MyChoice Study Reveals a 7.8% Rise in Accidents as a Result of Ontario’s G Driving Test Overhaul

In January 2022, Ontario introduced significant alterations to its G road test, a move aimed at addressing the backlog of drivers waiting to take their test due to the COVID-19 pandemic. These changes, made without formal safety evaluations or cabinet approval, involved removing certain elements deemed duplicative from the test. Emergency stops, three-point turns, parallel parking, and driving in residential areas were excluded completely. In June 2022, just six months after implementing the reduced G road test, the Ministry of Transportation performed an evaluation, which, according to the formal audit done by the office of the Auditor General of Ontario, revealed a 30% increase in the at-fault collision rate among novice drivers who passed the reduced test (2.4%) compared to those who passed the full test (1.8%). Despite this increase, the Ministry concluded that the differences were not statistically significant due to the small number of collisions, stating that it was too early to draw meaningful conclusions.

To understand the real-world impact of these test changes two years after they were enacted – MyChoice, a top car insurance comparison website, conducted a study involving 4,800 Ontario G-licensed drivers. The company compared two groups of drivers:

- Those who got licensed at any point in 2022 with at least one year of driving experience;

- Those who got licensed at any point in 2021 with at least one year of driving experience;

MyChoice looked at 2,400 G-licensed drivers from each category mentioned above, picked randomly without any bias, from the overall quotes completed on their website. The company focused on the percentage of drivers involved in accidents for each period.

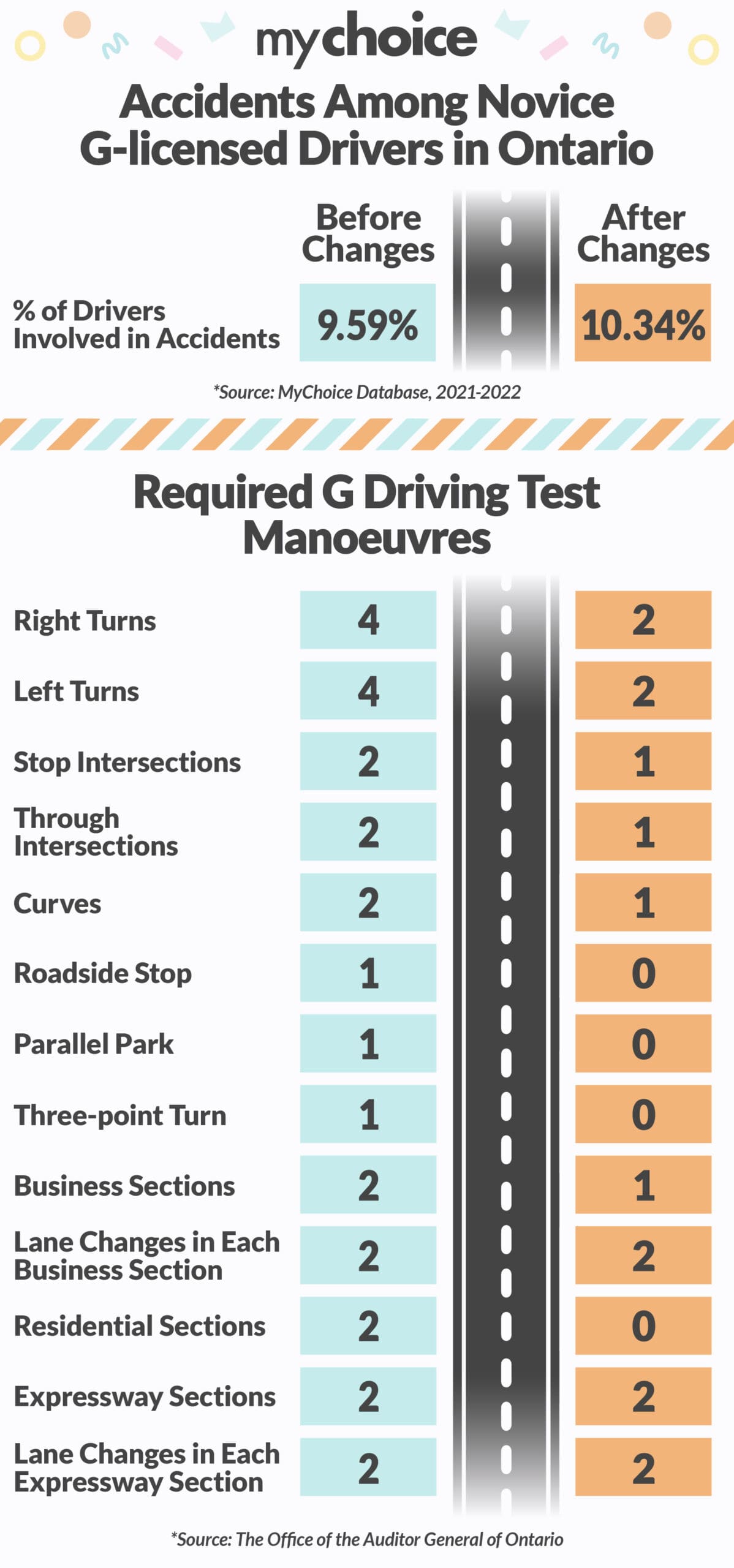

See the attached graphic for the full study results and the differences between required G test manoeuvres in 2021 vs 2022.

The findings indicate a concerning trend. After the test changes, the percentage of novice drivers involved in accidents increased from 9.59% to 10.34%, a 7.82% overall increase. This uptick in accident rates suggests that removing certain driving test elements may have had unintended consequences on road safety.

Aren Mirzaian, CEO of MyChoice, reflects on these findings: “The increase in accident rates among new drivers after the test changes in our sample is a matter of concern. It indicates that while the test changes addressed the backlog issue, they may have inadvertently compromised certain aspects of driving proficiency.”

MyChoice’s study comes one month after the office of the Auditor General of Ontario conducted a formal audit of the changes in December 2023, in which it stated that the decision to streamline the G road test changes was made without proper review and that it may have impacted the road safety. This raises concerns, especially since approximately 54,000 drivers from other countries who can bypass the G2 road test if they have a license from their home country are no longer being tested for these techniques in Ontario.

Mirzaian emphasizes the need for a balanced approach: “While it’s essential to streamline processes, especially in unprecedented times like a pandemic, our study underscores the necessity of thorough driver training and testing. A rise in accidents will undoubtedly have an impact on insurance rates as overall claims amounts rise. This, unfortunately, may result in higher car insurance costs for the public in Ontario.”