Millions of people across Canada keep some personal belongings in a storage unit. Unfortunately, there are many unpredictable events that can happen that may lead to damage or loss of possessions in a storage unit. Taking out a storage unit insurance policy will ensure that you’re covered in the event of theft, vandalism, or fire in a storage unit.

Storage Unit Insurance at a Glance

- Storage unit insurance covers belongings that are kept in a storage unit.

- Many storage facilities will require you to take out a storage insurance policy before you can rent out a unit.

- Some homeowners’ or renter’s insurance policies will have storage insurance baked in, but those typically have limited coverage compared to a standalone storage insurance policy.

Keeping your possessions in a storage unit doesn’t always mean that they’re protected. Purchasing storage unit insurance will keep your belongings protected in case of theft, vandalism, fire, or weather damage. Most storage facilities in Canada require their tenants to have some form of storage unit insurance, either through their own policy or a separate one. While storage facilities have their own insurance, their policies only cover the building itself and the equipment, not the belongings being stored in the units. Read on to learn more about storage unit insurance, and whether you need it for your possessions.

Why Do I Need Storage Unit Insurance?

Taking out insurance for a storage unit may seem like an unnecessary expense. But if you’re keeping anything important in your storage unit, you’ll want to keep your belongings protected from unfortunate events.

Storage insurance in Ontario keeps your personal belongings protected from a wide range of risks such as theft, vandalism, fire, water damage, and other kinds of weather-related incidents. You can’t predict when something might happen to your belongings in a storage unit, so taking out storage insurance can protect you from significant financial loss.

Most home insurance policies typically offer limited coverage for personal belongings stored outside your home. However, this is usually a lower percentage of your home insurance, meaning that if you have a lot of items kept in your storage unit, you may not be completely covered. If you’re keeping high-value items outside of your home, taking out extra storage unit insurance will give you a greater degree of protection and peace of mind.

Just like you need car insurance before you can drive a car, many storage facilities will require you to take out storage insurance before you can rent out a space on their premises. This ensures that both your belongings and the facility itself are covered in case of property loss or damage.

While you can take out storage insurance through your existing home insurance policy, you can also get standalone storage insurance. Getting a separate policy for your storage unit typically gives you more comprehensive coverage, and prevents storage insurance claims from affecting your home insurance premiums.

What Does Storage Unit Insurance Cover?

Before taking out storage unit insurance, it’s important to know what’s included in the coverage.

- Theft and vandalism: Storage insurance protects you against theft and vandalism, two of the most common risks associated with renting out a storage unit.

- Fire damage: Taking out storage insurance keeps your belongings protected in case of a fire starting in the storage facility.

- Weather-related damage: Storage unit insurance can protect your belongings against damage caused by unpredictable weather, though this can vary greatly depending on where you’re located and the specifics of your policy.

- Pest Damage: Sometimes, mice or insects can get into your storage unit and damage your belongings. Storage insurance typically doesn’t cover this kind of damage.

- Negligence: Storage insurance doesn’t cover damage or losses that are a result of the storage unit renter’s negligence. This includes items getting damaged from improper packing, precarious stacking, or lack of maintenance.

- Natural Disasters: Typically, natural disasters such as earthquakes or flooding aren’t covered by storage insurance. However, you can take out additional insurance to protect against these events.

Does My Home Insurance Policy Include Storage Insurance?

Most home insurance policies have storage insurance as added coverage, though this only insures your personal belongings for a percentage of your insurance payout. This is typically between 10-15% of your total insurance payout, and may not be enough to completely cover all of your stored possessions.

Taking out a separate storage unit insurance policy can guarantee that any belongings in your storage unit are protected against any untoward events. With storage locker theft becoming very common in Ontario, it’s important to make sure that all of your belongings have protection in case of a break-in.

One man lost $11,000 worth of belongings from his storage unit and entered into a dispute with the storage facility over who should compensate him for the loss. Unfortunately, this can be a common occurrence, especially if you don’t have standalone storage insurance.

How to Choose the Right Storage Insurance

When looking for a storage insurance policy, you can be presented with a myriad of options. Here’s how to find one that covers what you need while fitting within your budget:

- Check your existing homeowner’s or renter’s insurance policies to see if they come with storage unit insurance built-in.

- Take stock of the belongings in your storage container and determine how valuable they are, both monetarily and sentimentally. Some higher-value items may require additional coverage to be properly protected.

- Compare the coverage and premiums of different insurance providers and policies. Assess how much coverage you’ll need and how much you can afford to spend on insurance premiums.

- When you’ve chosen a policy, pay close attention to the details. Take note of the deductibles, coverage limits, and exclusions to be certain that your needs are met.

Tips to Secure Your Storage Unit

Even when you have storage unit insurance, it’s a good idea to take steps to make sure that your possessions are safe and secure. Since storage insurance policies exclude some types of damages, taking preventive measures will give you more peace of mind, especially when your storage unit is filled with items of sentimental value like old photos, furniture, or family heirlooms. Here are a few steps you can take to ensure the safety of your belongings:

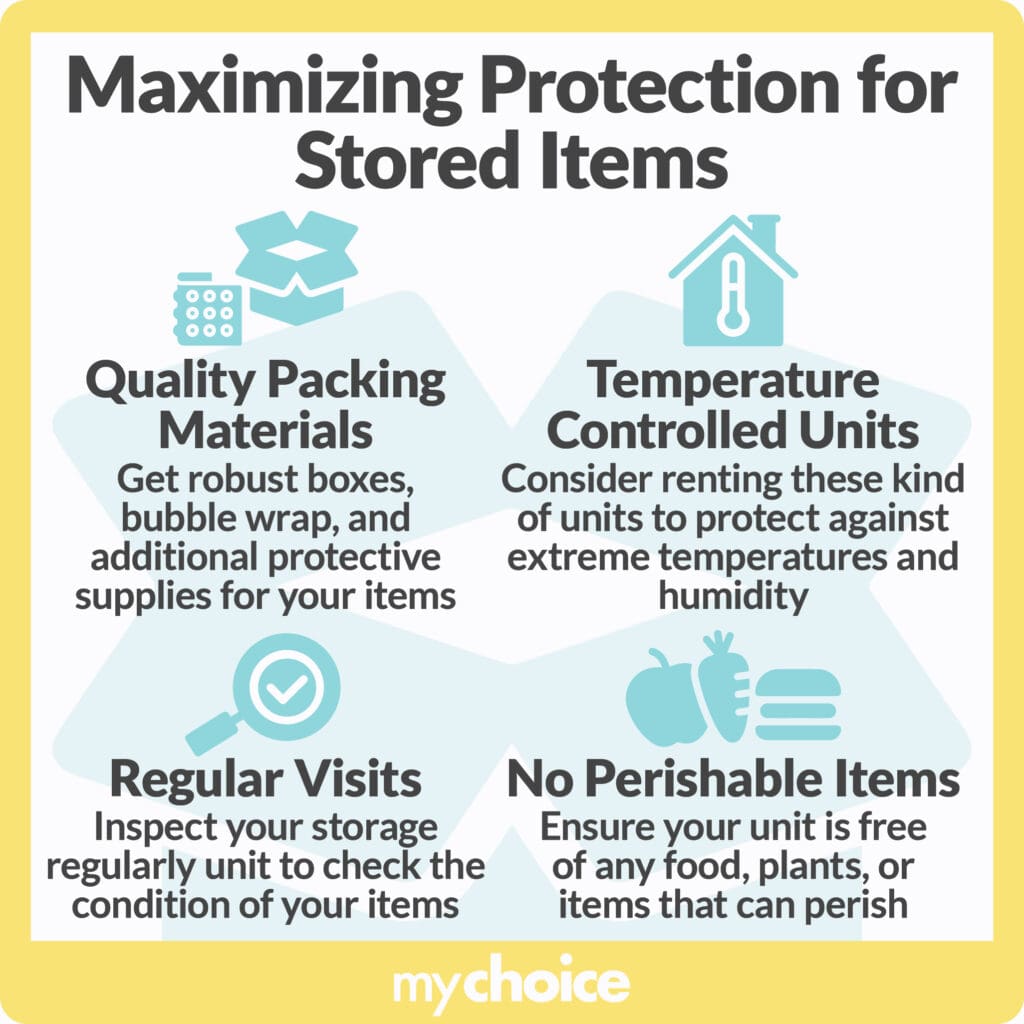

- Avoid storing food, plants, or other perishable items in your storage container. Not only can they decompose and create a nasty environment in your storage container, but they can also attract pests like mice or cockroaches that can further damage your other possessions.

- Properly pack and store your belongings. Purchase quality boxes to store your items, along with some bubble wrap to prevent damage from impacts. Make sure that boxes and other large items are stacked securely to prevent them from falling. Put covers over upholstered furniture to keep them from being dirtied by dust and other particles.

- Regularly visit your storage container to conduct an inspection of your belongings. Make sure that everything’s in good condition and that your storage unit is secure. Look around the gate or door for loose screws or signs of lockpicking. Search the walls and floor of your storage unit for holes that might have been made by pests. If you see any signs of damage to your storage unit, report it to the storage facility immediately.

- If you’re storing important documents, electronics, antiques, or other fragile items, consider renting a climate-controlled storage unit. Not only will this protect your belongings from humidity and extreme temperature changes, but these kinds of storage units generally have better security and are continuously monitored by the storage facility staff.

- Buy your own locks if your storage unit allows you to do so. While some storage facilities have their own locks, it’s generally a good idea to shop around for a sturdy lock for your unit to keep your mind at ease. You may have to leave a copy of the key with the storage facility in those cases.

Key Advice From MyChoice

- Storage unit insurance may be included in your home insurance policy or bought as a standalone policy.

- Assess the value of the items in your storage unit to determine whether or not you need a separate storage insurance policy.

- Claims made on a standalone storage insurance policy don’t affect the premiums of your main home insurance policy.

- Make sure that items in your storage unit are packed and stored properly, as storage insurance doesn’t cover damage as a result of negligence. Visit your storage unit regularly to make sure that all of your belongings are in good condition.