Your home insurance policy consists of multiple parts, one of which is dwelling coverage, also known as dwelling insurance. What is dwelling coverage, and what does it protect? Keep reading to learn more about dwelling coverage and how it works as part of your home insurance policy.

What Is Dwelling Coverage?

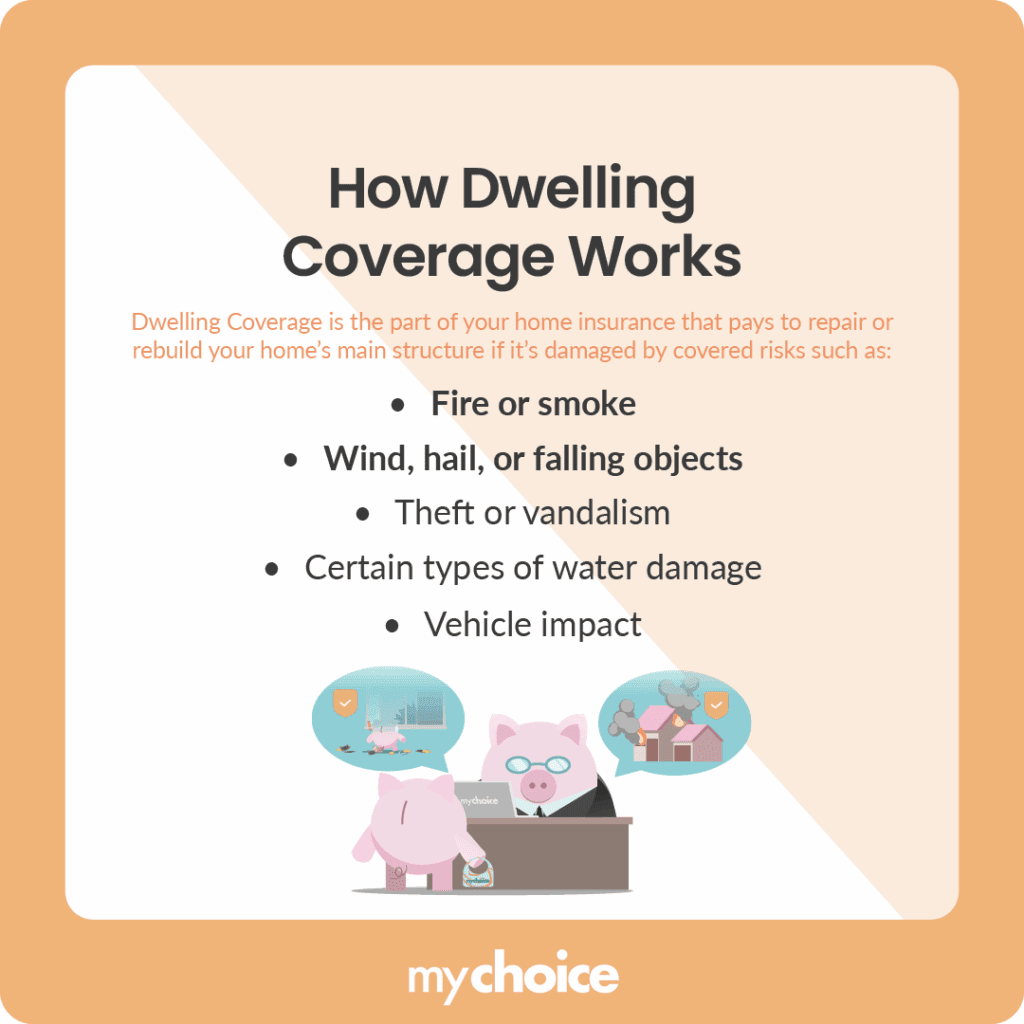

Dwelling coverage is part of your home insurance policy that covers damage and repairs to the physical structure of your home. This type of coverage protects your home from common perils like the following:

- Falling objects

- Fire

- Hail

- Vehicle impacts

- Theft

- Vandalism

- Windstorms

- Some types of water damage

What Exactly Counts as the “Dwelling” of Your Home?

What counts as the “dwelling” is your home’s foundation, walls, flooring, doors, windows, roof, and other aspects of the home. Dwelling coverage also typically covers attached structures, such as garages, decks, and porches.

Note that dwelling coverage only protects attached structures. So, separate guest homes, fences, sheds, and detached garages aren’t covered. If you want to get insurance protection for separate structures, you can look for coverage for other structures or outbuildings.

That said, some outside objects or structures like swimming pools and plants may be covered by your dwelling insurance.

Common Exclusions You Might Not Expect

As part of your homeowners’ insurance policy, your dwelling coverage doesn’t cover every peril that can damage your home. Unfortunately, it’s not exactly intuitive since some things that you might think are covered by home insurance actually aren’t. Here are three common dwelling insurance exclusions that you may encounter.

How Much Dwelling Coverage Do You Really Need?

The amount of dwelling insurance you need depends on your protection needs. Generally, you need enough coverage to replace your home with one of the same size and similar features if it’s completely destroyed. Note that your home’s replacement cost isn’t the same as its market value. Getting coverage for the amount your home would sell on the current housing market can lead to over- or under-insuring, since market values often fluctuate.

Dwelling Coverage vs. Other Parts of Your Policy

Your home insurance policy is made up of multiple different elements, with dwelling coverage being one of them. What does each part of your homeowners’ insurance policy cover? Let’s take a look at the table below:

| Coverage Type | What it Protects | Example of Protected Damage |

|---|---|---|

| Dwelling | The house building itself, alongside all attached structures and some outside objects like plants and pools | Your house burns down due to a fire, a windstorm uproots your tree, a vandal breaks your window |

| Contents | Personal items and property within your house, up to a certain value | Your smart TV gets smashed by a hailstone that entered through your window, your books get destroyed in a fire, your art piece gets stolen |

| Personal Liability | Claims of bodily injury and property damage sustained by other people | A guest slips on a loose rug and fractures their hip, your dog bites the mail carrier |

| Voluntary Medical Payments | Medical expenses for people who suffer bodily harm while on your property | A guest falls down your stairs and breaks their leg, an accident causes somebody to pass away on your property |

| Voluntary Property Damage | Unintentional damage caused by you or someone in your household to someone else’s property that you’re not legally liable for | Your tree falls onto your neighbour’s house damaging their fence, your child threw a ball that broke the neighbour’s window |

Key Advice from MyChoice

- Consider purchasing extra insurance protection for floods, earthquakes, and sewer backups if your house is vulnerable to damage from these perils.

- Get as much dwelling coverage to cover a complete replacement of your house, because matching your dwelling coverage amount to your house’s market value can result in being over- or under-insured.

- Get coverage for outbuildings or extra structures if your home includes separate garages, guest houses, or other buildings that aren’t covered by dwelling insurance.