When you look at your home insurance bill, you’re probably not thinking about global trade wars or financial market volatility. However, significant shifts in the global economy are putting pressure on insurers behind the scenes, which trickle down to your home insurance premium.

Home insurance rates in Canada have already gone up by 5.28% in 2025. While some of that rise is due to familiar factors like increased weather-related disasters, global financial volatility also plays a role. These include unstable bond markets, rising reinsurance prices, and even U.S. tariffs. Each one of these factors indirectly affects premiums through ripple effects in the global supply chain.

The Hidden Connection: Bond Market & Reinsurance Capacity

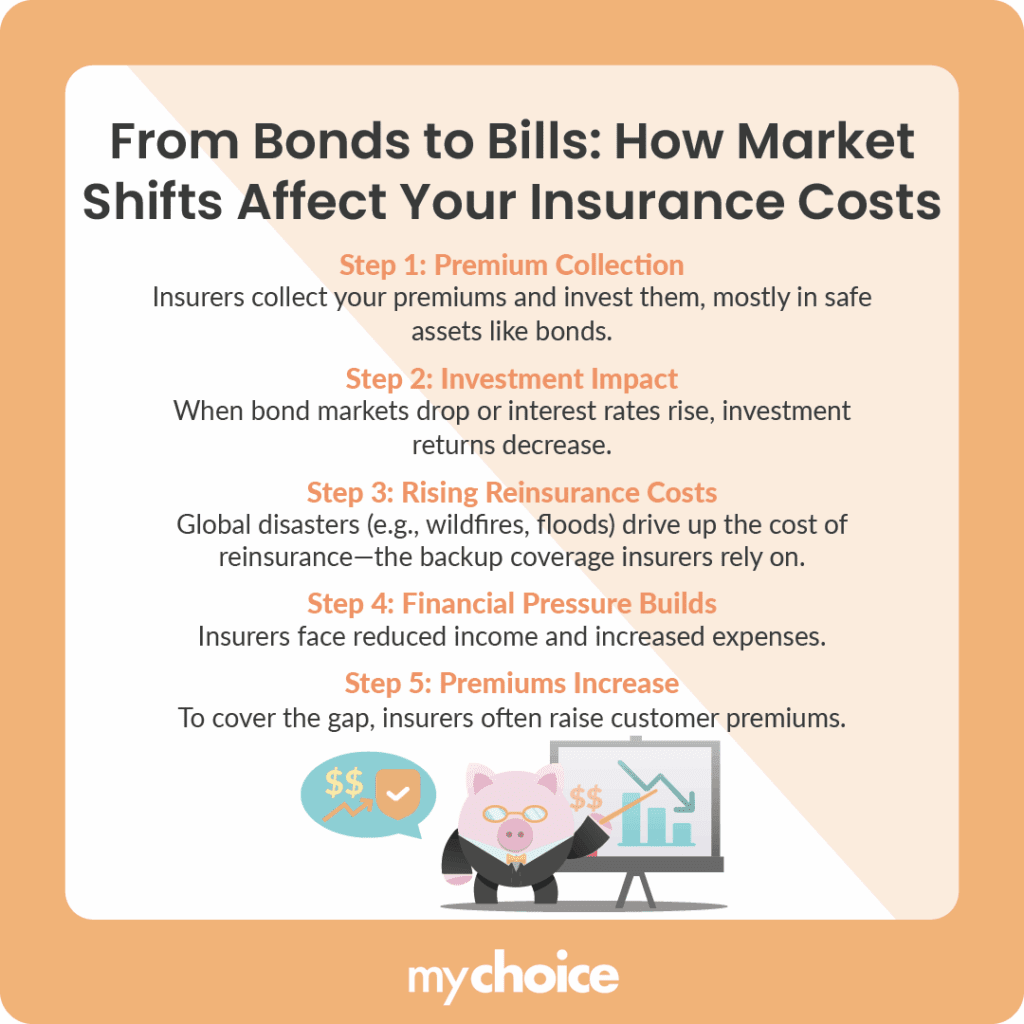

Think of your insurance premium like money going into a safety fund. Insurers invest that money, mostly in safe and low-risk options like government bonds, to help pay future claims. But when bond markets take a hit (like during interest spikes or selloffs), that “fund” doesn’t grow as much.

On top of that, reinsurers, the backup for your insurer, are also dealing with higher costs thanks to things like wildfires, floods, and unstable global markets. When claims surge and investment income drops, reinsurance gets pricey. For example, if a major wildfire causes billions in damages, your insurer might not be able to cover all the claims on its own. Reinsurance helps spread that risk globally, so no single company goes under. And when their costs go up, yours usually do too.

It’s like insurers are missing part of their usual paycheck, so they start filling the gap with your premium.

Why the Bond Market Crisis Makes Home Insurers More Cautious

When insurers earn less from their investments, they tend to rethink how to manage their risks and how they price your policy. This could mean things like:

- Re-evaluating coverage in high-risk areas

- Dropping certain policies

- Raising premiums to make up for the loss

If your home is in a high-risk zone, whether due to climate, crime, or high rebuilding costs, you’re more likely to feel the increase in home insurance premiums.

Canadian Reinsurance Trends

Canada’s reinsurance prices have continued to rise since 2022, largely driven by increasing climate-related disasters and a global tightening of capital. According to Aon’s 2025 Insurance Market Update, a string of weather-related disasters, like damaging summer floods in Ontario and Jasper wildfires, have still put pressure on reinsurers.

These severe storms comprised 62% of last year’s insured losses, pushing reinsurers to raise prices and tighten terms, especially for property coverage. As a result, Canadian insurers face higher costs to transfer their own risk, which may gradually flow through to homeowners in the form of higher premiums.

It’s not all bad news since Canada’s reinsurance market is still more stable than many others around the world. However, this upward trend is real, and homeowners should keep an eye out, especially if their home is located in a higher-risk area.

Why Tariffs Play a Major Role

Tariffs can have a big impact on the cost of home insurance as well. The key takeaway here is simple: tariffs increase the cost of materials and labour needed for repairs.

When the US or another key trading partner adds tariffs, prices for building supplies like lumber, steel, and electrical parts go up. That leads to:

- More expensive home repairs

- Higher rebuilding costs after claims

- Bigger payouts for insurers

Even though tariffs might seem far removed from your home insurance policy, they can contribute to higher costs for both repairs and insurance premiums.

Areas and Property Types Most at Risk for Premium Hikes

Not every home faces the same level of risk when it comes to premium hikes. Some factors, like the location of your home or the type of property you own, make your insurance premiums more likely to increase.

Here are some examples of homes more likely to experience rate hikes:

- Wildfire- or coastal flood-prone regions (like in B.C., Nova Scotia, Quebec) due to the greater risk of damage

- Older homes with outdated infrastructure are more expensive to fix because old wiring and plumbing mean repairs and maintenance

- Custom or luxury builds (rebuilding costs are way higher), as these may have expensive materials

- Rural homes where access to emergency services is limited, like a lack of medical or fire services, which could lead to the risk of severe damage

If your property falls under these categories, your insurer may be updating your home insurance premium rates more often.

How Homeowners Can Offset Rising Home Insurance Costs

There are ways to lessen the impact, even if your home insurance costs start rising. A few smart moves now can help you save both in the short and long term. Here’s what you can do:

- Shop around at renewal time by getting a few quotes to see if you’re getting the best deal. MyChoice’s rate comparison tool is a great place to start.

- Bundle your policies like combining your home and car insurance with the same provider, it often comes with a nice discount.

- Install protective tech in your home like alarm systems, smoke detectors, fire extinguishers, water sensors, and smart locks that can lower your premiums.

- Consider raising your deductible if it’s manageable. A higher deductible can lower monthly payments, just make sure it’s a manageable amount if you ever need to claim.

- Skip the small, frequent claims, even for minor issues, as it can raise your rates faster than general market trends.

A little strategy goes a long way, and these small changes can help you stay protected without letting premiums take over your budget.

Key Advice from MyChoice

- Stay updated on global financial trends, like bond yields and tariffs, to better understand what’s influencing your insurance premium costs.

- If you’re in a high-risk area, find out your home’s risks; this can help you act early to get ahead of premium hikes.

- Use online comparison tools like MyChoice to find other home insurance rates before renewing, so you know you’re always staying ahead of increasing premiums.