Learning to drive is one of the important milestones of growing up in Canada. However, driving comes with a number of risks and costs, with insurance rates being one of the most obvious costs of driving. There are a number of ways for young drivers to save money on car insurance, ranging from having good grades to driving a safe car. One of the quickest and easiest ways to save money on car insurance is to take a driving school course.

How Much Does Driving School Take Off Your Insurance?

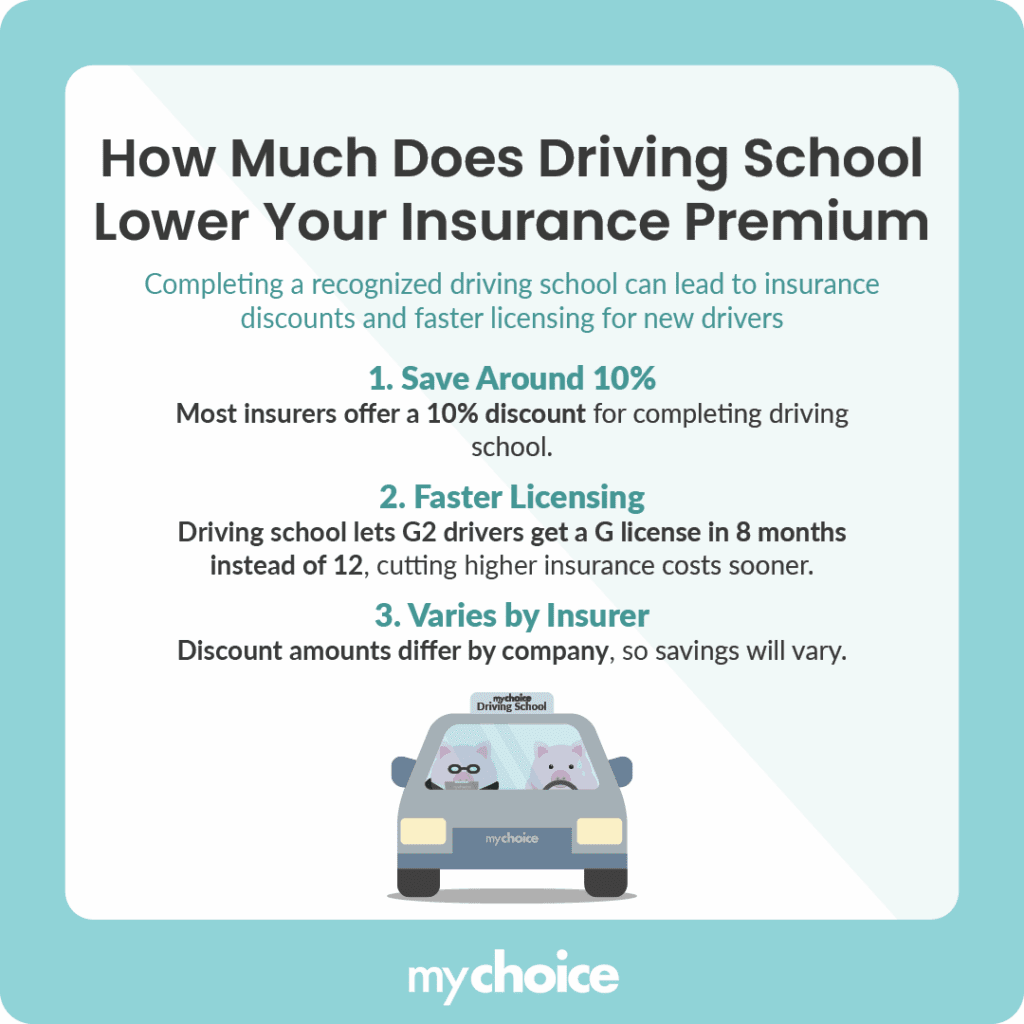

Several factors contribute to determining car insurance rates. Generally, driving school will result in a ten percent reduction in insurance rates. This can add up to large savings as young drivers are considered high-risk drivers and frequently pay huge insurance premiums.

There are a number of other ways that driving school helps reduce insurance rates. A G2 driver who attends driving school can graduate to a G license driver after eight months instead of the usual twelve months. G2 drivers frequently pay more than G-licensed drivers. This means that a driver can reduce the amount of time they pay higher insurance rates by four months. It is essential to note that different insurance companies offer varying levels of driving school discounts, so the actual amount reduced will vary on a driver-by-driver basis.

Which Insurers Offer Driving School Discounts?

Many top insurance companies offer driving school discounts in Ontario. Here’s a quick look at some of them alongside any additional details like qualification conditions and discount percentages, if applicable:

This is not an exhaustive list since so many insurers in Ontario offer driving school discounts. Contact the insurance company if you’re considering getting a policy from a specific insurer and wondering if it offers driving school discounts.

It’s not just your driver’s training certificate that’ll land you a discount. Driving school gives you the fundamentals of safe driving to increase your likelihood of being a safe driver. By being a safe driver, you may also qualify for lower car insurance premiums.

Cheaper Car Insurance by way of a Discount

The most direct way that driving schools save money on auto insurance is by receiving a discount from insurance providers. This process requires you to show a driver training certificate to your insurance company. The insurance company should then offer you a discount.

You should also consider a driving school insurance discount when shopping for car insurance. Most insurance companies list their discounts on their websites. If not, they should be able to inform you about their driving school discount by calling them.

One good option is to check with your insurance company before taking a driving school course, as this will allow you to determine if they will offer an insurance discount if you complete the course, and vice versa if they do not offer a discount.

How Much Does A Typical Driving School Cost?

The average cost of attending driving school is $600. While it is possible to shop around in order to find a cheaper driving school, this six-hundred-dollar cost should be considered an investment towards getting cheaper car insurance.

An example of savings would be a seventeen-year-old driver who would receive average car insurance rates of $6,870 per year without driving school and $5,181 per year with driving school. This would result in yearly savings of $1,689 per year. This makes it well worth the six hundred dollars that driving school costs. A seventeen-year-old driver would face close to the same rates for a three-year period. This means that driver’s school could result in savings of $5,067 over the course of a three-year period. This makes getting a driver training certificate a very attractive investment.

Find an Approved Driver Training School

You must use an MTO-approved driving school in order to receive the benefits of a driving school, and there are several MTO-approved driving schools in Ontario for you to choose from. Here is the most up-to-date list of approved driving schools that can be filtered to your location.

When looking at different driving schools, it is important to look at the specific details of the school. This can include such things as the length of a course, the cost, and the times when a course is held. This will ensure that you are able to successfully complete driving school while spending as little money as possible.

What Is Driving School Like?

What driving school is like depends on the particular driving school. Most driving schools will include a review of the rules of the road, proper vehicle handling techniques, and the licensing process. This is a good way for drivers to learn the information they will need in order to be successful on their official driving tests.

Many driving schools will also take drivers out on the road. This gives them the chance to practice driving with an experienced driver who can properly teach them. This is important as many beginner drivers do not have the chance to learn how to perform manoeuvres such as parallel parking or driving on highways.

One of the nice things about taking a driving course is that it is now possible to take the majority of classes online. This could be especially handy for some young drivers who don’t own their own car as it could mean they would not need to be present at the driving school to still take the course.

Young Drivers Can Save on Insurance by Taking a Driver’s Ed Course

Enrolling in a driving school is generally a good idea for most young drivers. This is because it allows you to save a significant amount of money. Driving school will also enable drivers to obtain their full G license more quickly. This can make it much more convenient for families and young people.

Not forgetting one of the most apparent benefits of driving school is that it makes young drivers safer drivers, which should reduce the risk of them being involved in an accident and then having higher insurance rates.

Key Advice from MyChoice

- Driving school costs around six hundred dollars on average, but it can lower your Ontario car insurance rates.

- Insurance companies like Avenue, Onlia, and TD offer lower rates for driving course graduates.

- Be sure to attend MTO-approved driving schools to qualify for insurance rate reductions.