Navigating the world of auto insurance can sometimes feel like deciphering a complex puzzle. But, as always, MyChoice is here to guide you through it. Today, we’re diving deep into the topic of OPCF 19/19A. By the end of this article, you’ll have a clear understanding of its importance and whether you need it.

What is OPCF 19?

An Ontario Policy Change Form (OPCF) is an add-on to your existing auto insurance policy. OPCF 19, also known as “Limiting the Amount Paid for Loss or Damage Coverages,” determines the maximum amount your insurer will pay out in the event of a loss. The insurer will pay the lesser of the ACV (actual cash value) at the time of the claim or the limit set by OPCF 19. This endorsement typically sets a limit based on the appraised value of the vehicle.

What is OPCF 19A?

OPCF 19A, known as the “Agreed Value of Automobile(s) Endorsement,” guarantees to pay the amount stated in the agreement, which is predetermined by the vehicle’s appraisal. This endorsement is especially beneficial for classic or antique cars, where the value is often higher than a typical vehicle. Most antique-specific insurance coverages include the OPCF 19A endorsement.

The Distinct Differences Between OPCF 19 and OPCF 19A

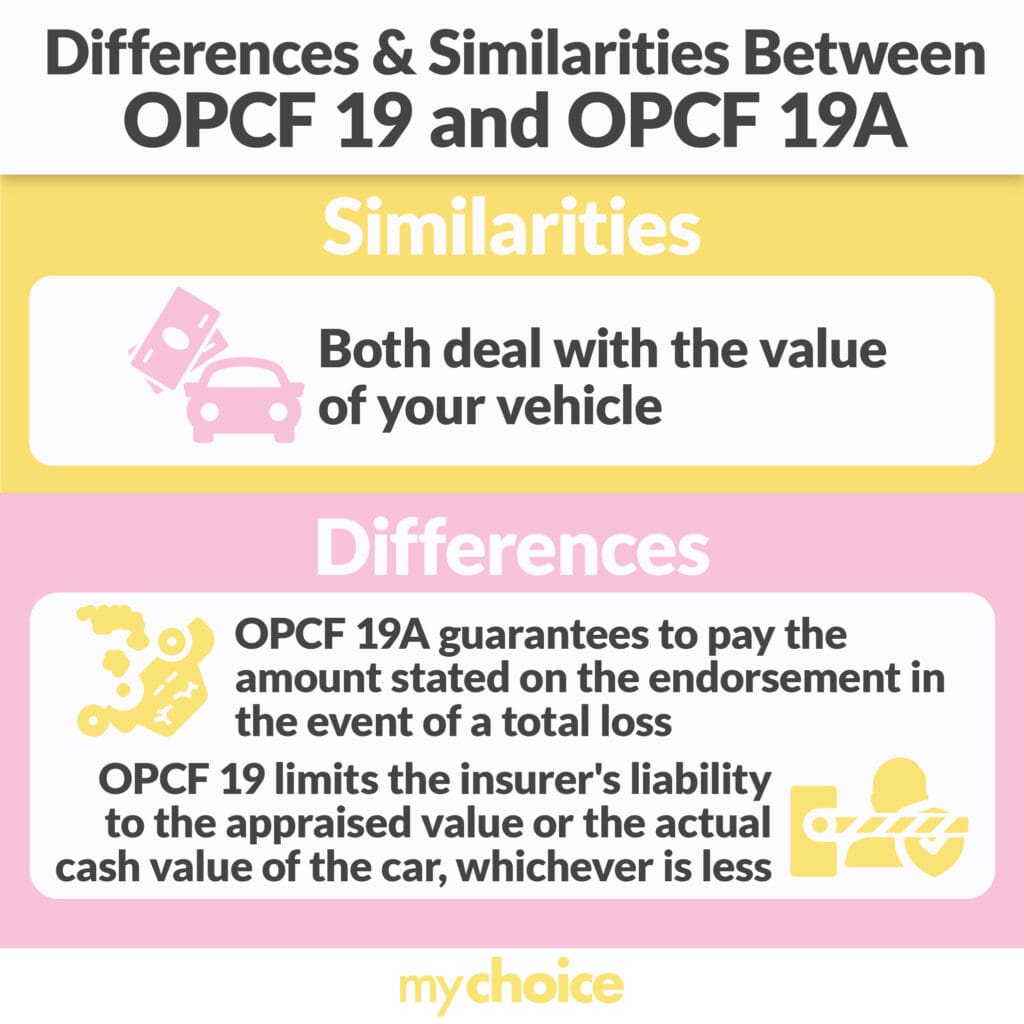

While both endorsements deal with the value of your vehicle, they serve different purposes:

- OPCF 19A: This endorsement guarantees to pay the amount stated on the endorsement in the event of a total loss. The appraisal of the car determines that amount. This is the coverage you want for your antique car!

- OPCF 19: This endorsement limits the insurer’s liability to the appraised value or the actual cash value (ACV) of the car, whichever is less. It’s essential to note that the ACV might be more than the appraised value, especially if a significant amount of time has passed between appraisals. However, the insurance company might attempt to settle for less than the appraised value.

Is OPCF 19/19A Mandatory in Ontario?

While having a valid policy is a mandatory requirement in Ontario, endorsements such as OPCF 19/19A are not legally required to drive in the province. They are optional additions you can incorporate if you seek additional protection for your car insurance.

How to Add OPCF 19/19A to Your Policy

Incorporating OPCF 19/19A is straightforward. Simply contact your broker and inform them of your decision. It’s beneficial to have a professional car appraisal done beforehand to support the process, ensuring you have evidence of the vehicle’s value in case of disputes. This ensures you receive fair value for your vehicle.

Real-Life OPCF 19 Policy Example

Consider a car manufactured in 1990, now considered a classic car, since it’s over 20 years old. If you opt for a “classic or special interest car” insurance policy, the premiums are very low, and the coverage is the best with a 19A endorsement. However, if you choose a regular auto policy, informing the insurance company of the vehicle’s quality will help in any future dispute. A car appraisal by an expert is the best way to inform an insurance company of the vehicle’s quality and true fair value.

Bottom Line

OPCF 19/19A endorsements offer an added layer of protection, ensuring that you receive the agreed-upon value for your vehicle in case of a loss. As always, MyChoice is here to guide you through the insurance maze, offering a variety of options tailored to your needs.