In Ontario, the Financial Services Regulatory Authority (FSRA) has rolled out new rules to spot and track fraudulent claims. The new Fraud Reporting Service (FRS) Rule requires all auto insurers to regularly submit detailed data on suspected fraud.

The FSRA aims to gather consistent, industry-wide information so regulators can identify trends, close loopholes, and help stop scams before they spread. Here’s an overview of how regulators and insurers are working together to continue cracking down on auto insurance fraud and what reporting means for your premiums.

A System Under Pressure

Even without fraud, Canada’s auto insurance system has been under financial strain. Insurers in provinces such as Ontario and Alberta have been losing money on auto policies for years, with some reporting loss ratios (a.k.a. the percentage of claims costs to premiums collected) of more than 100% in personal auto. That means for every $1 collected in premiums, more than $1.10 is going right back out to cover claims and expenses.

When this keeps happening year after year, insurers have limited options: raise rates, reduce coverage options, tighten their rules for who can get insured, or in some cases, stop offering certain types of coverage altogether. Fraud just makes the problem worse, inflating claims costs and driving everyone’s premiums higher.

Fraud is a Major and Growing Issue

Fraud isn’t the only reason for high loss ratios for auto insurers, as repair costs, medical expenses, and more severe weather events also play a role. However, it’s a major and growing one. Some of the biggest auto insurance fraud types in Canada right now include:

One especially bold scheme uncovered by Aviva involved a Ferrari 599 GTB disguised as the far rarer and more expensive 599 GTO. By swapping vehicle identification numbers (VINs) and doctoring records, scammers tried to insure the car for over $1 million, even though it was worth a fraction of that. This kind of “ReVINing” has spiked in recent years, with thieves using stolen identities and vehicle numbers to pass off stolen cars as legitimate.

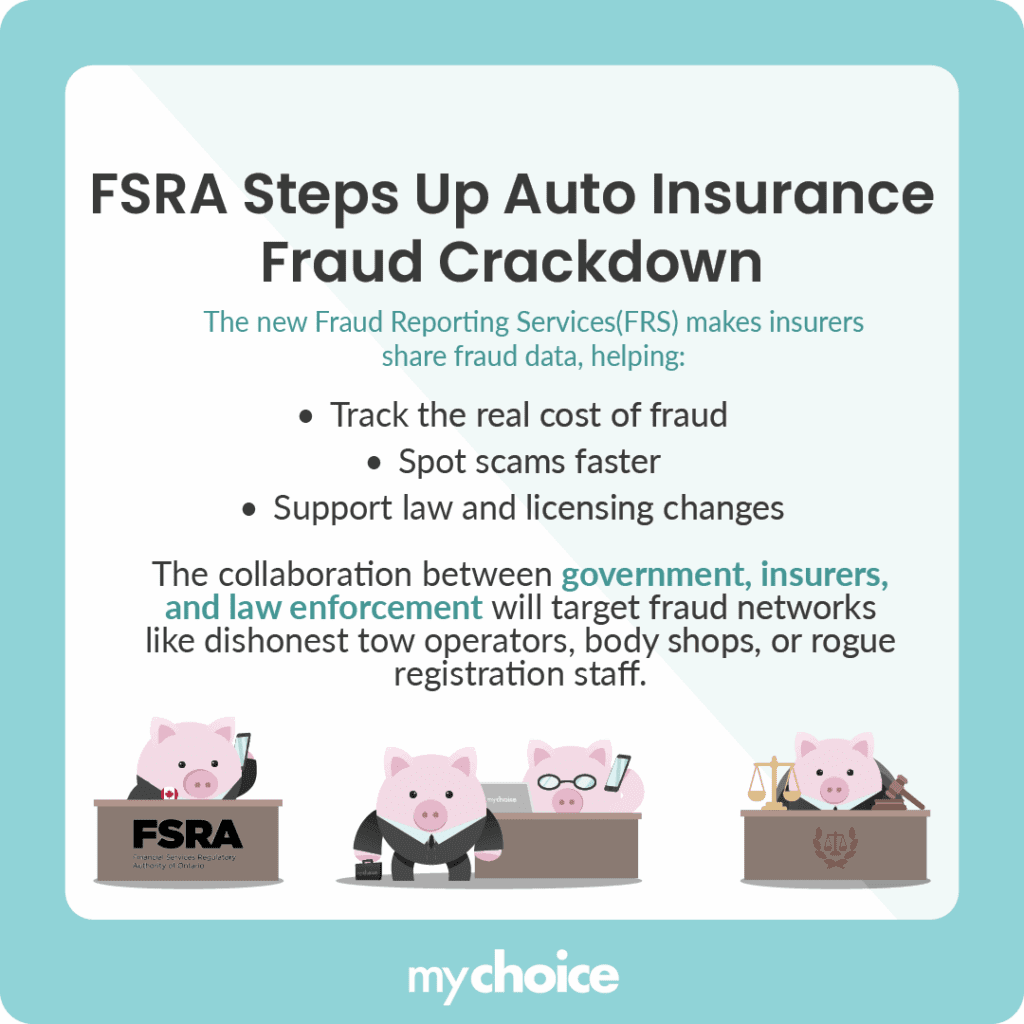

What’s Changing: FSRA’s Multi-Pronged Crackdown

Under the new FRS Rule, every insurer will have to share standardized fraud-related data. That means:

- Better visibility into how much fraud is really costing the system.

- Faster detection of emerging scams or patterns.

- Stronger cases for changing laws or tightening registration and licensing rules.

Regulators are also calling for more collaboration between government ministries, insurers, and law enforcement. This is because fraud often involves multiple players, such as dishonest tow truck operators, body shops, and even, in rare cases, corrupt employees at vehicle registration offices. Without shared data, these networks can operate under the radar for years.

Industry Response: Tech, AI, and Policy Reform

To combat the rise in auto insurance fraud, insurers are investing heavily in technology to detect suspicious activity sooner. Some of the tools and strategies now in play include:

On the policy side, insurers are pushing for changes that would give them more power to deny coverage to known fraudsters, levy stronger penalties, and work more closely with police fraud units.

What Drivers Can Expect Going Forward

For honest drivers, the crackdown is good news in the long run, but it may come with some short-term changes. Here’s what to watch for:

Key Advice from MyChoice

- Be cautious with repair shops and tow operators you don’t know, and stick to insurer-approved providers.

- Keep your vehicle secure. Luxury or not, any car can be a target for theft or VIN cloning.

- Document everything if you’re in a collision to successfully prove your claims, such as photos, witness names, and police report numbers.