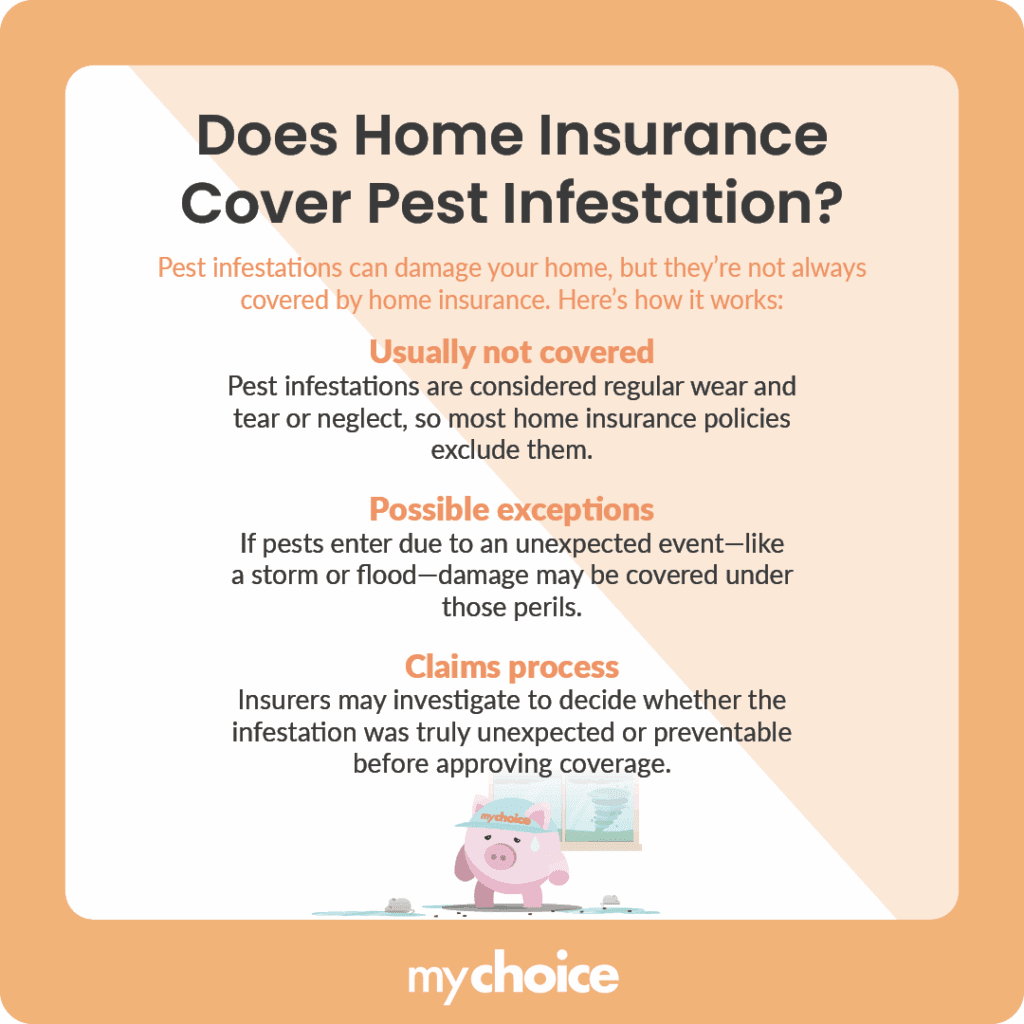

Pest infestations can be troublesome and dangerous for both your home and your health. Unfortunately, pest infestations usually aren’t covered by your home insurance, though there are exceptions.

Does Home Insurance Cover Pest Infestation?

Generally, most Canadian home insurance policies don’t cover pest infestations. Pest infestations are usually considered regular home wear and tear that’s preventable or caused by neglect, so in most cases, home insurance companies won’t cover pest treatments and damage caused by pest infestations.

However, if the pest infestation and resulting damage can be considered unexpected, it may be covered by your insurance. For instance, if the pests sneaked into your home after a severe storm, you can still be covered as long as your home insurance policy covers storms. Pests can also end up in your home after a flood, so you may still be covered for pest-related damage as part of your flood insurance.

Your insurer might launch an investigation after you make the claim to ascertain whether the damage was truly unexpected or if it was still preventable, after which they’ll decide whether or not to accept your claim.

What Are the Biggest Pest Threats to Canadian Homes

Many types of animals can be considered pests to Canadian homes. However, some animals are more common than others. Let’s take a look at common pest threats to Canadian homeowners and learn more about how to deal with them.

In terms of structural damage, termites can be among the most destructive pests. They chew through wood structures, weakening them and increasing the potential for collapses that could result in costly repairs down the line. According to the Canadian Wood Council, termites are often found in coastal British Columbia and certain parts of Ontario.

Key termite prevention steps include keeping soil around the foundation dry, storing wooden items away from the house, and periodic inspections.

What to Do If You Discover a Pest Problem

If you notice the telltale signs of a pest problem, such as animal droppings, gnaw marks, or nests, it’s essential to take immediate action. Secure all food in sealed containers and take the trash out regularly to ensure the most common pest attractors are no longer there.

The next step will depend on which type of pest is the issue, but it generally involves cutting off their access. You can usually place screens over potential entry points, such as vents and cracks in the wall. You can also consider do-it-yourself pest control measures, such as placing traps or baits.

If the pest issue has worsened, you may need to call professional exterminators to ensure the problem is resolved properly.

Tips to Prevent Pest Infestations

Pest infestations can be frustrating and costly, so the best way to deal with them is to prevent them from occurring in the first place. Here’s what you can do to prevent potential pest infestations:

- Store food and leftovers in airtight containers.

- Use trash cans with tight lids and keep them closed at all times.

- Check your house for cracks and holes regularly, sealing them as soon as possible.

- Ensure your sinks and bathtubs are free of standing water.

Key Advice from MyChoice

- Your home insurance generally only covers pest infestations if it’s part of unexpected damage caused by other incidents, like storms that caused pests to move into your home.

- When dealing with pests, preventing infestations is often more effective than trying to repair the damage they cause.

- If a pest infestation gets out of hand, consider calling a professional exterminator.