While standard home insurance in Canada typically encompasses all types of fires, the reality is that the insurance industry is undergoing significant shifts due to the increasing risks of wildfires. Those shifts may leave you dangerously uninsured without your knowledge.

Does My Home Insurance Cover Wildfires in Canada?

The simple answer is yes. Standard home insurance policies in Canada cover wildfire damage in most cases. Wildfires are typically listed as a covered peril, meaning damage to your home and personal belongings caused by fire, smoke, or ash from a wildfire would be included in your coverage.

Why the Wildfire Question Is Different Now

In 2023, Canada experienced 5,475 wildfires, with a total area burned of 17,347,637 hectares, a record-breaking figure. This is seven times higher than the annual average over the past few years, causing Canada’s insurers and reinsurers to pay wildfire claims of over $5 billion over the last decade. Wildfire-related losses in the country have increased by 740% in the last ten years, too, pushing average annual losses from $84 million to a staggering $706 million.

The 2024 Jasper wildfire alone caused over $1.1 billion in damages. Meanwhile, across the border, the January 2025 LA wildfires are estimated to result in insured losses of up to $40 billion, potentially making them the costliest wildfire disaster in U.S. history.

The succession of wildfires is showing insurers what happens when climate risks outpace the insurance market, and the numbers show no signs of going down. If wildfire risks continue to escalate in severity and cost, some Canadian insurers may refuse to provide coverage in high-risk areas altogether.

Which Areas Are at Higher Risk from Wildfires?

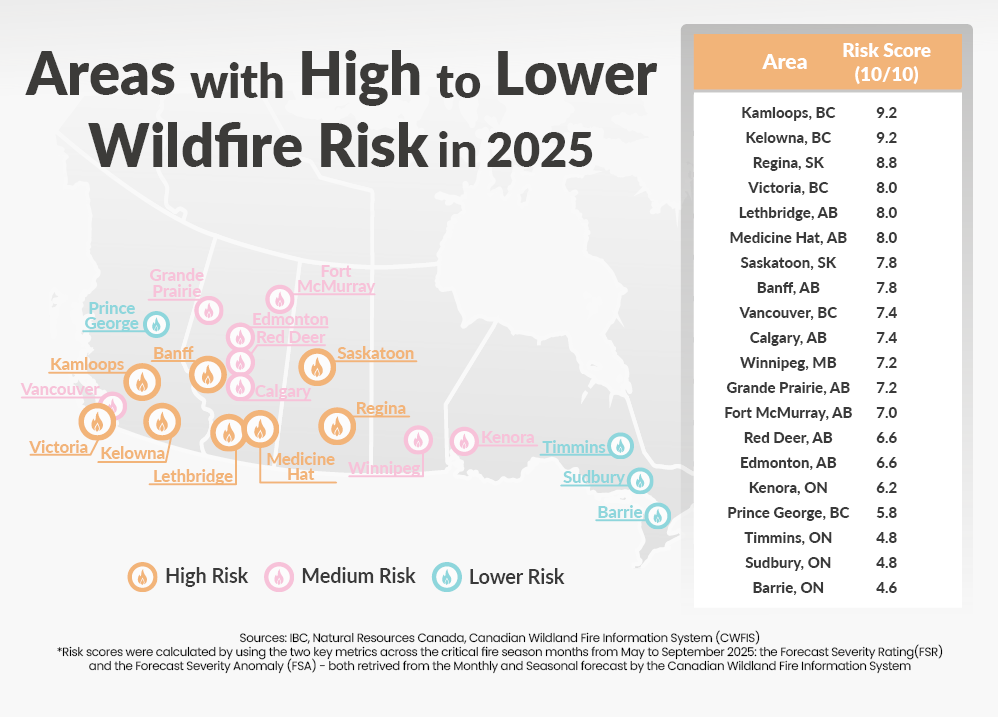

MyChoice recently analyzed wildfire risk across Canadian cities using data from the Canadian Wildland Fire Information System, ranking areas on a scale from 1 (lowest risk) to 10 (highest risk) to identify where homeowners should be most concerned about securing adequate coverage in 2025.

Kamloops and Kelowna in British Columbia both have a score of 9.2, while Regina, SK (8.8), and the Alberta cities of Lethbridge and Medicine Hat (both 8) also make it to the highest-risk cities in this analysis. This can be strongly attributed to British Columbia and Alberta bearing the brunt of forest fires in recent years, with BC experiencing 2,840,754 hectares burned in 2023, and the Jasper wildfires considered the country’s second most expensive wildfire disaster for insurance payouts.

The Fine Print Most People Miss in Their Home Insurance Policy

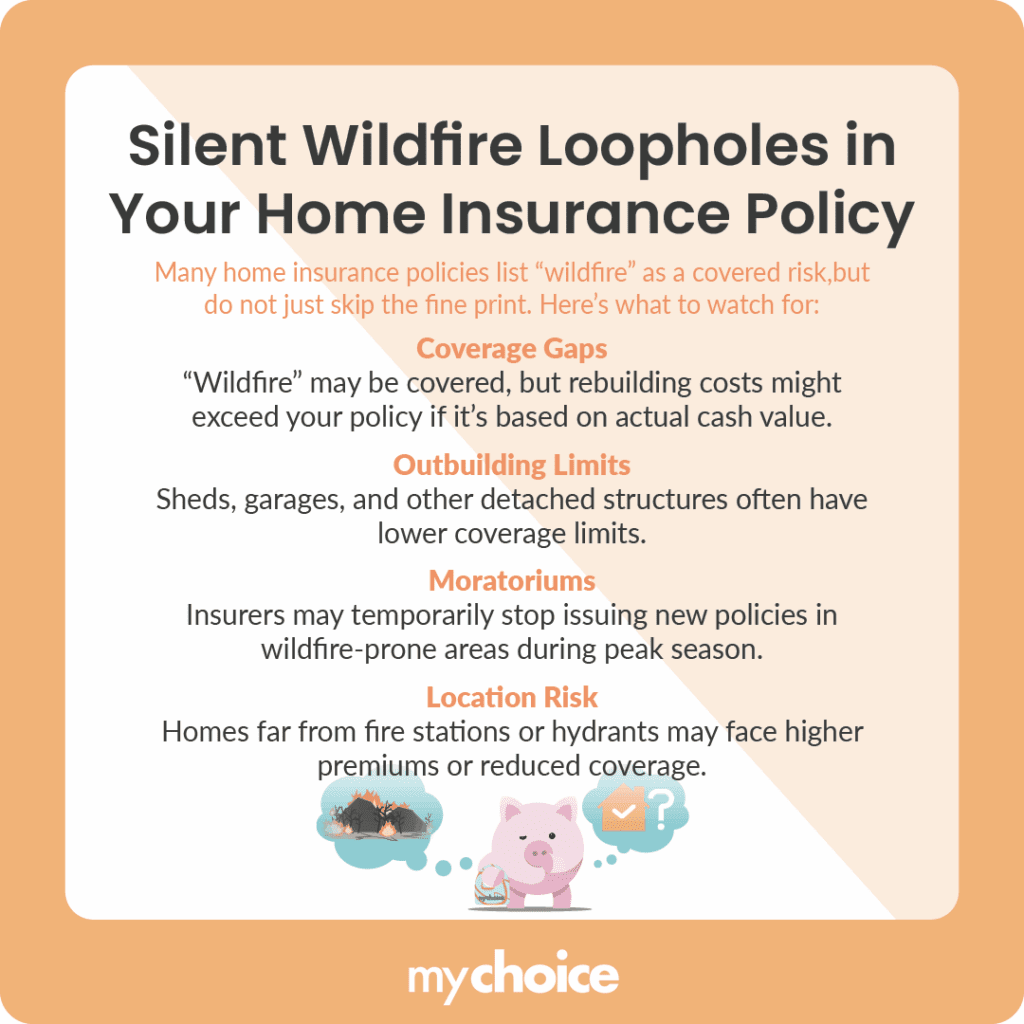

If you’re wondering, “Does house insurance cover forest fires?”, you may see “wildfire” as a covered risk in your standard home insurance policy and breathe a sigh of relief. The truth is that there are details that limit what and when something is covered. Let’s go through those potential landmines:

The Future of Wildfire Coverage in Canada

There are clear warning signs that California’s wildfire-related insurance crisis could be felt in Canada. Simply put, more risks and greater damage due to wildfires mean that more insurance companies have had to file claims with their reinsurance companies. With 2024 being the single most expensive year on record in terms of insurance payouts in Canada, home insurers are warning that rates are likely to increase even further.

The summer of 2024 stands out as one of the worst years for insured losses due to wildfires, floods and hailstorms. In July and August last year alone, four catastrophic weather events resulted in over $7 billion in insured losses.

So, does insurance cover wildfires in Canada? Yes, it still does. The more flexible regulatory environment has helped maintain coverage availability for now, but consumers should expect potential premium hikes or even coverage exclusions as these extreme climate events happen more frequently.

What You Can Do Right Now to Stay Protected

Home insurers are staying updated and ready to protect their bottom line, and so should you. No need to wait for policy renewal to try these proactive measures:

Key Advice from MyChoice

- Take photos and videos of your property and belongings, and store those copies off-site or in the cloud. In the event of a wildfire, this will help you prove loss or damage that should be covered by your policy.

- During evacuations due to wildfires and other events, there can be coverage gaps. Standard home and tenant insurance policies provide additional living coverage the moment you’re evacuated, but make sure you understand your policy’s time limits and expense caps.

- Notify your insurer of any significant home improvements (e.g., new roof, siding, sprinkler system) that may affect rebuild costs or reduce wildfire risk.