Car insurance is mandatory in Canada. However, you might end up getting your policy from a government insurer or a private company, depending on where you live.

The type of car insurance system available in your province or territory will affect your rates, coverage options, and your ability to customize your policy.

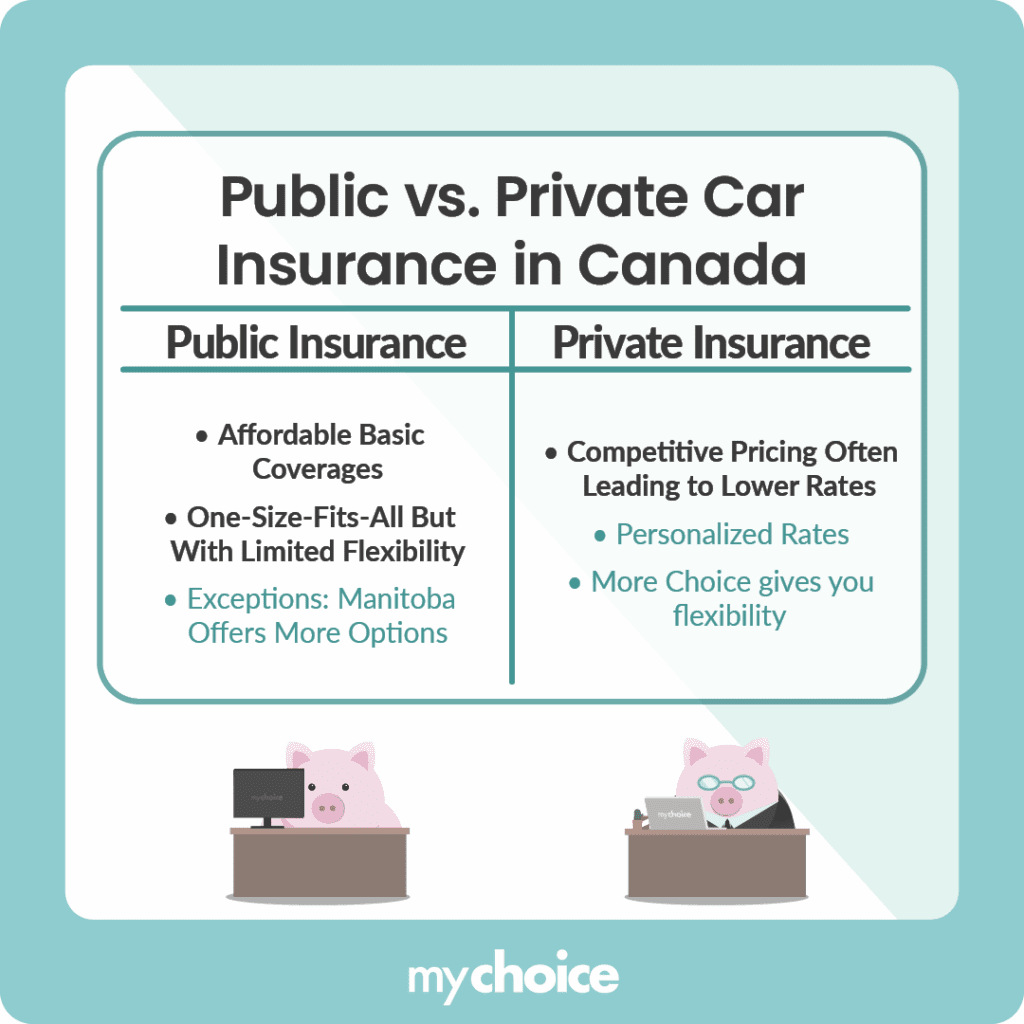

The infographic below showcases the main differences between public and private auto insurance in Canada.

Overview of Auto Insurance Systems Across Canadian Provinces & Territories

| Province / Territory | Insurance System Type | Who Provides Mandatory Coverage | Optional Coverage Options |

|---|---|---|---|

| British Columbia | Public | Government (ICBC) | optional coverages available from private insurers |

| Manitoba | Public | Government (Manitoba Public Insurance – MPI) | optional add-ons are available, some sold by private companies |

| Saskatchewan | Public | Government (Saskatchewan Government Insurance – SGI) | additional optional coverage available in the private market |

| Québec | Hybrid (Public + Private) | Public insurer (SAAQ) provides injury/death coverage; private companies provide liability/property coverages | private insurers handle collision, comprehensive, liability beyond basic |

| Ontario | Private | Private insurers provide all mandatory coverage | optional coverages available from private insurers |

| Alberta | Private | Private companies provide all required coverage | optional coverages available from private insurers |

| New Brunswick | Private | Private insurers sell all required coverage | optional coverages available from private insurers |

| Nova Scotia | Private | Private insurers provide required coverage | optional coverages available from private insurers |

| Prince Edward Island | Private | Private insurers sell compensation coverage | optional coverages available from private insurers |

| Newfoundland & Labrador | Private | Private insurance companies provide all required coverage | optional coverages available from private insurers |

| Yukon | Private | Private insurers sell mandatory coverage | optional coverages available from private insurers |

| Northwest Territories | Private | Private insurance market for all mandatory coverage | optional coverages available from private insurers |

| Nunavut | Private | Private insurers provide all basic coverage | optional coverages available from private insurers |

Why does Public Insurance exist in Canada?

Public auto insurance in Canada helps ensure that every driver can get basic protection. This is true for all drivers, no matter their income or risk level.

The goal is to provide a steady, affordable level of coverage. This way, financial problems won’t stop people from getting insurance. It also ensures that road crash victims receive compensation.

Which System is Better for Canadian Drivers?

The answer is that it depends on the angle you look at it from.

Public insurance guarantees access to coverage at affordable rates. Private insurance rewards low-risk drivers and encourages competition between the insurers. Each system optimizes for something different, and that difference shows up in pricing, behaviour, and outcomes.

Public auto insurance works by spreading risk evenly across all the drivers. This keeps the insurance rates accessible even for high-risk drivers. This stability is effective, but it also means individual behaviour has less influence on the price.

Private auto insurance calculates and prices risk based on different driver segments. For instance, safe drivers with longer insurance histories pay lower premiums. In Ontario, a driver with a clean driving record pays, on average, 96% less in car insurance than a driver with one at-fault accident. While this is a more precise system, it can create pricing volatility. Premiums can rise rapidly in high-risk areas, creating affordability gaps. Moreover, insurers may choose to cease operations entirely if they become unprofitable (i.e. Alberta).

Matthew Roberts, COO of MyChoice, puts it simply: “Public auto insurance guarantees access to coverage. Private insurance rewards safe driving behaviour. The real debate isn’t about which system is better, but which outcomes a province is prioritizing.”

Key Advice from MyChoice

- Carefully review your coverage regardless of whether you live in a province with public or private insurance.

- Understand your minimum coverage limits. If you move from a public province (i.e. Manitoba) to a private one (i.e. Ontario), remember that basic coverage in Ontario provides far less protection (Liability only) than the same coverage in Manitoba (All Perils). You will need to purchase Collision/Comprehensive separately.

- Shop around for cheaper rates if you live in a province with private insurance. Review your policy annually to ensure you aren’t missing out on a better deal.