For decades, fire safety in Canada steadily improved. Following the 1970s, the introduction of mandatory smoke alarms, improved building safety standards, and public education campaigns led to a steady decline in fire-related fatalities and injuries across the country.

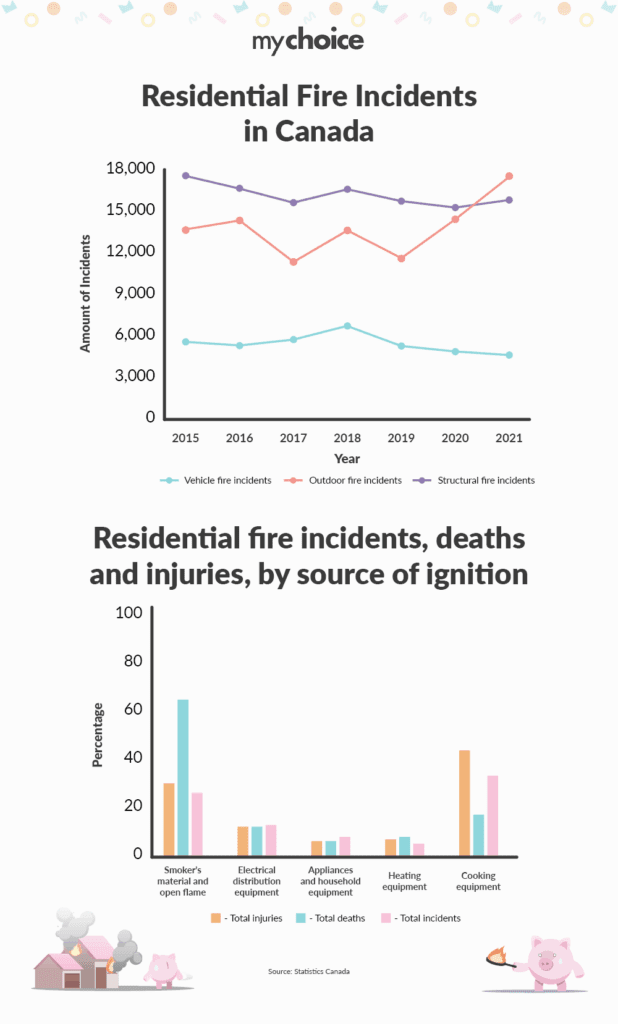

But that trend has quietly reversed. According to Statistics Canada, reported fire incidents rose from about 33,000 to more than 39,000 across Canada between 2017 and 2021.

Modern house fires burn faster, produce more toxic smoke, and leave far less time to escape than fires before. Additionally, the aging housing supply in Canada and emerging smart technologies introduce risks that traditional safety systems were not designed to address.

Our team at MyChoice reviewed national residential fire statistics, housing conditions, and emerging technologies to understand why Canadian homes are becoming more vulnerable,and what this means for homeowners and insurance premiums.

Residential Fires Are On the Rise

Fire departments are responding to more incidents than just a few years ago.

As mentioned earlier, reported fire incidents rose by 18% across Canada between 2017 and 2021. Approximately 70% of structural fires occur in homes, and they are by far the deadliest. In 2021 alone, roughly 77% of fire-related deaths happened in residential properties.

More time spent at home since the pandemic has amplified everyday risks associated with cooking, heating, and smoking, but the underlying issue is structural. Homes started to burn in a completely different way.

Residential Fire Causes Haven’t Changed Much

Below are the most common sources of structural residential fires in Canada and how they have changed since 2017.

| Ignition Source | 2017 Incidents | 2021 Incidents | Change |

|---|---|---|---|

| Cooking equipment | 2,714 | 2,299 | -15% |

| Heating equipment | 1,295 | 1,111 | -14% |

| Appliances | 662 | 590 | -11% |

| Electrical distribution | 1,302 | 1,231 | -5% |

| Other electrical | 521 | 441 | -15% |

| Smoking / open flame | 2,405 | 2,612 | +9% |

| Exposure fires | 599 | 1,190 | +99% |

| No igniting object | 163 | 123 | -24% |

| Unknown source | 6,182 | 6,389 | +3% |

Cooking causes the most fires, but smoking materials remain the leading cause of fatalities because they often start smouldering fires while occupants are asleep.

Many injuries occur when people attempt to extinguish fires themselves, especially grease fires, using improper methods.

Exposure fires (i.e., fires that did not start inside the home) are on the rise. This is likely attributable to the increasing risk of wildfires nationwide.

Modern Fires Burn Faster Than Older Fires

Thirty years ago, a typical house fire gave occupants about 14 to 17 minutes to escape. Today, that window is closer to 2 to 3 minutes.

The biggest reason is materials. Older homes were filled with natural materials like wood, cotton, and wool. Modern homes contain synthetic materials such as polyurethane foam and plastics. These materials ignite faster and produce dense, toxic smoke.

Instead of gradually spreading, modern fires can reach full room ignition (“flashover”) within minutes.

That means smoke alarms matter more than ever, just as much as your reaction time.

The Smoke Alarm Gap

Smoke alarms remain the single most important life-saving device, yet many homes fail to maintain them.

Homes without working alarms accounted for roughly three-quarters of fire deaths.

| Alarm status | Share of fires | Share of deaths |

|---|---|---|

| Working alarm | 37% | 26% |

| Failed to activate | 12% | — |

| No alarm installed | 13% | — |

| Unknown | 38% | — |

Lithium-Ion Batteries Are a Rapidly Growing Risk

One of the biggest emerging dangers is lithium-ion battery failure. E-bike fires are up 1200% in Toronto since 2020.

When damaged or improperly charged, these batteries can undergo thermal runaway, a chemical reaction that releases extreme heat and toxic gases and is difficult to extinguish.

Unlike traditional fires, these can grow from smoke to a room-engulfing blaze in under 90 seconds.

What This Means for Home Insurance

Fire risk is changing from a predictable hazard into a volatile one.

Insurers now need to account for:

• Faster-spreading fires

• Higher claim severity

• Technology-related ignition sources

• Aging housing stock

Aren Mirzaian, CEO of MyChoice, explains what this means for insurance: “The nature of fire risk has fundamentally changed. Modern homes ignite a lot more easily and quickly. For insurers, that means higher claim severity and more volatility. For homeowners, it means prevention is now just as important as protection when it comes to keeping premiums manageable.”

Key Advice From MyChoice

- Install smoke alarms on every level of your home and inside sleeping areas. Replace detectors every 10 years.

- Test smoke alarms monthly and replace batteries immediately if they chirp.

- Avoid charging e-bikes, scooters, or lithium-ion devices overnight or unattended.

- Upgrade outdated electrical panels and aluminum wiring where possible.

- Keep at least one fire extinguisher on every level of your home, especially near the kitchen and garage.

- Review your rebuild coverage limits annually to reflect rising material and labour costs.

- Ask your insurer about available alarm system discounts or safety-related premium credits. For instance, installing a smoke alarm can reduce homeowners’ average home insurance premiums by $74 in Ontario.