In 2023, wildfire evacuations displaced over 232,000 Canadians, the highest number since records began in 2008. While the physical destruction of homes often dominates the headlines, the most recent StatCan report indicates an invisible economic toll that is reaching a point where standard home insurance policies can no longer fully address it.

In this MyChoice analysis, we further examined the report data to identify which regions face the highest economic exposure and how the evolving nature of wildfire risk is fundamentally changing the insurance landscape for every Canadian.

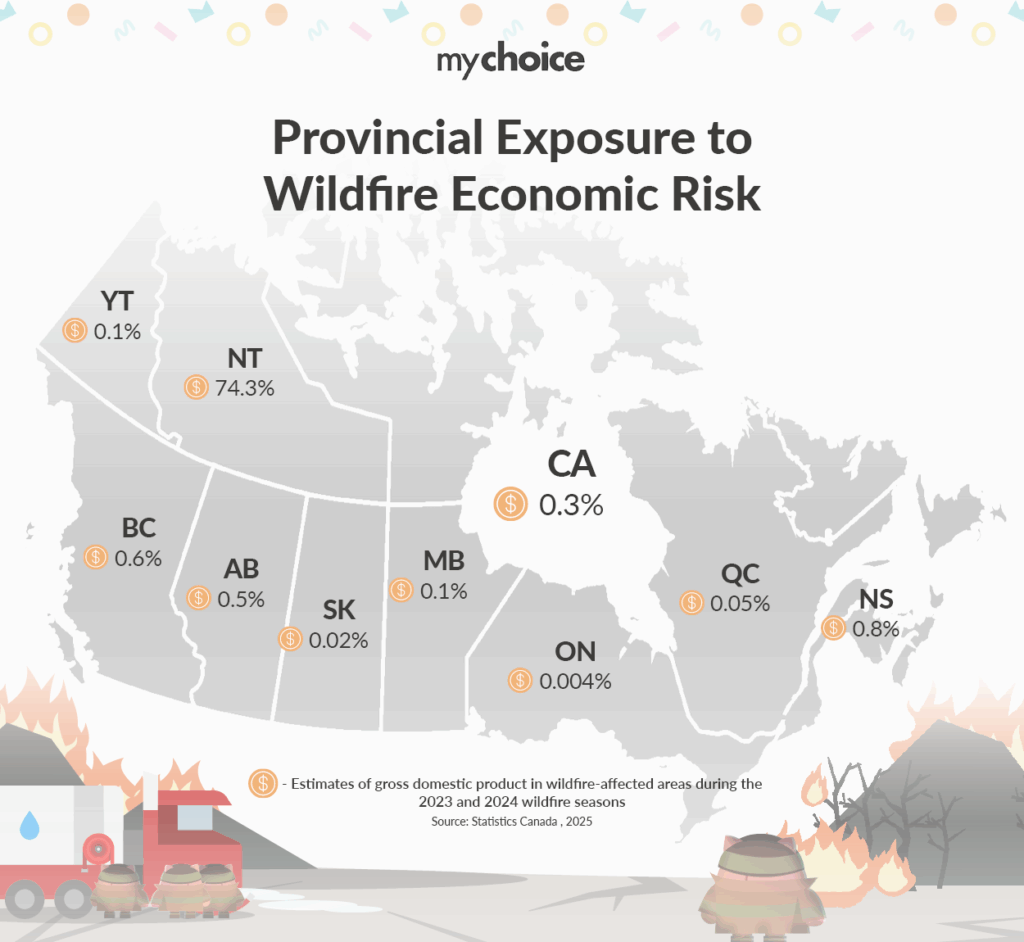

Which Provinces Have The Most at Stake in Terms of Economic Impact?

According to the report, the wildfire impacts are mostly local, not national. On a federal scale, the total GDP located within wildfire-affected areas is relatively small. However, for specific provinces and territories, the numbers tell a story of extreme vulnerability.

In the Northwest Territories, the 2023 wildfires were not regional concerns alone, but were in fact a systemic economic threat. With nearly the entire city of Yellowknife evacuated, roughly 62% of the territory’s GDP was located within the affected areas. Similarly, in British Columbia, the Central Okanagan (including Kelowna) saw significant portions of its local economy grind to a halt for weeks.

This exposure means that when a fire strikes, it doesn’t just damage property. It freezes the circulation of money. Tourism, forestry, and local retail are often hit hardest, with the forestry industry alone seeing a 20% reduction in Canadian lumber production during the 2023 season.

The Evacuation Duration Factor

The true economic cost of a wildfire often correlates more closely with the duration of evacuations from affected areas. Every day a business is closed, and a worker is displaced, the local economy bleeds productivity that is often irrecoverable.

The table below shows the number of days the affected areas were evacuated and the number of working days lost in that area.

| Location | Year | Total Days Evacuated | Affected Working Days | % of Annual Working Days |

|---|---|---|---|---|

| Kelowna, BC | 2023 | 36 | 26 | 10.4% |

| Yellowknife, NT | 2023 | 22 | 16 | 6.4% |

| Jasper, AB | 2024 | 27 | 20 | 8.0% |

| Edson, AB | 2023 | 7 | 5 | 2.0% |

| Upper Tantallon, NS | 2023 | 14 | 10 | 4.0% |

For a city like Jasper, losing 8% of its annual working days in a single event is a catastrophic blow to local economy. For households, these weeks spent in hotels or with relatives lead to mounting “Additional Living Expenses” (ALE) that can quickly exhaust standard home insurance policy limits.

With recent evacuations keeping residents out for longer than covered periods, these claims are becoming a headache for insurance providers. Longer evacuations increase claim severity and volume. A two-day evacuation might be manageable out of pocket, but as seen in Kelowna’s 36-day displacement, the costs of temporary housing, pet boarding, and increased food expenses can total thousands of dollars per household.

Does Home Insurance Cover Wildfire Evacuations?

The quick answer is yes, but every home insurance policy has its coverage limits and limitations. Understanding what your policy actually covers and what it doesn’t is essential for financial preparation and resilience in the event of a wildfire:

| Coverage Type | Covered? | Limitations/Details |

|---|---|---|

| Mass Evacuation/ Prohibited Access | Yes | Usually limited to 14–30 days; covers hotel, food, and gas. |

| Additional Living Expenses (ALE) | Yes | Triggered if the home is damaged/unlivable. Caps are often 20–30% of home value. |

| Lost Wages | No | Standard home policies do not cover personal income loss. |

| Business Interruption | Varies | Requires a specific commercial policy; often has a 48–72 hour waiting period. |

| Property Damage | Yes | Covers structure and contents, often including smoke damage. |

Evacuations Trigger Claims Even When Homes Aren’t Destroyed

One common myth amongst Canadian policyholders is that insurance only matters if your house burns down. In reality, modern wildfire seasons are characterized by “non-damage” claims. When a local government unit issues an evacuation order, it triggers “Prohibited Access” coverage.

In this case, you don’t even need a single ember to touch your roof for this to kick in. The mere fact that the police or fire department has legally barred you from your street is enough.

It typically covers:

- Accommodations: Hotel rooms or short-term rentals.

- Food: The extra cost of eating out because you don’t have access to your kitchen (often calculated as a daily per-diem or the difference between your normal grocery bill and your restaurant receipts).

- Incidentals: Essential items you couldn’t pack, like toiletries or a change of clothes, and sometimes even the extra fuel costs associated with travelling further to work from a hotel.

But while ALE coverage for a destroyed home can last for a year or more (until the home is rebuilt), Prohibited Access coverage is usually time-limited. Most Canadian policies limit this “non-damage” evacuation coverage to 14 or 30 days.

If an evacuation exceeds the 14 or 30-day “Mass Evacuation” limit and the home itself remains undamaged, policyholders may find their insurance support suddenly cut off while they are still unable to return home.

What This Means for Households in Canada

For the average Canadian, the primary risk is no longer just the destruction of their primary home, but also the affordability of relocation costs.

The real exposure isn’t limited to losing your home (permanently or temporarily), but in losing continuity:

- Missed paycheques

- Interrupted schooling

- Unplanned debt

- Long-term financial stress

The insurance industry is currently reassessing how it prices these risks. As extreme weather events increase, so do premiums. In high-risk areas, some insurers may even restrict the sale of new policies or limit coverage adjustments during active wildfire threats, a practice known as “moratoriums”. This means waiting until the smoke is on the horizon to check your policy is a dangerous strategy.

Home insurance remains a critical safety net, but it was never designed to replace weeks of lost economic income. Understanding that gap and increasing coverage when needed is essential for households assessing their own resilience, and again through their taxes.”

Key Advice from MyChoice

- Make sure your Additional Living Expenses coverage is at least 20% to 30% of your home’s replacement value. If you live in a high-risk area, consider asking for higher limits in case of prolonged evacuations.

- Ask your insurer explicitly about duration caps, not just dollar limits, before wildfire season starts, in case you need to increase your coverage.

- Build emergency savings alongside insurance protection. Many policies only cover mass evacuation for 14 days. If a fire doesn’t damage your home but keeps you out for 30 days, you need a financial “evacuation fund” to bridge that gap.