How We Calculated the Average Cost of Owning a Car

Let’s take a look at the total price of your new car in one year:

- Average cost of a new car: $60,000

- 20% depreciation: $12,000

- Fuel (avg. 8.5 L/100 km @ $1.54/L): $1,990

- Insurance premium (National Avg.): $1,435

- Interest payment (1st year of loan): $3,510

- Maintenance/tires: $1,500

This brings your total cost of owning a new car to $20,435 in the first year! Even excluding the ‘invisible’ cost of depreciation, you are still spending over $8,400 in cash to keep that car on the road.

1. Depreciation

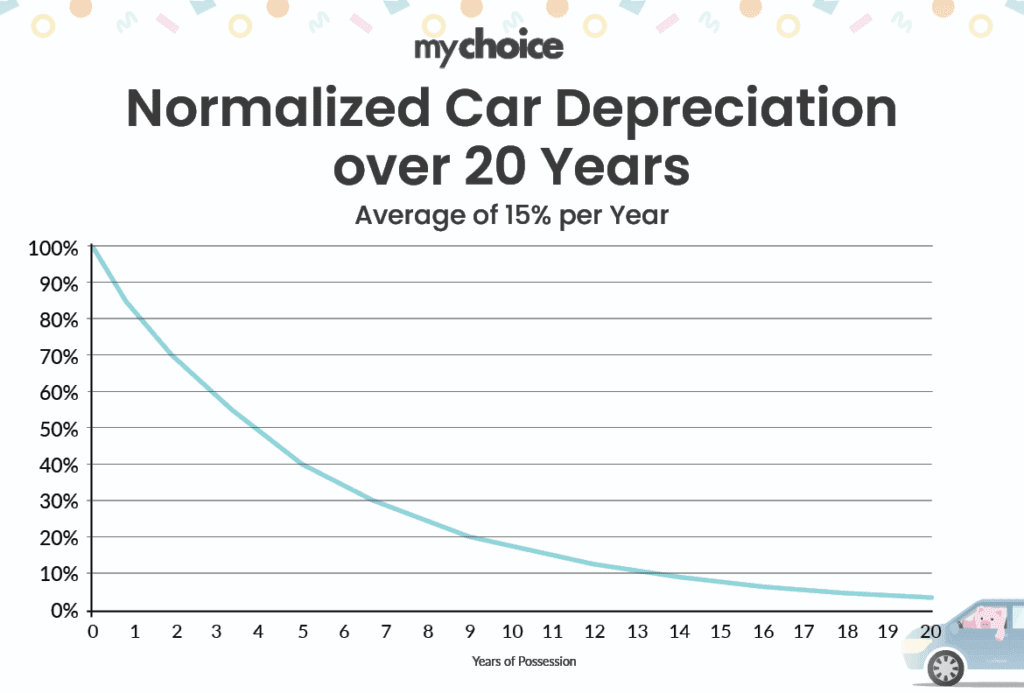

“Depreciation isn’t a cost, though. I’m not paying anything.” That’s correct but, you are still losing something, and that’s value. A car is an investment. You want to keep it as valuable as possible because you might expect to sell it one day.

Let’s say you buy your new car for $60,000. It drops to $48,000 a year later because the average depreciation rate for a new car is 20% in the first year. You just burned twelve grand!

2. Gas

The type of car you choose to drive will make an enormous difference in your gas expenses.

The average Canadian drives about 15,200 kilometres a year. With gas prices averaging $1.54 per litre in early 2026, fuel efficiency is critical. For a $60,000 vehicle, likely a mid-sized SUV, you can expect to spend about $1,990 per year in fuel (averaging 8.5 L/100 km).

In contrast, a highly efficient hybrid could save you nearly $900 annually.

3. Insurance

Insurance premiums are an important consideration in the total cost of car ownership. The inflationary pressures, an auto theft and fraud crisis, are all contributing factors to why you’ve been paying more for your car insurance in recent years.

It’s worth shopping around for a better car insurance rate if your premium has gone up. The average car insurance premium in Ontario is $1,921 per year for a driver with a clean driving record, but your exact location can also affect those rates. For example, car insurance premiums in Toronto ($2,287 per year) differ from those in Otatwa ($1,599 per year).

Use MyChoice’s car insurance comparison platform and find the best coverage for your dollar.

4. Financing

The general rule is: avoid financing your vehicle through dealerships. They tend to tack on fees and fine print to your deal. Every deal will be different, of course, depending on credit and even the condition of the car.

If you provide a 10% down payment ($6,000) on a $60,000 car and finance the remaining $54,000 over five years at a typical 6.5% interest rate, you will pay approximately $3,510 in interest alone during the first year. Your total annual payments (principal plus interest) would actually be closer to $12,700 per year.

5. Maintenance and Tires

You can only avoid that oil change for so long. Our estimates suggest you should budget approximately $1,500 per year for maintenance and tires. This covers routine oil changes, seasonal tire swaps (essential for Ontario winters), and wear-and-tear items not covered by warranty.

Keep in mind, this is for a new car. An older car with more mileage will begin hurting your wallet with maintenance fees.

Key Advice from MyChoice

- Before buying a car, calculate the total annual cost of ownership (insurance, fuel, interest, and maintenance). A vehicle that fits your initial payment may still strain your finances.

- Insurance varies heavily by car model and the postal code you live in. Compare quotes online before you buy a vehicle that is unexpectedly expensive to insure.

- When it comes to buying a car, choose efficiency over features if you want to save money. The fuel economy and reliability have a big long-term financial impact.