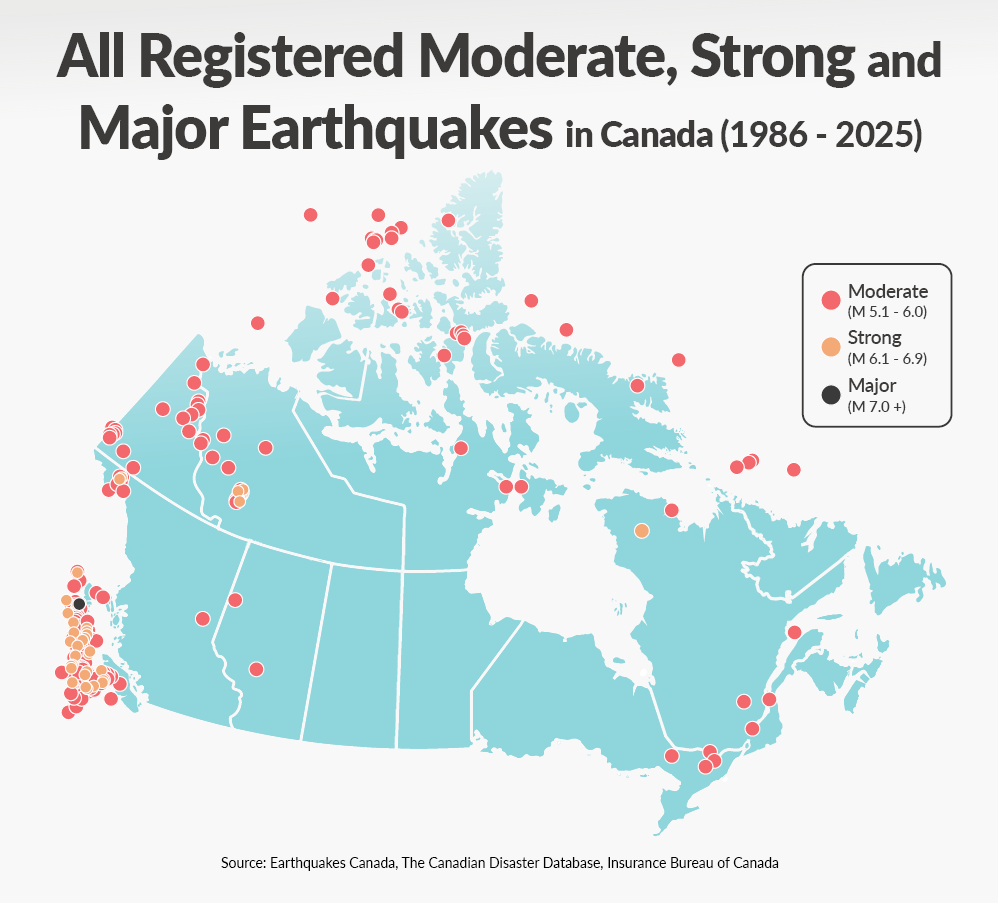

While Canada doesn’t experience earthquakes as often or as violently as other countries, the risk they pose is still very real. Over 300 significant earthquakes of magnitude 4 or higher have shaken Canadian soil since 1986, but despite this, millions of homes remain uninsured.

Let’s break down what you need to know about earthquake insurance and whether you should add it to your home insurance in Canada.

How Does Earthquake Insurance Work in Canada?

Earthquake insurance is not part of a standard home insurance policy. It’s typically offered as an optional top-up endorsement that you need to request for an extra charge, much like sewer backup or flood coverage.

Here’s a simple breakdown to help clarify what earthquake insurance actually does:

| Typically Covered | Typically Not Covered |

|---|---|

| Damage to your home’s structure from shaking | Flood damage caused by tsunami (unless flood insurance is added) |

| Detached buildings on your property (garage, shed) | Pre-existing damage or poor maintenance issues |

| Your personal belongings (furniture, appliances, clothing) | Fencing, landscaping, patios, or pools |

| Additional living expenses (hotel stays, food, rentals) | Damage due to unrelated causes (fire, theft) unless separately covered |

| Condo loss assessments due to earthquake-related damage | Damage outside your policy area or timeframe |

Note that some earthquake insurance policies may also cover land stabilization, which can be crucial if your foundation shifts or the ground beneath your home becomes unsafe after a quake. Check with your insurer if this is part of any earthquake insurance coverage you purchase.

Which Parts of Canada Face the Highest Earthquake Risk?

Earthquakes are not equally distributed across Canada. While some areas are relatively stable, others face consistent and significant seismic activity. Based on data from Earthquakes Canada between 1986 and 2025, here’s what we know about which parts of Canada face high earthquake risk:

How Much Does Earthquake Insurance Cost?

Earthquake insurance in Canada typically ranges from around $40 per year in low-risk regions to $400 or more annually in high-risk zones such as British Columbia, based on a home valued at $1 million.

Your insurance premium will ultimately depend on several key factors:

Who Should Seriously Consider It?

Earthquake insurance isn’t necessary for every homeowner, but for many Canadians, especially those in higher-risk areas, it’s a crucial form of protection. Here’s a breakdown of who should strongly consider adding it to their policy.

Why Having Earthquake Coverage is Important

Asking yourself, “Is earthquake insurance worth it?” Here’s why you shouldn’t leave yourself exposed to this potential natural disaster:

Key Advice from MyChoice

- Seismic retrofits like bolting your home to its foundation or reinforcing walls can reduce quake damage and may lower your insurance costs. Ask your insurer if they offer discounts for earthquake-resistant upgrades.

- If a major earthquake disrupts your area, you may not have access to physical files. Save a digital copy of your policy and key contacts on your phone and on digital cloud storage.

- In the event of a claim, insurers will ask for proof of lost or damaged items. Keep a detailed inventory with photos or videos of your belongings, especially high-value items.