Home fire insurance is a crucial component of homeowners insurance, offering protection against potential fire-related damages to your property and belongings. With the increasing number of residential fires reported annually, understanding the intricacies of fire insurance becomes essential for homeowners. This article delves deep into the realm of home fire insurance, ensuring you’re well-equipped with the knowledge to safeguard your valuable assets.

Is Fire Insurance Included in Home Insurance?

Yes, fire insurance is typically included in standard homeowners insurance policies. It provides coverage for damages to your home, detached structures on your property, and personal belongings resulting from fires. However, it’s essential to read your policy documents carefully to understand the extent of the coverage and any exclusions.

What Does Fire Insurance Cover?

Dwelling Coverage

This covers the structure of your home, including attached structures like garages. If a fire damages your home, this coverage helps pay for repairs or rebuilding. It’s crucial to ensure that your coverage limit aligns with the current rebuilding costs.

Detached Structures

Often referred to as “other structures coverage,” this covers structures not attached to your home, such as sheds, fences, and detached garages.

Personal Property

This coverage extends to your personal belongings, like furniture, appliances, and clothing. If a fire damages these items, the insurance will help pay for their repair or replacement. However, certain high-value items might have coverage limits, so consider additional coverage if needed.

Additional Living Expenses

If a fire renders your home uninhabitable, this coverage helps pay for additional living expenses, such as hotel stays and meals.

Types of Fires Covered by Insurance

Insurance typically covers various fire types, including:

- Candle Fires: Fires resulting from knocked-over candles.

- Grease Fires: Common in homes with gas ranges, these occur when cooking oil ignites.

- Electrical Fires: Caused by short circuits or power surges.

Accidental fires, like those caused by knocking over a candle, are generally covered. However, intentional fires or those resulting from acts of war are not covered.

Standalone Fire Insurance Policy vs. Comprehensive Policy

A standalone fire insurance policy is a limited type of insurance that only covers losses caused by fire. This means it doesn’t cover damages from water, burst pipes, vandalism, storms, or personal liability. It’s primarily designed for those who can financially handle all but the most severe damages or for properties that might be old or in poor condition.

On the other hand, a comprehensive home and contents policy, which includes fire insurance coverage, offers a more holistic protection against a variety of perils. It often comes with more favourable payment terms, including replacement costs that cover repairs or rebuilds, even if the costs exceed the policy limits.

How Much Does Fire Insurance Cost?

The cost of fire insurance is influenced by various factors, including:

- The property’s replacement value

- Proximity to fire hydrants and fire stations

- The home’s geographical location

- Security features in the home

For instance, a home valued at $300,000 located near a fire hydrant and fire station might have a fire insurance cost ranging between $200 and $400 annually. However, the same home in a remote area could cost between $600 and $900 per year.

It’s essential to review your policy periodically, especially after significant life changes or home renovations. Also, it’s worth considering having a WETT inspection done in your house in case you have a lot of wood-burining appliances.

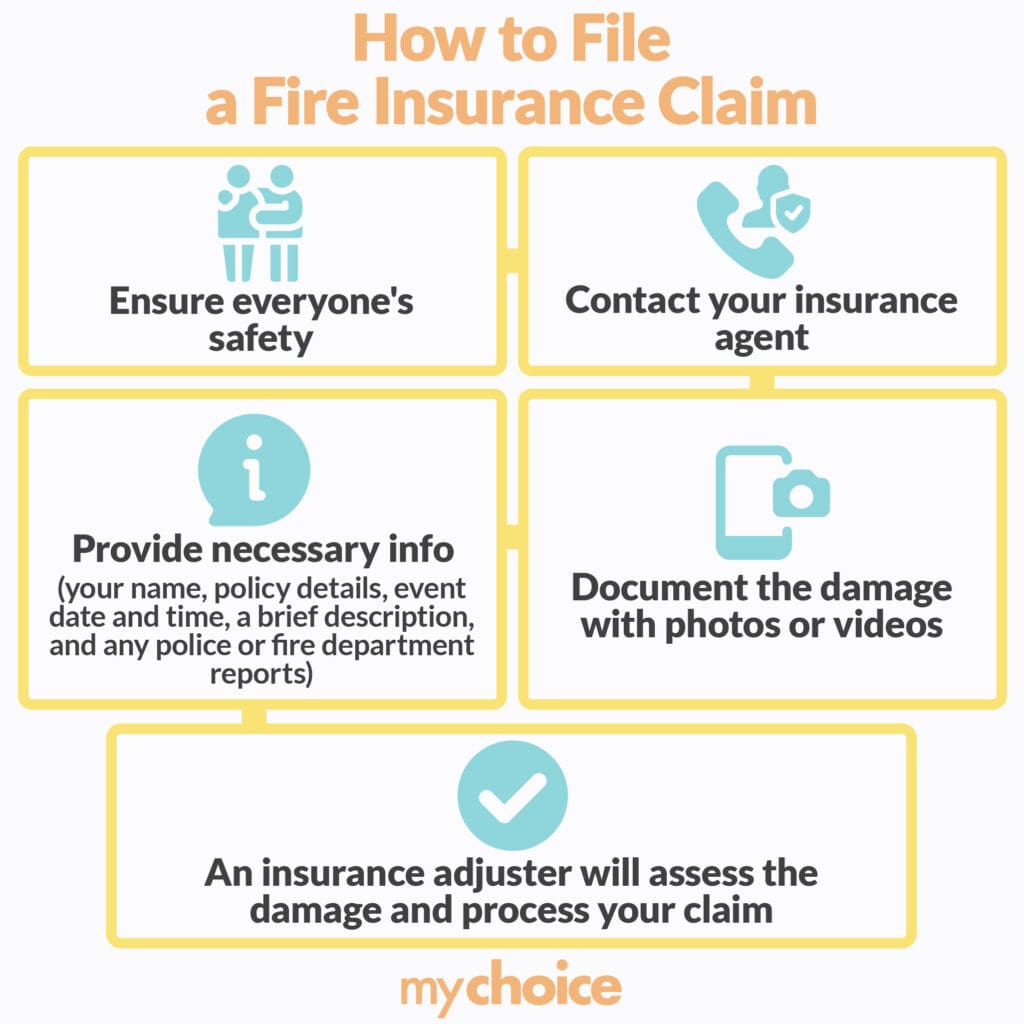

How to File a Fire Insurance Claim

In the unfortunate event of a fire:

- Ensure everyone’s safety.

- Contact your insurance agent.

- Provide necessary information, including your name, policy details, event date and time, a brief description, and any police or fire department reports.

- Document the damage with photos or videos.

- An insurance adjuster will assess the damage and process your claim.

Fire Damage Not Covered by Homeowners Insurance

While homeowners insurance offers extensive fire coverage, certain scenarios aren’t covered:

- Intentional Fires: If you deliberately start a fire, the resulting damage won’t be covered.

- Acts of War: Damages resulting from wars are typically excluded.

Final Thoughts

Home fire insurance is a protective shield for homeowners, ensuring financial security in the face of unforeseen fire-related damages. By understanding its nuances and ensuring adequate coverage, homeowners can achieve peace of mind, knowing their most valuable asset is well-protected.