When it comes to insurance, understanding all of the nitty-gritty details can be confusing and overwhelming. But it’s important to know exactly what you’re covered for in case the unexpected happens.

One of the major distinctions when it comes to property insurance is between actual cash value vs. replacement cost coverage. Understanding these two terms is vital if you want your insurance policy to accurately reflect your needs and get the peace of mind that your possessions are safe and secure.

In this blog post, we take a deep dive into what actual cash value and replacement cost entail, their pros and cons, and whether one is better than the other.

And for more quick guides to home insurance, check out this list of the top 10 questions to ask your insurance broker.

What Is Replacement Cost Value?

In home insurance, replacement cost value (RCV) refers to the cost of replacing or refurbishing damaged or stolen property with no deductions for depreciation. In other words, your insurance provider will pay for the replacement of an item at its current price.

For example, if your phone goes on the fritz, you receive the cost of purchasing the same or a similar model at the shop.

For homes, calculating the replacement cost is more complicated. Insurers will have to factor in the cost of labour and materials required to build up the structure. Some policies also factor in the cost of lodging while your home is being rebuilt.

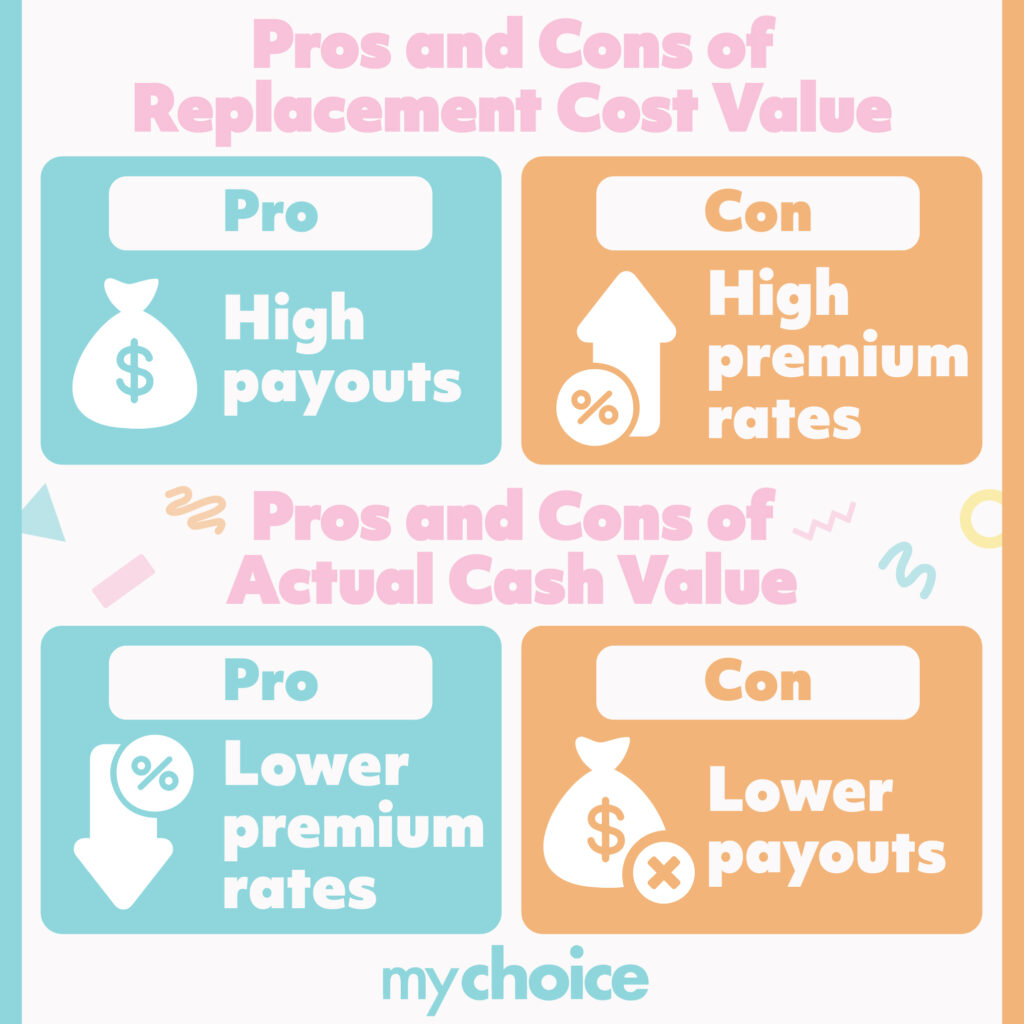

Pros and Cons of Replacement Cost Value

- Pro: High payouts. Policyholders usually don’t have to worry about dipping into their bank accounts to cover the cost of repairing their property.

- Con: High premiums. Because the payouts are higher, insurers charge more for policies that offer this kind of covered losses. If you’re already spending a lot on your mortgage, an RCV-based policy may be too heavy on your wallet.

What Is Actual Cash Value?

Actual cash value (ACV) is a home insurance term that refers to the actual value of an item or property with depreciation factored into the computation.

Most things lose value over time. A TV becomes less valuable as newer models surpass its technology. A used sofa sells for cheaper than a brand-new one because its fabric, springs, and frame gets worn out from constant use.

This is what is referred to as depreciation. Insurers factor it in when calculating the actual cash value of an insured property.

Now, you may be wondering why anyone would opt for ACV when RCV pays more. In reality, most policyholders do prefer RCV for damages or theft on their property. However, RCV can be costly to cover.

ACV actually costs less in premiums than RCV. That means property insurance policyholders can save more on monthly or annual premiums over time.

Pros and Cons of Actual Cash Value

- Pro: Lower premium rates. Policyholders don’t have to worry too much about paying exorbitant premiums on a monthly or yearly basis.

Con: Lower payouts. If you opt for this type of coverage, you will likely have to pay a certain percentage of what it will take to replace or repair damaged/stolen items on your property.

Actual Cash Value vs Replacement Cost Insurance: What Is Better?

Whether ACV or RCV is better for you will depend on your financial situation. In most cases, replacement cost insurance is the better option, as it covers more damages and theft.

However, it also requires higher monthly or annual premiums. In essence, you’re saving less month-to-month or year-to-year – all to give yourself the assurance that you won’t have to dip into your savings should the time come that your home is damaged or burglarized.

With ACV, you’ll be paying less in premiums, but you’ll have to take care of the difference between the cost of depreciation and your property’s replacement value. For some, that means dipping into their savings. For others, it means taking on a home improvement loan. Learn more about home improvement loans here.

For policyholders who are already taking on a lot of monthly expenses, ACV may be the better option. ACV can also work for people who have other assets they can rely on in case one of their properties needs to be replaced or repaired.

The Bottom Line

Understanding the difference between ACV and RCV is integral to making an educated decision about how best to insure yourself against unforeseen events.

Whatever you decide, MyChoice is here to help. Compare auto and home insurance quotes from the top companies on our site and find the best insurance providers in your area today! Head to our home insurance calculator to get started.