Car break-ins are a common concern for many Canadians, with one being stolen every six minutes. In many cases, thieves and vandals steal valuables you might leave inside the vehicle, including laptops, wallets, and other items. Do you know if your car insurance covers theft of personal items? This guide will discuss what’s covered and what isn’t, and provide tips on how to protect your vehicle and personal belongings.

Does Car Insurance Cover Theft of Personal Items?

Generally, standard auto insurance in Canada doesn’t cover personal belongings stolen from a vehicle. It’ll only cover the car itself. Thus, you’ll get compensation for items permanently attached to the vehicle, such as side mirrors or tires.

However, you might get coverage for personal items through your homeowner’s or tenant’s insurance, even if the theft occurs away from your home. Ultimately, it’ll come down to your policy’s terms and conditions.

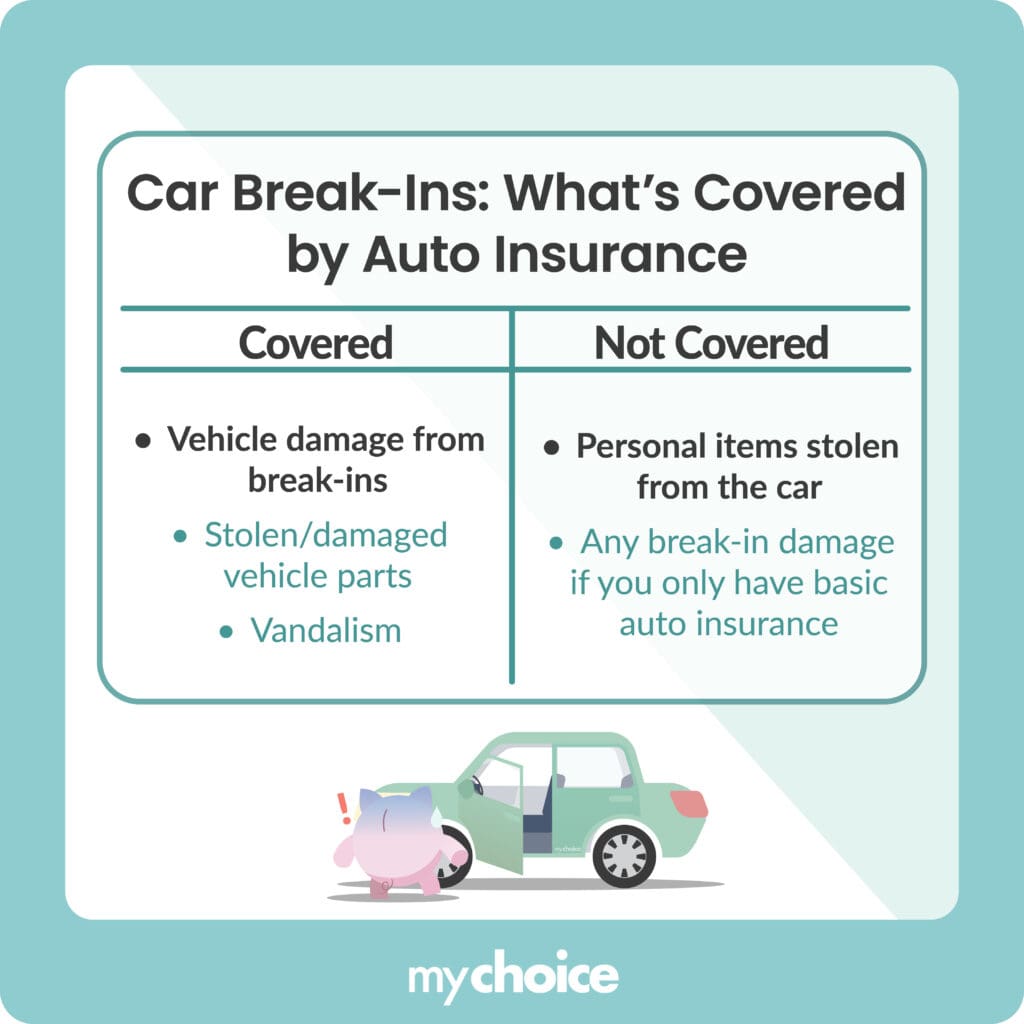

What’s Covered by Your Auto Insurance Policy?

If you have comprehensive or all-perils coverage on your auto insurance policy, you’ll get coverage for damage to the vehicle itself, including:

- Damage from forced entry, such as broken windows, smashed windshields, or pried-open doors

- Stolen or damaged vehicle parts, such as stereo systems, wheels, rims, or converters

- Vandalism, such as slashed tires or graffiti on the car

- Damage from attempted theft, such as a broken ignition, missing keys, or any physical harm

Excluded from auto insurance are any personal belongings you leave inside the vehicle. It’s also worth noting that basic auto insurance doesn’t cover theft or vandalism at all, so you’ll need comprehensive coverage to cover things like broken glass.

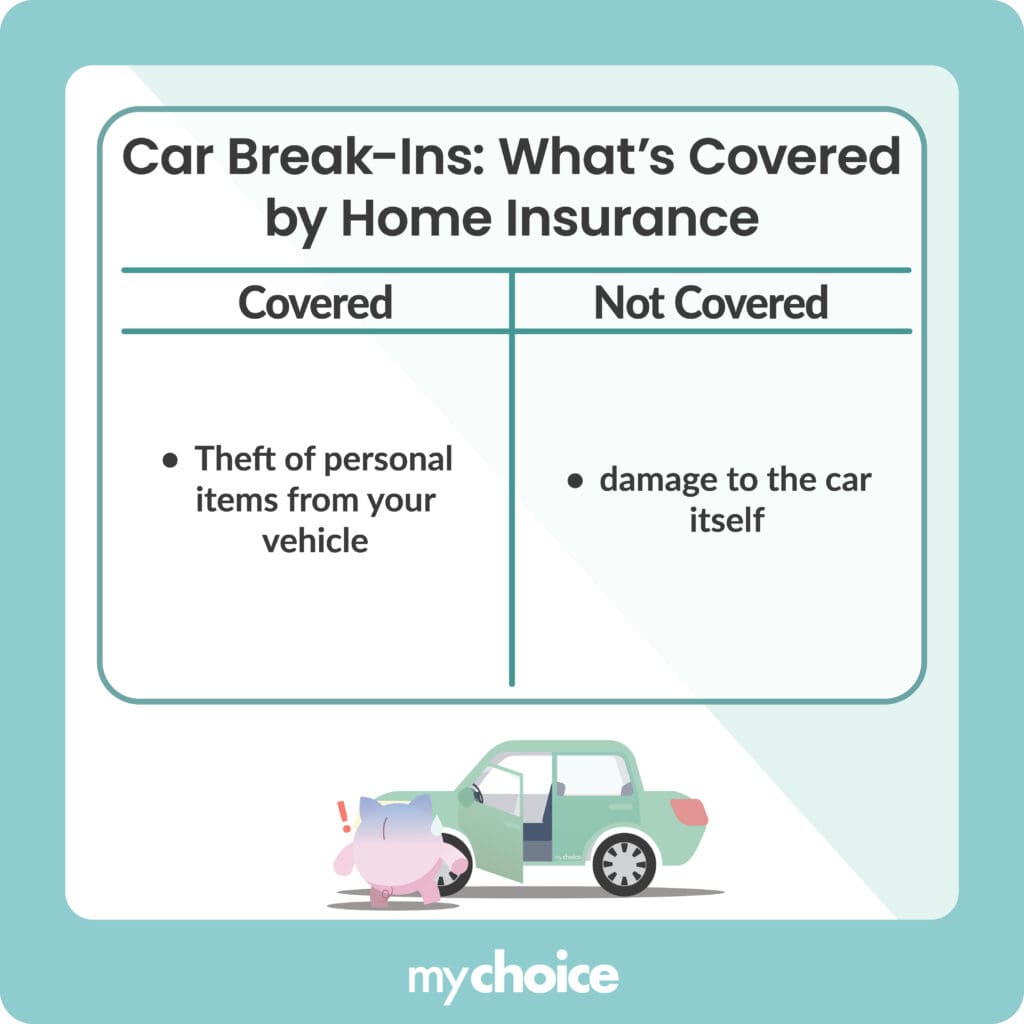

What’s Covered by Your Home Insurance Policy?

Homeowner’s insurance covers personal property theft, and this coverage extends to items in your vehicle. For example, if a thief swipes a laptop, purse, phone, and jewelry stored in your car, you can file a claim under your home insurance policy for those items.

However, claims for these items are subject to specific conditions, such as:

- Your deductible: If the stolen goods aren’t worth much more than your deductible, you may get little to nothing from a claim.

- Coverage limits and exclusions: Certain items, such as jewelry, watches, and collectible items, may be subject to special coverage limits.

- Proof of loss: As with any insurance claim, you must present documentation of the stolen items through receipts, photos, and serial numbers.

In this context, home insurance won’t cover damages to the vehicle itself or any stolen items.

What is an Immediate Action Plan After a Break-In?

Realizing your car has been broken into can be distressing, but it’s critical to ensure your safety before worrying about what items are missing. Here are some simple rules to follow:

- Step 1: Check your surroundings to ensure the perpetrator is no longer present and get to a secure location. Then, contact your local authorities.

- Step 2: Document the scene by taking photos and videos with your phone. This visual evidence will be helpful for the police and for making your claim later on.

- Step 3: Take an inventory of missing items from your vehicle and include their approximate values. If any sensitive personal items were stolen, call your bank to cancel missing credit cards. Take immediate steps to prevent misuse if you notice your driver’s license, passport, or any documents that contain personal information are missing.

- Step 4: Secure your vehicle by covering broken openings with a plastic tarp or towing it to a safe location. From there, contact your insurance company to start the claims process. Provide them with details of the incident, including your inventory and any photos you took of the scene.

Tips for Filing a Claim After a Break-In

Filing a claim after a break-in can be complicated, mainly because there are two separate claims to make. To ensure the process runs smoothly, consider the following tips.

Alternative Compensation Options You Might Not Know

Besides your primary insurance policies, there are other ways to get your money back on stolen items. Here are lesser-known options for compensating your losses.

How to Prevent Future Break-Ins

You’ve dealt with a break-in once; you don’t want to deal with it again. Many insurers stress basic but effective precautions like:

- Locking your doors and windows every time you park

- Writing down your VIN number

- Keeping items out of view or removing them from the car entirely, especially those listing personal information

- Park in secure, well-lit areas with high visibility

- Use anti-theft devices, such as steering wheel locks and tag tracking

- Keeping spare keys or garage openers on your person, not in your car

- Staying vigilant in higher-risk areas

- Joining a neighbourhood watch and always letting family members or friends know where you are

Key Advice From MyChoice

- Focus on making your vehicle a difficult target to steal from or damage. Install an alarm system and lock up your valuables in a safer location.

- Contact your car dealer or manufacturer for potential security guarantees, which can equip your vehicle with anti-theft systems.

- Understand the differences between auto and home insurance when it comes to theft coverage. If you need guidance, consult your insurance provider to better understand how to navigate the claims process.