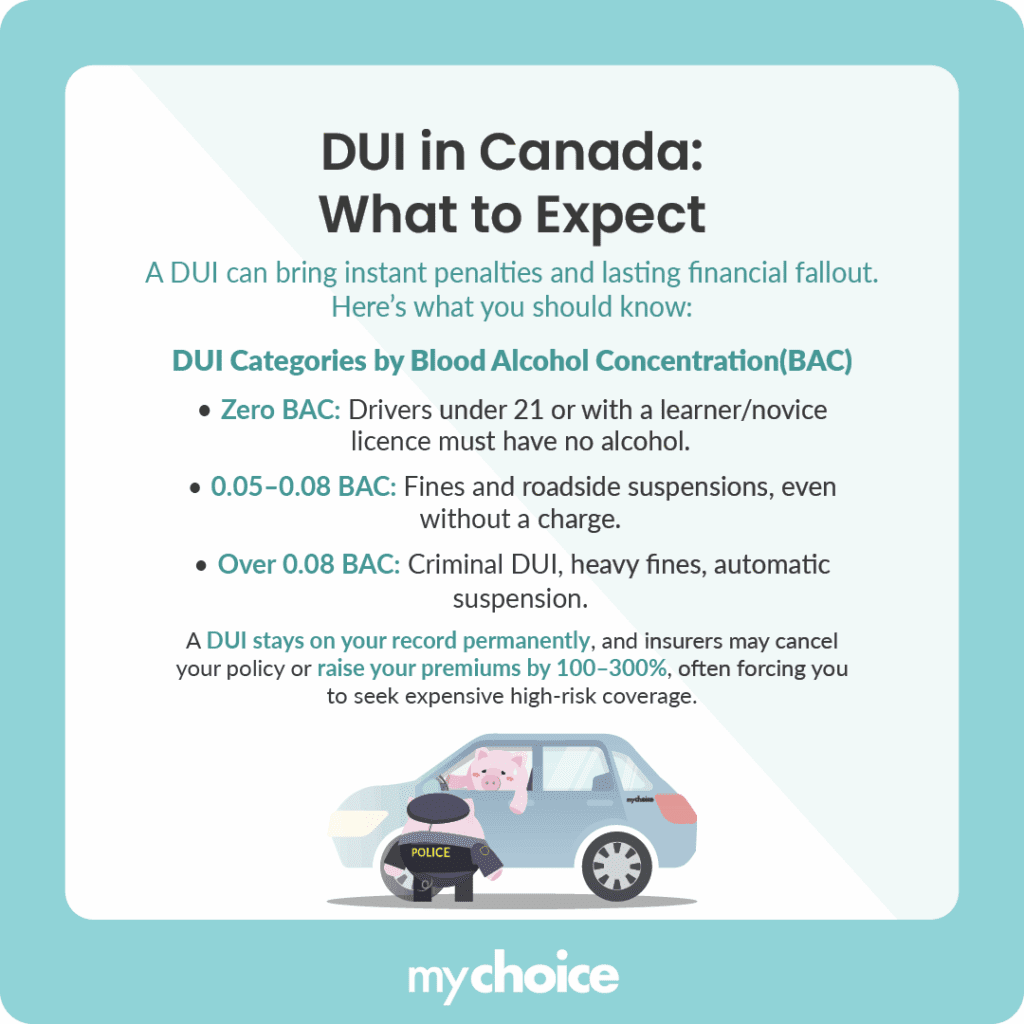

Getting charged with a DUI (driving under the influence) is a serious event that comes with a long list of consequences, including effects on your car insurance rates. Whether this is your first conviction or you’ve been through it before, understanding what happens next can help you make informed choices and avoid further penalties.

What Happens After a DUI?

After being convicted of a DUI in Canada, your insurance situation changes immediately and drastically. Your provincial license will be suspended, often on the spot or shortly after your court date.

DUIs are categorized in Canada as follows:

- Zero BAC: Drivers 21 and under, or with learner/novice licenses, must have zero blood alcohol concentration.

- Warn Range (BAC 0.05–0.08): Drivers in this range face roadside suspensions and fines, even if they aren’t criminally charged.

- Over 0.08 BAC: This results in a DUI charge, criminal penalties, and automatic license suspensions

Because a DUI is a criminal offence in Canada, it shows up on your permanent record. This means employers, financial institutions, and other organizations will see your conviction if they ask if you have any criminal records.

Your auto insurer may cancel your policy entirely, or your premiums may increase by 100% to 300%, depending on your history. You’ll be classified as a “high-risk” driver by most, if not all, car insurers, and you likely need to seek coverage from insurers that specialize in high-risk drivers at much higher rates.

Province-by-Province Differences When it Comes to DUI

Every province handles DUIs a bit differently, both in terms of penalties and how insurance premiums are affected. Here’s a simplified comparison table:

| Province | License Suspension (1st Offence) | Insurance Premium Impact |

|---|---|---|

| Ontario | 90-day roadside and 1-year post-conviction | Premiums often double or triple |

| Alberta | Immediate 90-day and 1-year interlock | High-risk insurance mandatory |

| British Columbia | 90-day Immediate Roadside Prohibition (IRP) | Insurance through ICBC; major rate hike |

| Quebec | 90-day suspension and fines | Premiums rise, must reapply with SAAQ |

| Manitoba | 3-month suspension and alcohol program | MPI premiums increase significantly |

| Nova Scotia | 1-year suspension | Insurance premiums increase dramatically |

| Saskatchewan | 1-3 year suspension and safe driver program | SGI considers you high-risk |

| Newfoundland | 1-year suspension | Fewer insurers available post-DUI |

The “Hidden Costs” of a DUI on Your Policy

When it comes to DUIs, most drivers focus on the immediate premium increase, but the real cost often comes from the loss of valuable discounts and benefits that were quietly reducing your insurance bill in the background.

Here’s what typically disappears after a DUI conviction:

Steps You Can Take to Speed Up Your Return to Standard Rates

While a DUI stays on your driving record for several years (often 3-6 years for insurance purposes), there are ways to help recover sooner:

- Take a driving course: Many provinces offer education or rehab programs. Completing one can look good to insurers and may be required to reinstate your license.

- Install an ignition interlock device: This is not optional in some provinces, but even when it is, it may show your commitment to safe driving.

- Stay clean: A spotless record after your DUI goes a long way. Avoid speeding, distracted driving, and other minor offences.

- Shop around: Once you’re eligible again, start comparing quotes using websites like MyChoice to find affordable coverage. Some insurers specialize in helping people rebuild after convictions.

- Get a high-risk policy temporarily: It’s expensive, but it keeps you insured and builds a new record.

Key Advice from MyChoice

- Do not attempt to drive with a suspended licence. Consider carpooling, rideshare apps, or public transit while rebuilding your record.

- Consider a defensive driving course to demonstrate responsibility and possibly reduce rates.

- Attend all court-ordered or provincial education programs (like Back on Track in Ontario). Completion is often required to get your license and insurance back.