Who is Considered a High-Risk Driver?

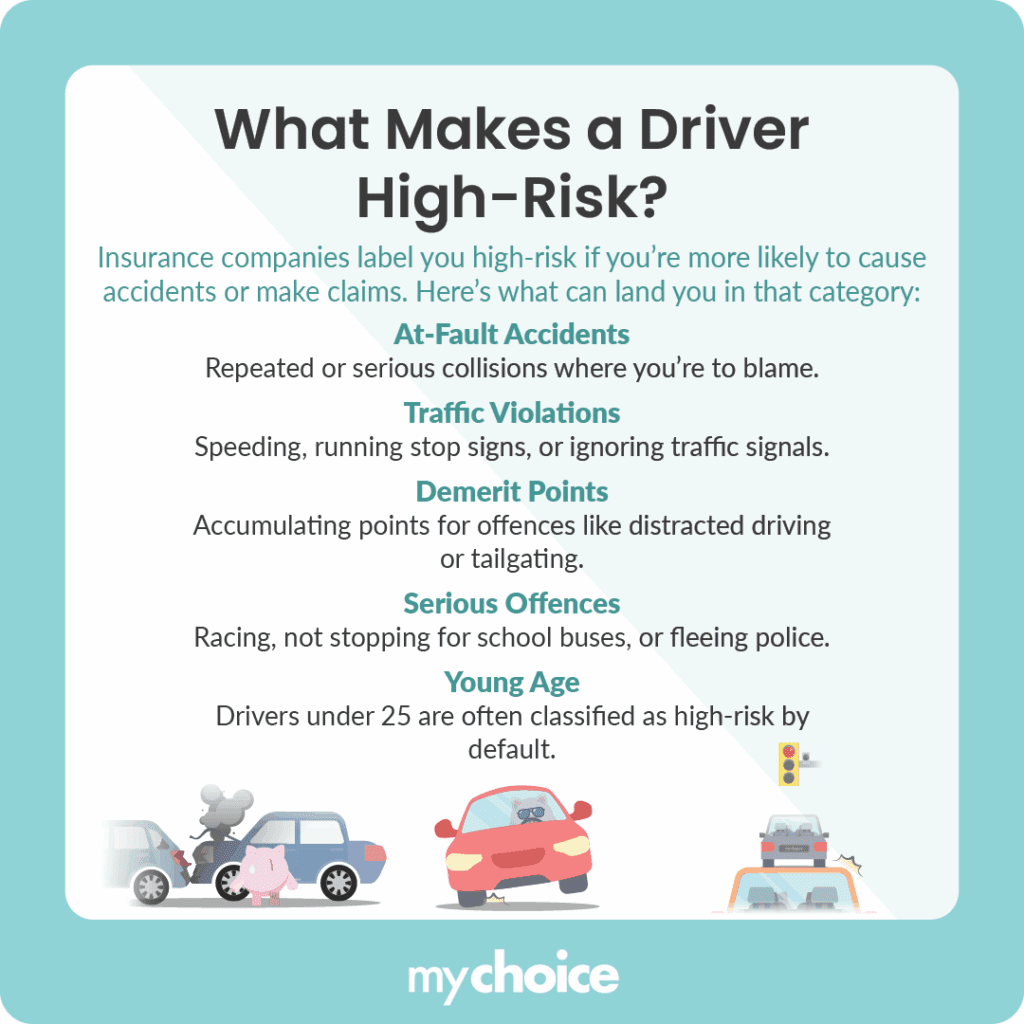

You become a high-risk driver if insurers consider you more likely to file a claim. This classification happens based on your driving history, experience level, or personal circumstances. High-risk drivers typically pay higher premiums.

You are considered a high-risk driver if you have:

- At-fault accidents on your record;

- Tickets, suspensions, or major convictions;

- Lapses in insurance history;

- Filed multiple claims in a short period of time.

As your driving record improves and you maintain continuous insurance without incidents, you can gradually move out of the high-risk category and see your rates come down over time.

How much is high-risk insurance in Ontario?

Driving history matters a lot when it comes to your car insurance rates in Ontario. Accidents, tickets, licence suspensions, and even insurance cancellations will increase your rates.

The table below shows the average annual car insurance premiums in Ontario categorized by common driving violations.

| Driving Violation | Average Annual Car Insurance Premium |

|---|---|

| Clean driving record | $1,894 |

| Insurance cancellation due to non-payment | $2,633 |

| Licence suspension for alcohol-related offences | $1,989 |

| One at-fault accident | $3,712 |

| Speeding ticket | $2,292 |

What is the Best Car Insurance Company for High-Risk Drivers?

There is no single best company for high-risk drivers in Ontario. However, according ot our latest study on the best auto insurance companies in Ontario, Coachman offers auto insurance solutions for drivers who fall outside standard underwriting guidelines, such as those with prior accidents or driving violations.

How to Save Money as a High-Risk Driver?

It’s important to remember that every insurer prices their risk differently. That’s why comparing rates from multiple providers is key.

You can use our auto insurance comparison platform to see what rates you can get from different providers.

How Can I Lower My Risk Profile to Get Cheaper Rates?

Showing insurers that you are becoming a safer, more predictable driver works over time. If you maintain a clean driving record, your rates will eventually go down.

Avoiding lapses in coverage and choosing a car with lower insurance premiums can also make a meaningful difference.

Pro Insurance Tip: Moving to an area with fewer reported accidents can significantly reduce your car insurance rates. Insurers factor location-based risk into pricing, so avoiding high-accident or high-claim neighbourhoods can lead to lower premiums over time.

Key Advice from MyChoice

- Compare quotes from multiple providers.

- Avoid insurance lapses since gaps in your coverage can significantly increase rates.

- Focus on keeping a clean driving record to improve your risk profile.

- Re-shop your insurance regularly, especially 2 months before your renewal.