Canadian drivers are feeling the pinch as the cost of owning and maintaining a car rises faster than overall inflation.

The latest Consumer Price Index (CPI) data from Statistics Canada shows that maintenance and repair costs for passenger vehicles went up 4.1% from last year, much higher than the overall CPI increase of 2.4%.

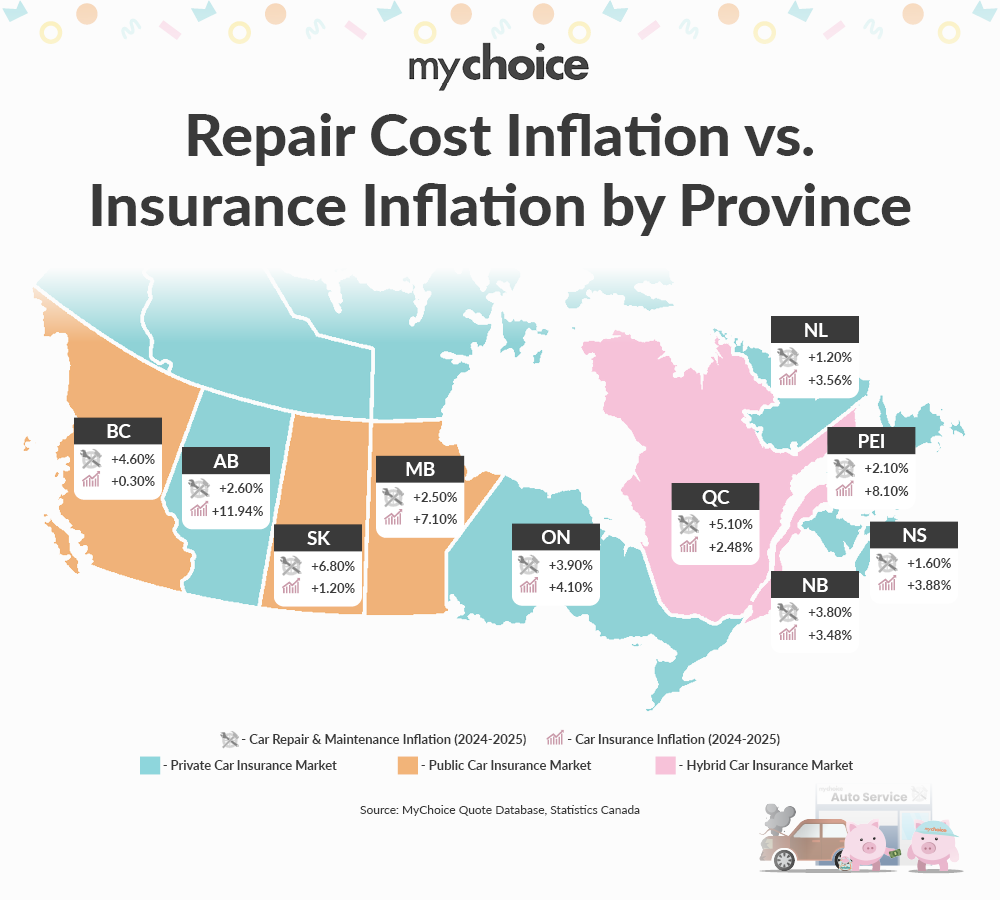

Our team at MyChoice took a deeper look at repair cost inflation across Canada to understand what’s driving these increases and how they’re translating into higher auto insurance rates. Our analysis combines car repair cost inflation data from Statistics Canada with MyChoice’s car insurance infaltion data, derived from thousands of auto insurance quotes collected between 2024 and 2025.

Provincial Data: Repair vs. Insurance Inflation

Here’s how repair costs and insurance prices have changed in each province over the past year.

*Car insurance inflation data for BC, SK, MB, QC and PEI is taken from the Satistics Canada’s CPI report.

Why Insurance Inflation Isn’t Tracking Repair Costs Evenly?

Higher repair bills are just one part of the issue. Other factors like stagnant vehicle recovery rates from thefts, fraud and more frequent claims are all causing insurers to readjust premiums.

In public insurance auto insurance markets like BC and Sasktachewan, the government seems to absorb a portion of that cost to keep insurance rates lower for drivers.

Why Service Costs Are Rising Faster Than Parts

A critical trend in the current market is the deviation between the cost of automotive goods and automotive services. While supply chains for car parts have begun to normalize, the cost of the labour-intensive “service” component continues to climb faster.

| Product Group | Dec 2024-2025 Change |

|---|---|

| Vehicle repair & maintenance services | 4.7% |

| Vehicle parts & accessories | 3.6% |

| All-items CPI | 2.4% |

Repairing modern cars requires more than just parts. Shops need advanced tools and skilled technicians, so a larger share of the cost now comes from labour rather than components.

Canada’s Automotive Labour Shortage

The main reason service costs are rising is straightforward. There are not enough trained people to do the work.

- Automotive technician vacancies are on the rise across the country.

- More than 49,000 workers in vehicle repair and maintenance were nearing retirement.

- New tech like electric vehicles and advanced safety systems means that even experienced mechanics need to continue learning. That skills gap makes it harder to find the right people for the job.

With fewer certified technicians around, wages are going up. Those higher pay rates translate to what drivers end up paying at the repair shop.

The Dealership Premium Is Widening

Labour costs and special dealership tools are making the price difference between dealerships and independent shops even bigger.

| Service Provider | 2023 Avg. | 2024 Avg. | 2025 Avg. | 3-Year Change |

|---|---|---|---|---|

| Dealership | $432 | $465 | $539 | +24.8% |

| Independent / Aftermarket | $262 | $273 | $302 | +15.3% |

For simple repairs, paying extra at the dealership usually does not give you a better outcome. It simply costs more.

The Escalating Price of Vehicle Ownership

As new vehicle prices remain high, averaging around $60,000, Canadians are holding onto their cars for loinger periods. The average age of a repairable, collision-damaged vehicle in Canada has risen to 6.01 years. This aging fleet requires more frequent and expensive repairs.

The magnitude of these increases is most evident when comparing common repair costs from 2020 to current 2025–2026 estimates:

| Repair Type | 2020 Avg. Cost | 2025–2026 Estimated Cost |

|---|---|---|

| Brake system replacement | $300-$600 | $900–$1,200 |

| Transmission replacement | $3,000 | $5,000–$7,000 |

| Suspension repair | $1,000 | $1,600–$2,800 |

| Battery replacement | $6,000 | $10,000–$13,000 |

What This Means for Auto Insurance

When repair costs go up, insurance claims become larger. This leads to higher premiums for everyone, even if you have not had an accident.

Matthew Roberts, COO of MyChoice, explains: “The era of simple mechanical repairs is over. Even minor collisions require use of sensors, software, and specialized labour. That complexity pushes claim costs higher, and those costs ultimately show up in auto isnurance premiums.”

Key Advice from MyChoice

- Stay on top of your car maintenance. Preventive care is your best defense against huge repair bills.

- Choose independent shops when doing repairs. Simple repairs can cost up to 30% less than at a dealership.

- Shop around for insurance regularly. Prices are changing faster than most people realize.