Starting July 2026, Ontario’s auto insurance system will look a little different. The province is de-standardizing parts of its accident benefits, which is the coverage that helps drivers pay for medical care, rehabilitation, and recovery costs if they’re injured in a collision, regardless of who was at fault.

Let’s break down why these changes are happening, their pros and cons, and how this affects your insurance coverage in the province.

Why Ontario Is Making These Changes

The Financial Services Regulatory Authority of Ontario (FSRA) states that these changes are aimed at promoting consumer choice and affordability. Over the years, Ontario drivers have paid some of the highest auto insurance premiums in Canada.

By making certain benefits optional, the government aims to help reduce costs for individuals who prefer simpler coverage, while still ensuring access to essential medical and rehabilitation care for all. At the same time, this reform aims to modernize how accident benefits are managed.

FSRA has released filing specifications that outline how insurers must update their systems, cost benchmarks, and rating factors. Insurers also have to follow new transparency expectations so customers understand exactly what they’re buying.

What are the Advantages of Optional Accident Benefits?

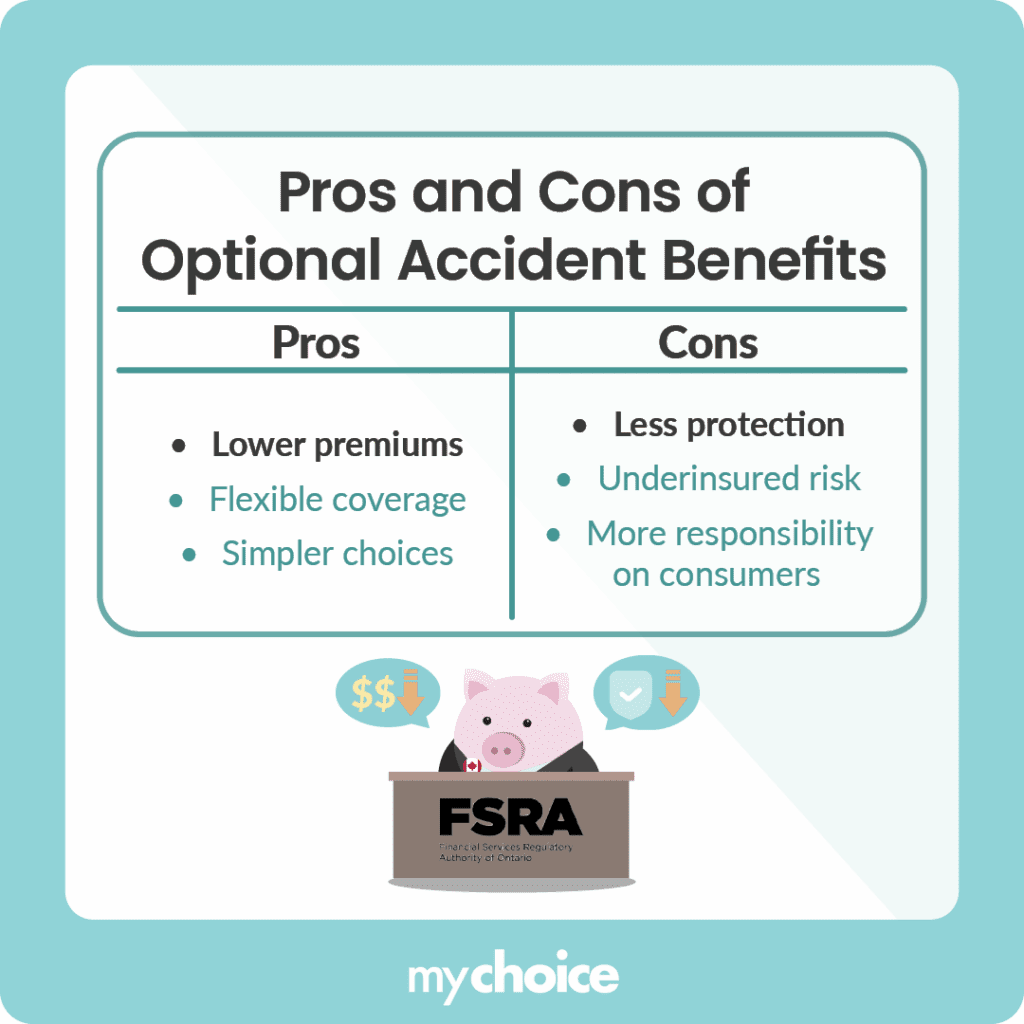

While more flexibility sounds good, it’s not without trade-offs. Let’s dig into the pros and cons in detail:

What are some of the Risks of the New Reform?

What Insurers and Brokers Will Be Required to Do

Ontario insurers are already preparing for the 2026 rollout. FSRA has introduced a detailed Filing Specification for Statutory Accident Benefits (SABS) Optionality, which outlines:

- How insurers must file their new product offerings

- Cost benchmarks and rating factors they must use

- Transparency requirements for explaining the changes to consumers

FSRA has also developed a communications toolkit in partnership with the insurance industry. This toolkit helps insurers, agents, and brokers clearly explain what’s changing and guide customers through their choices.

Several key forms are also being updated or replaced, including the Ontario Application for Automobile Insurance (OAF 1) and the Certificate of Automobile Insurance (AF-077). A new form, OPCF 47R, will specifically deal with optional accident benefits coverage and payment priority.

Things You Should Do Before Renewal

With changes like this, it pays to be proactive. Here’s how to prepare:

Key Advice from MyChoice

- Once optionality begins, insurers may offer a range of accident benefit “bundles” or add-ons. Compare car insurance quotes and packages with MyChoice to see how different combinations affect your premium.

- It’s tempting to drop benefits to save money, but serious accidents can cost far more than you’d expect. Consider how you’d manage financially if you couldn’t work for months before modifying your coverage.

- Ask your insurer for updated policy summaries or fact sheets to make it easier to compare choices. FSRA is requiring insurers to be clear about how optional benefits work and what each covers.