Home prices continue to drop in Ontario. According to CREA, the average price of a single detached house in the province decreased by 3.8% in 2025. However, according to our most recent Ontario home insurance market overview, the opposite is true for home insurance rates, which increased by an average of 7.15% across the province in the same year.

Is this a trend seen across Ontario, or are declining home prices and rising insurance costs just happening in some places? Our team at Mychoice examined municipalities across the province to find the answer.

Methodology

To analyze the relationship between home prices and insurance premiums in Ontario, we combined median resale price data for single-detached homes from the Canadian Real Estate Association (CREA) with thousands of real homeowner insurance quotes generated on MyChoice.ca between January and September 2025 and compared them to the same period in 2024.

When it comes to home insurance quote data, we looked at a standard homeowner profile: a 35-year-old with a clean claims history, living in a 3–4 bedroom detached or semi-detached home (2,000–2,500 sq. ft., approximately $1 million rebuild value), carrying a $1,000 deductible, $1 million in liability coverage, Enhanced Water Protection, and standard safety features such as monitored alarms and a fire extinguisher.

The Difference Between Home Prices and Insurance Premiums

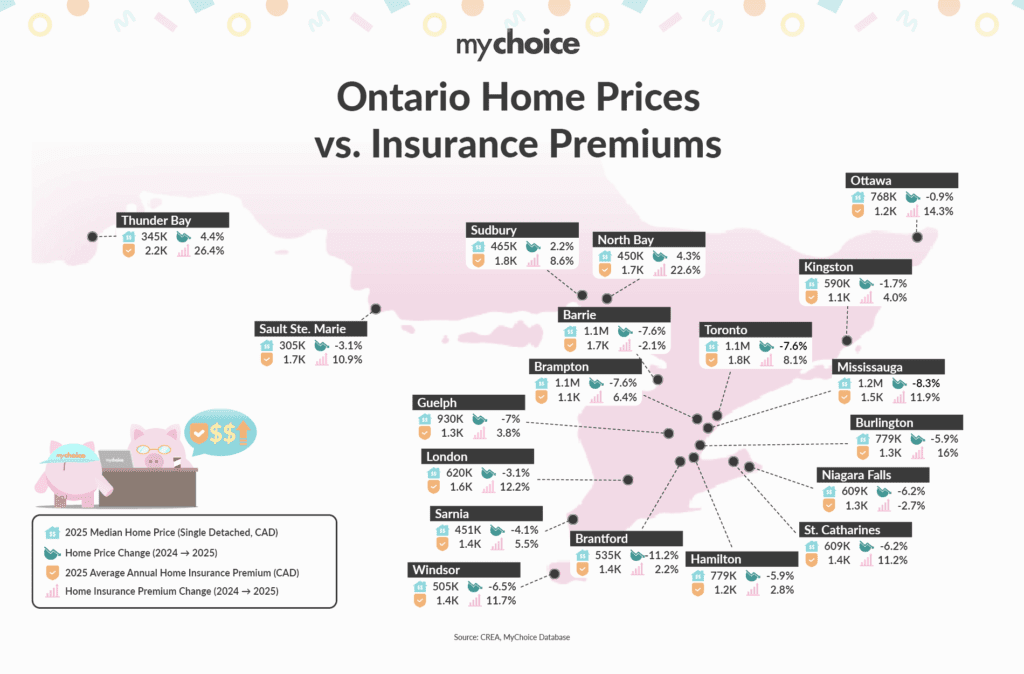

Of the Ontario cities examined, only three had rising home prices: Thunder Bay, North Bay, and Sudbury. Meanwhile, only Barrie and Niagara Falls saw reductions in home insurance rates.

Across most of Ontario, home prices and home insurance premiums are now moving in opposite directions. Southern Ontario cities such as Toronto, Mississauga, Windsor, and St. Catharines experienced declines in home values in 2025, yet insurance premiums continued to rise, reinforcing the growing disconnect between the housing and insurance markets.

This pattern holds across nearly every major southern municipality, indicating that cheaper homes on paper do not translate into lower insurance premiums in practice.

Northern Ontario tells a very different story. Thunder Bay, North Bay, and Sudbury are the only cities in the dataset in which both home values and insurance premiums increased in 2025.

Why Falling Home Prices Haven’t Lowered Insurance Premiums?

Falling home prices haven’t lowered insurance premiums because home insurance is priced on rebuild value, not market value. While resale prices reflect demand, interest rates, and buyer sentiment, insurance premiums are driven by the cost of repairing or fully rebuilding a home after a loss. Those costs have continued to rise due to construction inflation, higher labour rates, material shortages, and more frequent severe weather and catastrophe claims.

Additionally, the increase in insurance losses due to climate-related disasters put upward pressure on premiums regardless of what’s happening in the housing market. As a result, even when homes become cheaper to purchase, they are not necessarily cheaper to rebuild, and this disconnect is why insurance premiums can continue to rise while home values decline.

If Home Values Keep Falling, Will Insurance Prices Eventually Ease?

As we covered in the previous section, insurance prices are tied to a home’s rebuild value, not its market value. That means premiums aren’t guaranteed to ease even when home prices fall. In fact, insurance costs are more likely to keep rising due to construction inflation, higher labour and material costs, severe weather losses, and growing reinsurance pressures.

“People often assume that if their home is worth less, their insurance should get cheaper too, but that’s not how home insurance works,” says Matthew Roberts, COO of MyChoice. “Insurers are looking at what it would cost to rebuild your home from the ground up after a major loss. Right now, that number is still going up, even if resale prices are coming down.”

It’s not impossible for insurance prices to stabilize or even decline, especially if rebuilding costs normalize and insurers become more confident in the overall risk environment. Extended periods of favourable weather, fewer catastrophic losses, and lower construction and repair costs could all help relieve pressure on premiums. However, these factors are largely outside a homeowner’s control and tend to fluctuate year to year, which makes insurance pricing far less predictable than housing market values.

Key Advice from MyChoice

- Lower home prices won’t necessarily mean cheaper Ontario home insurance because insurance premiums are tied to rebuild values, not market values. This means you may need to take steps to reduce premiums yourself, rather than waiting for market changes, such as investing in upgrades like better drainage and insulation.

- Installing security systems, such as alarms and motion sensors, can make your home less vulnerable to theft and lower your insurance premiums. On average, installing a burglar alarm system can save you up to $110 in annual home insurance premiums in Ontario.

- If you’re anticipating a home insurance cost increase after a renewal, consider shopping around or bundling your home and auto insurance to get discounts.

Full Dataset:

| Municipality | 2025 Median Home Price | 2025 vs 2024 Home Price Change | 2025 Average Annual Home Insurance Premium | 2025 vs 2024 Home Insurance Premium Change |

|---|---|---|---|---|

| Toronto | 1,140,000 | -7.6% | 1,814 | +8.1% |

| Ottawa | 768,000 | -0.9% | 1,145 | +14.3% |

| Hamilton | 779,000 | -5.9% | 1,235 | +2.8% |

| Mississauga | $1,215,000 | -8.3% | 1,502 | +11.9% |

| Thunder Bay | 344,950 | +4.4% | 2,190 | +26.4% |

| North Bay | 450,000 | +4.3% | 1,657 | +22.6% |

| Burlington | 779,000 | -5.9% | 1,272 | +16.0% |

| London | 620,000 | -3.1% | 1,606 | +12.2% |

| Windsor | 505,000 | -6.5% | 1,422 | +11.7% |

| St. Catharines | 609,000 | -6.2% | 1,436 | +11.2% |

| Sudbury | 465,000 | +2.2% | 1,750 | +8.6% |

| Brampton | 1,140,000 | -7.6% | 1,099 | +6.4% |

| Sarnia | 450,500 | -4.1% | 1,368 | +5.5% |

| Kingston | 590,000 | -1.7% | 1,132 | +4.0% |

| Guelph | 930,000 | -7.0% | 1,319 | +3.8% |

| Brantford | 535,000 | -11.2% | 1,386 | +2.2% |

| Barrie | 1,140,000 | -7.6% | 1,700 | -2.1% |

| Niagara Falls | 609,000 | -6.2% | 1,329 | -2.7% |

| Sault Ste. Marie | 305,022 | -3.1% | 1,733 | +10.9% |