Electric vehicles (EVs) are growing in popularity with Canadians. They boast many benefits, like better fuel economy and lessened environmental impact. However, that doesn’t mean EVs come without risk. One of the potential risks of owning EVs is damage caused by the charger’s failure. Fortunately, it can still be mitigated by your home insurance policy.

Why EV Chargers and Battery Energy Storage Systems (BESS) Are a Growing Insurance Concern

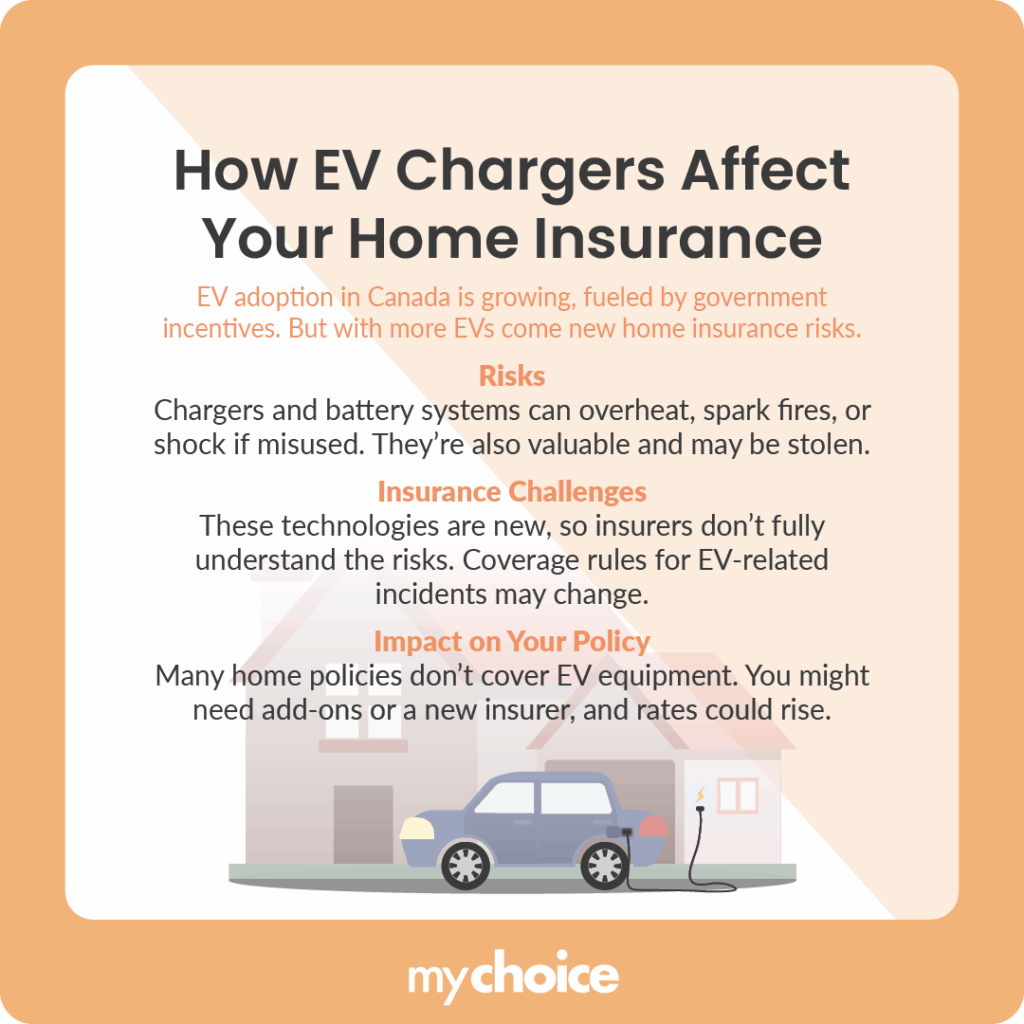

In 2021, 5.2% of new vehicle registrations in Canada were zero-emission vehicles, which included electric vehicles (EVs). With the Canadian government’s various zero-emission vehicle incentives, that number is very likely to continue increasing. But with the increasing popularity of EVs come insurance concerns.

Residential electric vehicle chargers and battery energy storage systems (BESS) pose insurance concerns because they introduce additional risks to your home. Overheating batteries can cause fires, and improper operation can cause electric shocks. EV chargers and batteries are also highly valuable and may be stolen.

Another concern for insurance is that EV chargers and BESS are relatively new technologies, so their risks are not yet well understood. The lack of precedent may lead insurers to modify their coverage conditions for EV equipment-related incidents frequently.

The newness and lack of precedent surrounding EV chargers and batteries also impact your wallet, as your home insurance rates may be affected. Moreover, not all home insurance policies cover EV chargers and batteries, so you may need extra coverage or find a new insurer if you plan to install EV equipment at home.

Do You Need to Tell Your Insurer About the EV Charger?

Yes, it’s a good idea to tell your insurer about the EV charger. Not all home insurance policies cover damage caused by EV chargers, so it’s best to tell your insurance company and work out the best way to protect your home with an EV charger installed.

What Happens if Your EV Charger Starts a Fire?

If your EV charger starts a fire and your home insurance covers EV-related fire damage, you’ll be covered for the incident. However, your home insurance policy may only cover damage to your home. If the fire also damages your car, you may need to consult with your car insurance provider to obtain coverage.

What’s Covered and What’s Not

EV chargers and batteries pose different types of risks that you may not be familiar with yet, as the technology is relatively new. Take a look at this table to learn more about common EV charger and battery risks and whether your home insurance covers them.

| Scenario | Is It Covered By Home Insurance? |

|---|---|

| Charger starts a fire | Yes, as part of your basic home insurance |

| Charger is stolen | Yes, if you have theft covered in your home insurance |

| Neighbour’s car damaged by charger sparks | Yes, as long as the damage isn’t intentional |

| Car battery fire damages your home | Yes, but you may also need car insurance if it was your car that caught fire |

The Evolving Regulatory Standards for EV Chargers

Since electric vehicles are an emerging technology, regulatory standards continue to shift as new risks are identified and new safety measures are developed.

In terms of equipment installation and operation safety, two standards are emerging in prominence:

- UL 9540A, an American and Canadian standard for assessing the fire risk of EV batteries related to thermal runaway incidents.

- NFPA 855, which outlines the minimum requirements for mitigating hazards associated with BESS.

If you’re an EV owner and have a battery installed at home, it’s a good idea to keep an eye on the latest EV-related regulatory changes, because one of the hidden costs of owning an EV is its insurance premiums. If you’re not careful, the hidden costs can sneak up on you and become too expensive to handle.

Key Advice from MyChoice

- If you’re planning to install an EV charger and battery, check with your insurer to ensure your home insurance includes coverage for EV-related damage.

- Tell your insurer if you have an EV charger to ensure you’re protected in case of any incidents.

- It’s a good idea to keep an eye on regulatory developments regarding EVs and their charging equipment to anticipate potential insurance-related changes.