact how much you personally pay for car insurance, such as:

Remember that premiums also reflect broader market trends that aren’t tied to just fraud, such as repair costs, inflation, and changes in driving habits. So while fraud prevention may help, it’s only one piece of the puzzle.

Key Advice from MyChoice

- Prices can vary widely between insurers, so use an online comparison tool like MyChoice to shop around for affordable car insurance.

- If you’re a “safe” driver, a.k.a. you have a clean driving record, raising your deductible can significantly lower your premium.

- Ask your insurer about discounts, as many Canadian insurance providers offer deals for those they deem lower-risk, such as owners of vehicles with safety features or low-mileage drivers.