Condo property tax is a levy that funds municipal services like road maintenance, parks, other public gathering locations, and public transportation. However, this required tax differs from condo fees, which can confuse new property owners.

Condo Property Tax at a Glance:

- All condominium owners are required to pay property tax to help fund the local community.

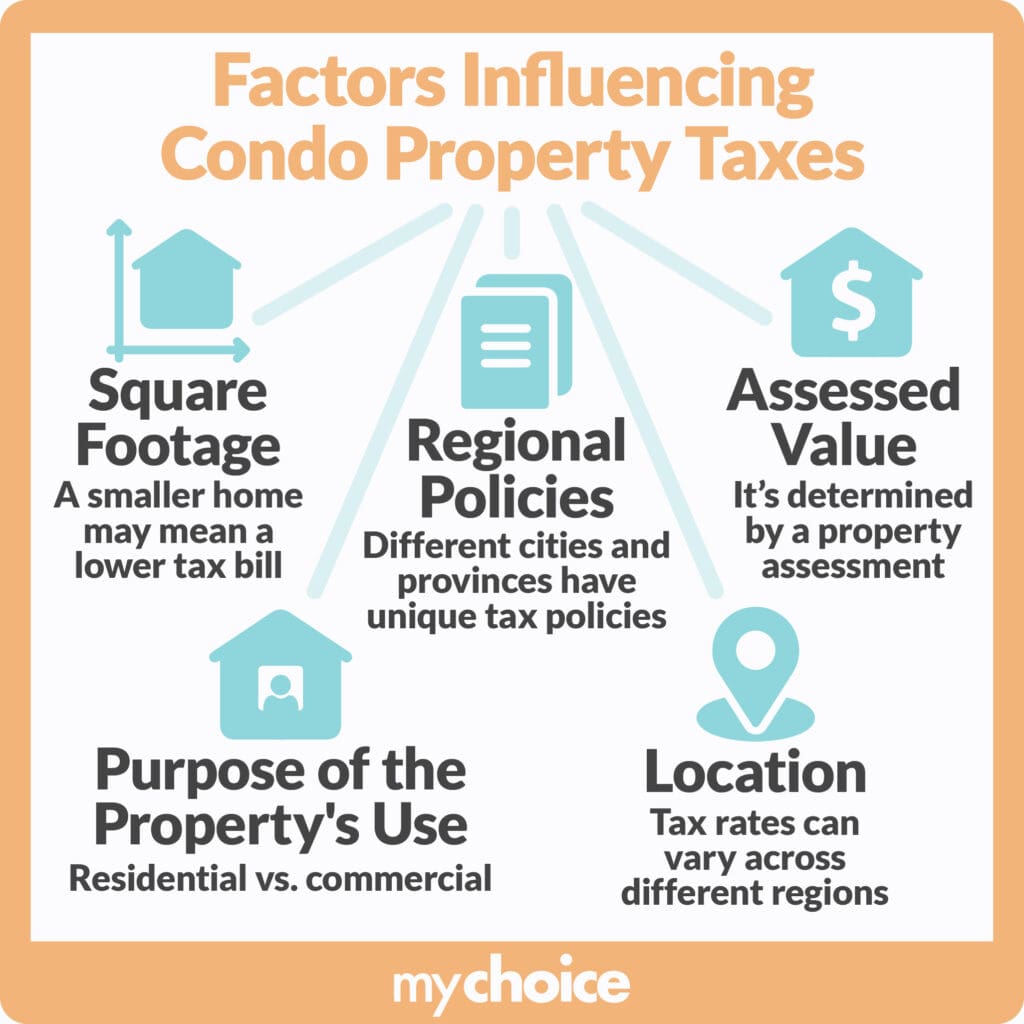

- Condo property taxes depend on municipal property rates and the building’s assessed value. Factors like location, property size, use, and recent assessments may alter these rates.

- Property owners can get rebates or exemptions if they are qualified for incentives like the Ontario Energy and Property Tax Credit.

By delving into the details of condo property tax, understanding how it’s calculated, and learning how to budget for it, you can equip yourself with the knowledge needed to manage your property effectively. This practical knowledge will help you feel prepared and confident in your role as a property owner.

Do You Pay Property Tax on Condos?

Yes, all Canadian residents must pay property tax on condos. Condo property taxes are annual fees paid to the municipal government to maintain the local community and its surroundings. They are required, and condo owners pay them directly to the local government.

Note that condo property tax differs from condo fees, which cover the maintenance and operation of the building itself.

In addition, rent-to-own tenants aren’t subject to condo property tax, as developers or sellers are responsible for this payment until the buying party completes all terms. It’s essential to review the terms of a rent-to-own agreement in case of specific clauses addressing property tax.

How is Condo Property Tax Calculated?

As a condo owner, knowing how the government calculates condo property taxes can help you ensure you aren’t being overcharged. Here’s how it works.

Municipal Property Tax Rates

Municipal property tax rates, or mill rates, determine how much of your condominium’s assessed property value goes to property taxes. Your local government sets these rates, which vary depending on where you live.

Currently, the property tax rates in Canada are between 0.28% and 2.6%. The country’s average tax rate is 1.12%.

Assessed Value of Your Condo

The Municipal Property Assessment Corporation (MPAC) determines and reflects the current market value of Canadian condo units. Here is a look at 2024 residential tax rates:

| City | 2024 Residential Tax Rate |

|---|---|

| Calgary | 0.66% |

| Charlottetown | 1.67% |

| Edmonton | 0.94% |

| Fredericton | 1.33% |

| Halifax | 1.12% |

| Kitchener | 1.21% |

| Montreal | 0.59% |

| Saskatoon | 1.29% |

| St. John’s | 0.91% |

| Toronto | 0.72% |

| Vancouver | 0.28% |

| Victoria | 0.44% |

| Winnipeg | 2.64% |

You can get regular updates on municipal tax rates via the Government of Canada.

Formula: Assessed Value x Mill Rate = Property Tax Amount

Suppose your condominium has an assessed value of $500,000 with a local mill rate of 1%. According to the formula, your condo tax would be as follows:

$500,000 x 0.01 = $5,000

Factors Affecting Condo Property Tax Rates

Condo property tax rates in Canada change annually, with your condo’s assessed value determined roughly every four years. However, other factors may affect these rates.

Location

Urban areas typically have broader tax bases due to businesses and commercial properties, generating more revenue for the municipality and potentially lowering mill rates for condo owners. However, property values tend to be higher, which can increase assessed values and overall property tax bills.

In addition, each region in Canada may have different mill rates depending on additional property tax components and structures.

Property Size

Larger condos typically have higher taxes, not just because of their square footage but also because of amenities that increase their market value.

Property Use

Residential and commercial condominiums are subject to different taxes. Commercial condo units are typically subject to higher taxes because they have greater earning potential.

Municipal Services Offered

Typically, regions with extensive public transport systems, new developments, recreational facilities, and more municipal services have higher mill rates.

Recent Property Assessments

Remember, property assessments are determinants for mill rates. If property values in your area are rising, expect mill rates to increase, too.

Resources for Finding Your Condo Property Tax Rate

Finding your condo property tax rate is simple. Here’s how to do it.

Municipal websites are the most direct and reliable sources for finding your condo property tax rate. Most municipal websites dedicate pages to property taxes, including updated mill rates. You may also find resources for estimating your property tax bill.

Many online property tax calculators can provide estimated quotes based on your location and your property’s assessed value in just a few minutes. While these calculators don’t give an exact amount, they are a good starting point for determining your bill.

Other ways to determine your condo property tax rate include the following:

- Contact your local municipality for information on your province’s current mill rate.

- Review your condominium association documents to see if they include tax rates.

- Speak to your realtor or property manager.

How to Pay Condo Property Tax

Paying condo property tax in Canada is identical to paying property tax for single-family homes. Below are the most convenient methods for paying condo tax:

- Municipal websites: You’ll need your property tax bill and login information to make a secure payment. Most websites accept debit and credit cards.

- Banks: Financial institutions like banks allow Canadian condo owners to pay their bills online, via telephone, or in person.

- Mail: Though uncommon, some municipalities still accept cheques and money orders by mail.

- Pre-authorized payments: To avoid missed payments and late fees, you can set up pre-authorized payments that deduct the bill amount from your bank account monthly or quarterly.

- Mortgage: Combining property taxes with a mortgage is more common for first-time homeowners. To calculate these fees, lenders take the annual property tax owed and divide this number by 12, adding it to your monthly mortgage payments.

Additional Considerations for Property Owners

When paying condo property taxes in Canada, there may be special considerations to make.

Property Tax Rebates or Exceptions

Qualified homeowners may receive property tax relief based on income, age, or disability. For instance, Ontario’s low- to moderate-income homeowners can apply for the Ontario Energy and Property Tax Credit (OEPTC) and receive monthly assistance.

You may be eligible for the OEPTC property tax component if you are:

- 18 years of age by June 1, 2025

- Married or living with a common-law spouse since December 31, 2023

- A parent living with their child

Seniors may be eligible for the senior homeowners’ property tax grant.

Property Improvements

Contrary to popular belief, home renovations to individual condo units may not directly affect property taxes. While renovations may increase the value of your unit, they won’t significantly impact the overall market value of the building.

However, renovations involving significant structural changes or upgrades to the building’s exterior could prompt the MPAC to reassess the entire building. Thus, knowing where the best and worst-kept homes in Ontario are can influence how much you pay in taxes, especially if the building undergoes frequent renovations.

Budgeting for Property Taxes

Whether your mill rates rise or fall over time, it’s essential to budget accordingly. Here are a few valuable tips:

- Gather as much information as possible, including your current mill rate, your condo’s assessed value, and past property bills. Use this information to calculate your annual property tax amount.

- Factor in potential increases of 1% to 2% and divide the annual amount by payment frequency. This will make your payments more predictable and easier to plan for.

- Round up payments to create a buffer for unexpected increases.

Key Advice from MyChoice

Now that you’re better versed in condo property tax, here is a quick refresher and tips from MyChoice:

- Knowing how your condo tax is calculated and what factors might affect this number can help you budget more efficiently.

- You can calculate your property tax through your municipality’s website, a free online tax calculator, your property manager, or by contacting your local government.

- You can pay condo property tax via mail, online/telephone/in-person banking, municipality website, pre-authorized payments, or your mortgage.