How Usage Based Car Insurance (UBI) Works

Usage-based insurance is the umbrella category that includes pay-as-you-go, pay-per-kilometre, and mileage-based car insurance programs. This kind of coverage rewards safe drivers who would otherwise pay unreasonably high auto insurance premiums.

Usage-based insurance allows insurance companies to set premiums based on how you actually behave behind the wheel rather than how insurance companies think you may behave.

What is Telematics in a Vehicle?

Telematics is a technology that tracks your driving behaviour (i.e. speed, braking, mileage, etc.). If you decide to purchase a usage-based insurance policy, a small telematics device will be installed in your vehicle and wirelessly communicate with your insurance company. In pay-as-you-go insurance, the device primarily tracks kilometres driven rather than driving behaviour.

Why Should I Opt In?

This can save you a great deal of money if you are a careful driver, and the savings can really add up if you are in a category traditionally considered high risk. Low-mileage drivers can often save even more, since fewer kilometres simply mean less exposure to accidents.

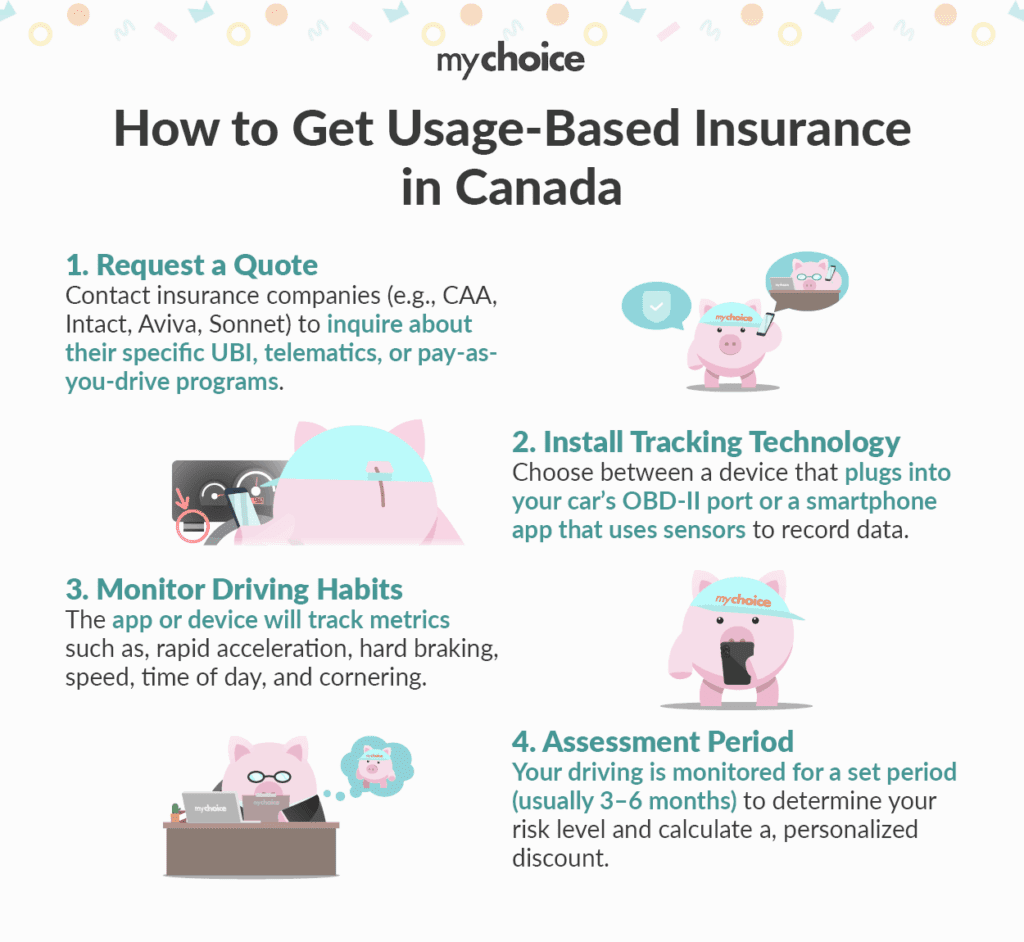

The infographic below shows how a driver can get usage based insurance in Canada.

How Much Can Drivers Save With Usage Based Car Insurance?

Drivers can save 5% to 25% on their car insurance with usage-based insurance. These savings come from behaviour-based usage insurance programs that reward smooth braking, safe speeds, and low-risk driving habits. In some cases, especially for drivers who would normally be considered higher risk, the savings can be even greater depending on the insurer.

Is it Similar for Pay-as-you-go Insurance?

Pay-as-you-go insurance works differently. Instead of rewarding how safely you drive, it rewards how little you drive. Drivers using mileage-based or pay-per-kilometre insurance can often see much larger savings, because their premium is based directly on how many kilometres they drive each year rather than an assumed average.

For very low-mileage drivers, total savings can reach 20% to 50% or more, and in extreme cases where a car is rarely used, savings may feel even higher compared to traditional policies.

Is Usage Based Insurance Available Throughout Canada?

Usage-based car insurance is mostly available in public insurance markets, including Ontario, Alberta Quebec, Nova Scotia, New Brunswick, and Prince Edward Island. Many insurers offer telematics-based programs that provide discounts for safe or low-mileage driving.

According to the Insurance Telematics in Europe and North America strategy report, Canada now ranks among the five leading telematics insurance markets globally, alongside the US, UK, Germany, and Italy.

Which Car Insurance Companies Offer Usage Based Insurance?

CAA is currently the only insurer in Canada that offers true pay-as-you-go car insurance through its MyPace program. MyPace is a mileage-based model in which drivers pay a base rate plus a fixed cost per 1,000 kilometres driven.

Other Canadian insurers, such as Allstate, Belair Direct, Desjardins, Intact, Onlia, Pembridge, TD Insurance, and Travellers, offer usage-based insurance (UBI) programs. These programs use telematics devices or smartphone apps to track driving behaviour, such as speed, braking, acceleration, time of day, and, sometimes, mileage. Drivers are rewarded with discounts for safe or low-risk driving habits.

While these UBI programs can lower premiums, they are different from pay-as-you-go insurance. Most of them do not charge drivers based directly on kilometres driven. Instead, they apply percentage discounts to a traditional policy based on driving performance.

Why Was Usage Based Car Insurance Created?

Insurance companies use elaborate risk assessment models to set their premiums, which can mean soaring costs for young drivers, those who purchase high-performance vehicles or motorists with less than pristine driving records.

Critics of traditional insurance say that basing rates on perceived rather than actual risks leads to higher costs for most drivers, and those who use their vehicles sparingly or rarely venture onto the roads during morning or afternoon rush hours may be paying especially high prices for their automobile coverage.

Pay-as-you-go insurance solves this problem by charging drivers based on real usage rather than assumptions. If you don’t drive often, you simply don’t pay as much.

The Hidden Benefits of Usage Based Insurance

Installing a telematics device can also help you to become a safer driver, which could lead to even greater savings down the road. Several companies that offer usage-based policies have also developed smartphone applications that give drivers instant feedback and provide them with tips to help them improve their driving, avoid accidents and lower their rates still further.

Are There Any Downsides to Usage Based Car Insurance?

While choosing usage-based automobile insurance can often reduce premiums by as much as 25 percent, privacy questions have been raised about how well insurance companies protect the telematics data they gather.

Insurance companies follow the Privacy Act and the Personal Information Protection and Electronic Documents Act, along with provincial privacy laws.

In Ontario, telematics data can only be used to calculate discounts. Using the information to raise rates, deny claims or cancel policies is prohibited. In Quebec, insurers are allowed to use telematics data to impose surcharges.

Pay-as-you-go insurance raises fewer privacy concerns because it typically tracks mileage rather than detailed driving behaviour.

What Kind of Data Does the Telematics Device Monitor?

Not all insurance companies approach usage-based insurance in the same way. Some insurers are interested in how fast motorists drive and how sharply they brake, while others are more concerned about when and where they drive. However, the telematics devices used by all insurance companies collect data on key driving metrics.