As they do with rent, utilities, and other costs of living, roommates can share renters insurance. On the upside, it’s cheaper, more convenient, and, in some cases, more comprehensive. However, co-signing a policy with someone is a responsibility—and potentially a risk.

College students and young adults aren’t the only ones with roommates. While one-census family households are still the most popular in Canada, roommate living arrangements have seen the fastest growth in the last 20 years.

With more and more Canadians sharing a lease, it’s important to know whether you can share one of the important costs associated with it: renters insurance. Learn more about it here.

Can Roommates Share Renters Insurance?

Yes, roommates can both be on a renters or tenant insurance policy. With some insurers, it may even be free to add someone else as a policyholder.

That said, some providers may place limits on who and how many are listed on the policy. In most cases, only two people can share tenant insurance.

For households with more than two roommates, it’s recommended that each one get their own policy. Some insurance companies may not offer joint policies either, requiring you to get separate policies. Check with your insurer to learn more about your options.

Do Both Roommates Need Renters Insurance?

Unlike with car owners and auto insurance, it’s not mandatory to get tenant insurance when renting. However, landlords may—and many do—require it as part of the rental agreement they make with you. This protects them from liability and reassures them of your responsibility.

Keep in mind that renters insurance covers individuals, not the shared space they’re living in. If a potential roommate doesn’t have insurance and your landlord asks for it, they have to be added to your policy or get their own.

Does My Parents’ Policy Still Cover Me?

Even if you live away from home, you may still be covered under your parents’ insurance if you are a full-time student, have only temporarily moved out for school, or are otherwise a dependent.

A dependent’s personal property is usually insured for up to 10% of the parents’ coverage. Reach out to your parents’ insurance provider for more specific information on your eligibility.

Renters Insurance Basics

Almost ⅔ of young Canadians rent their primary residence, and ⅓ of Canadians overall are renters. This means there’s a good chance you’ll need to get renters insurance at some point. If you haven’t already, that is.

Here’s what you need to know about renters insurance before you share a policy with someone or get one for yourself.

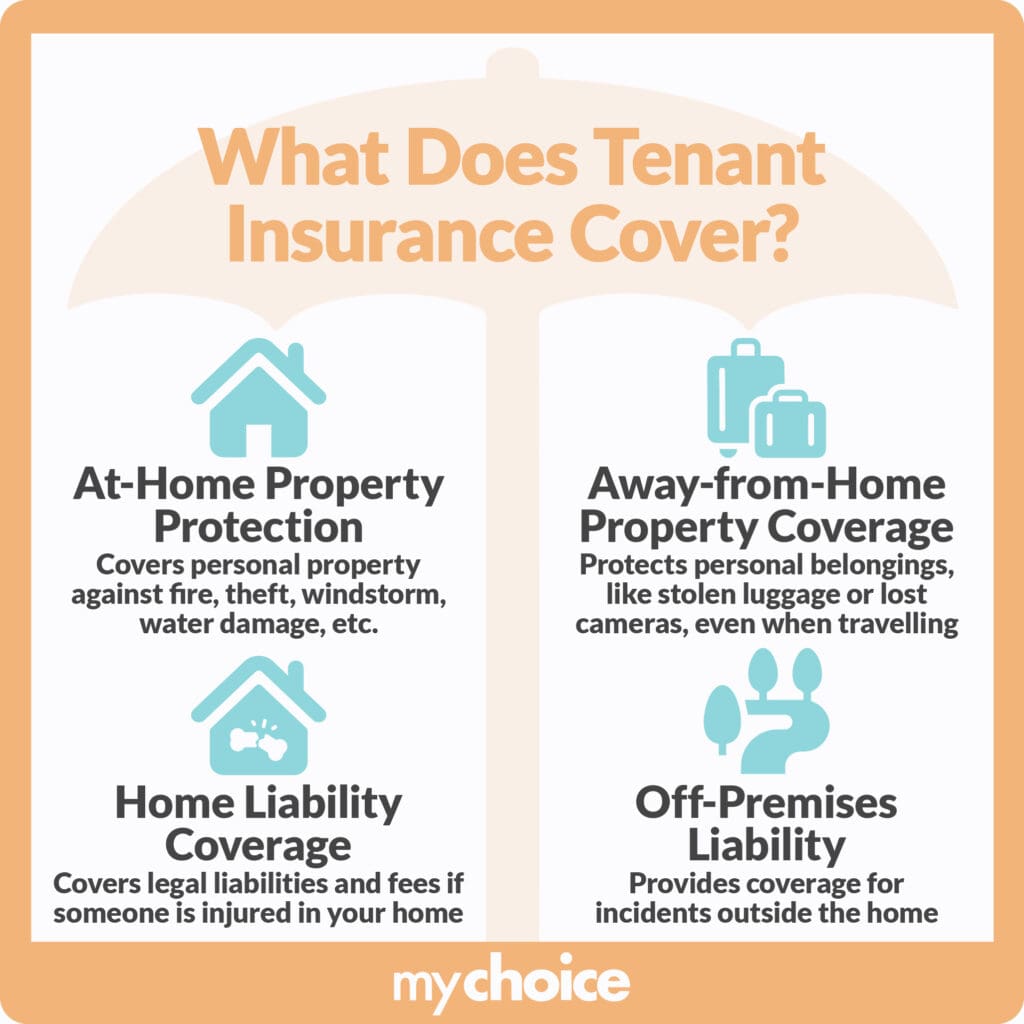

The below infographic shows the coverage options for shared renters insurance among roommates.

Why Share Insurance Between Roommates

People share an insurance policy with their roommates because of:

- Lower costs: Splitting the costs saves each insured an average of $12-15/month.

- Convenience: One policy is easier to manage than multiple policies, especially when it comes to paying premiums and filing claims.

- More coverage: You can potentially afford a more comprehensive policy if more people pay into it.

- Shared protection: It’s easier to rest at night knowing that your entire household is covered, even in the event of an accident.

Potential Considerations

Sharing an insurance policy with a roommate is a big responsibility. Below are some things you should keep in mind to ensure your best interests:

- Trust: How well do you know your roommate? Are they responsible with money? Sharing an insurance policy means commingling your finances, so do your due diligence.

- Financial impact: Any claims your roommates make can appear on your record and affect your credit score. Plus, another policyholder can change, cash out, or even cancel the policy, leaving you in a vulnerable position.

- Responsibilities & payouts: Discuss how to amicably split both the premiums and any claims, especially if one roommate has more assets or potential liability than the other.

- Inventory: Even if you share a policy, it’s each policyholder’s individual responsibility to take inventory of their own belongings. Make a list of your personal property, take pictures of their current condition, and keep receipts, updating the list as you make new purchases.

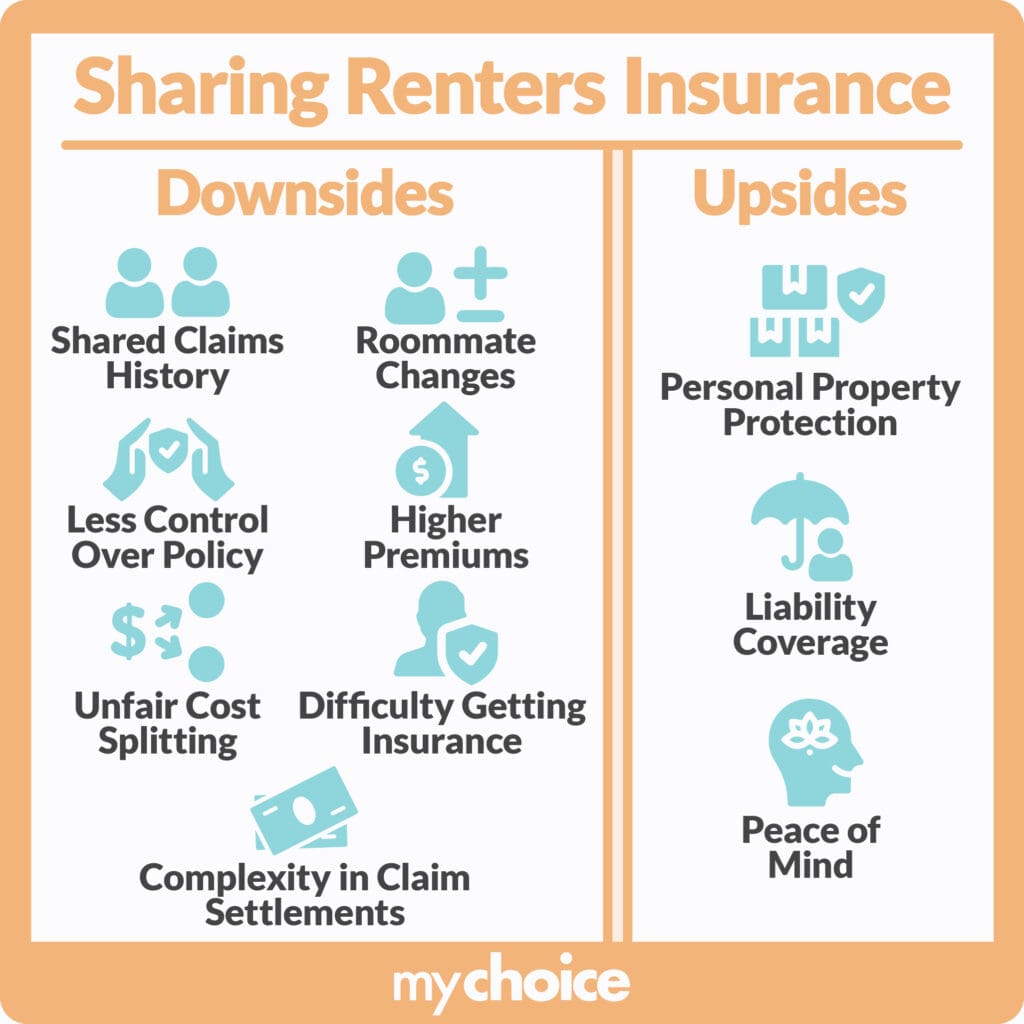

Have a look at the below infographic to see what the pros and cons of sharing renters insurance with roommates are.

Risk Assessment: Is Sharing Renters Insurance With a Roommate Right for You?

Whether you should share an insurance policy with your roommate depends on your specific circumstances. If both you and your roommate are willing to take on the responsibility, it could be a great way for you to save money and time.

Another option is to each get your own policies, especially if you don’t want to take on additional risk for a few dollars a month. While this will cost more overall, it guarantees coverage while also protecting you from each others’ liabilities.

Key Advice From MyChoice

So, how do you get the best value from sharing your renters insurance with roommates? Here’s our advice:

- Tenants may be required by a landlord to have renters insurance before they can move in. Roommates can get separate policies or share one.

- Some full-time students may still be covered by their parents’ insurance. Ask their insurers to avoid paying for unnecessary coverage.

- Instead of getting separate policies, you can discuss increasing the deductible on your joint policy.

- Shop around for rates on MyChoice and contact an insurance agent to get the best policy for you. Typically, you can also bundle it with other types of insurance for cheaper, such as home insurance, auto insurance, and more.