Condo fees are something all unit owners have to contend with, and understanding them on a deeper level can be great for financial planning – especially when you consider how a myriad of external factors determine exactly how much you’ll be paying on the regular.

Condo Fees in Ontario at a Glance

- What condo fees are, how they’re calculated, and what happens if you don’t pay them.

- The things that aren’t included vs. what is covered by your condo fees.

- How condo fees differ from province to province and how they’re impacted by external factors.

What Are Condo Fees?

Condo fees, alternatively known as common expense fees, are a set of monthly costs charged to condominium owners for the upkeep and maintenance of common spaces. These fees are generally payable to the condominium corporation and scale with the size of your property plus any parking – meaning families and individuals with larger units tend to pay more overall.

Despite this variation in what different unit owners may need to pay, condo fees are generally non-negotiable since they’re based on the condominium’s yearly operating budget – which also means they may increase over time.

With that said, condo fees are not mandatory for all condo owners, but this usually comes down to your building’s administration and the type of ownership you have over your property. For example, if you paid at least a 5% downpayment on your condo, you have divided co-ownership. This means you’ll have to pay mandatory condo fees.

However, if you put a down on your condo at 20% or more of its total value, you have undivided co-ownership, which could mean your condo fees aren’t as strict. In the end, it’s largely property-to-property, so you may want to consult with the condominium corporation before making any permanent decisions.

How Condo Fees Are Calculated

While every condominium corporation values the associated fees differently, there are a few basic considerations that impact how much you pay. Here are a few of the main elements that influence your condo fees:

- The building’s age: As buildings age, upkeep costs naturally begin to climb. For example, as water, sewage, and heating systems deteriorate over time, building associations may charge more to address replacements and repairs. However, this isn’t the case with all older buildings, as it generally comes down to the condominium corporation and how much upkeep is necessary.

- How many units your condo has: If you have a unit in a sprawling mega-condominium, it’s likely that there are more unit owners to split costs with – meaning you might get away with paying a bit less on your monthly dues.

- Common-use amenities: Condominiums with gyms, spas, saunas, and other amenities like pools, meeting rooms, and function rooms naturally require higher condo fees than buildings without similar amenities. Like all other fees, these scale with upkeep needs.

- Your property’s square footage: As a general rule, larger units accrue larger fees, and that’s because they’re usually calculated per square foot. As such, a studio unit would cost less in monthly fees than a 1BR or larger.

What Happens if I Don’t Pay My Condo Fees?

Like we mentioned earlier, condo fees are mandatory – meaning there are real repercussions if you decide not to pay your fees. Here are a few possible outcomes of failing (or forgetting) to pay your monthly dues:

- You could potentially get sued by the condo association for the unpaid amount on top of any legal fees or interest (as indicated in your contract.)

- You’ll be asked to pay interest on any outstanding condo fees.

- Your unit may be foreclosed.

How Much Can Condo Fees Increase?

Year upon year, the cost of living tends to increase – and so do our condo fees. In this case, you may be asking yourself, “How much can condo fees increase in Ontario?” The answer is that it depends. Factors like inflation, major building repairs, and renovations can all influence condo fees, and it’s difficult to pinpoint an exact figure.

What is Included vs What isn’t Included in Condo Fees

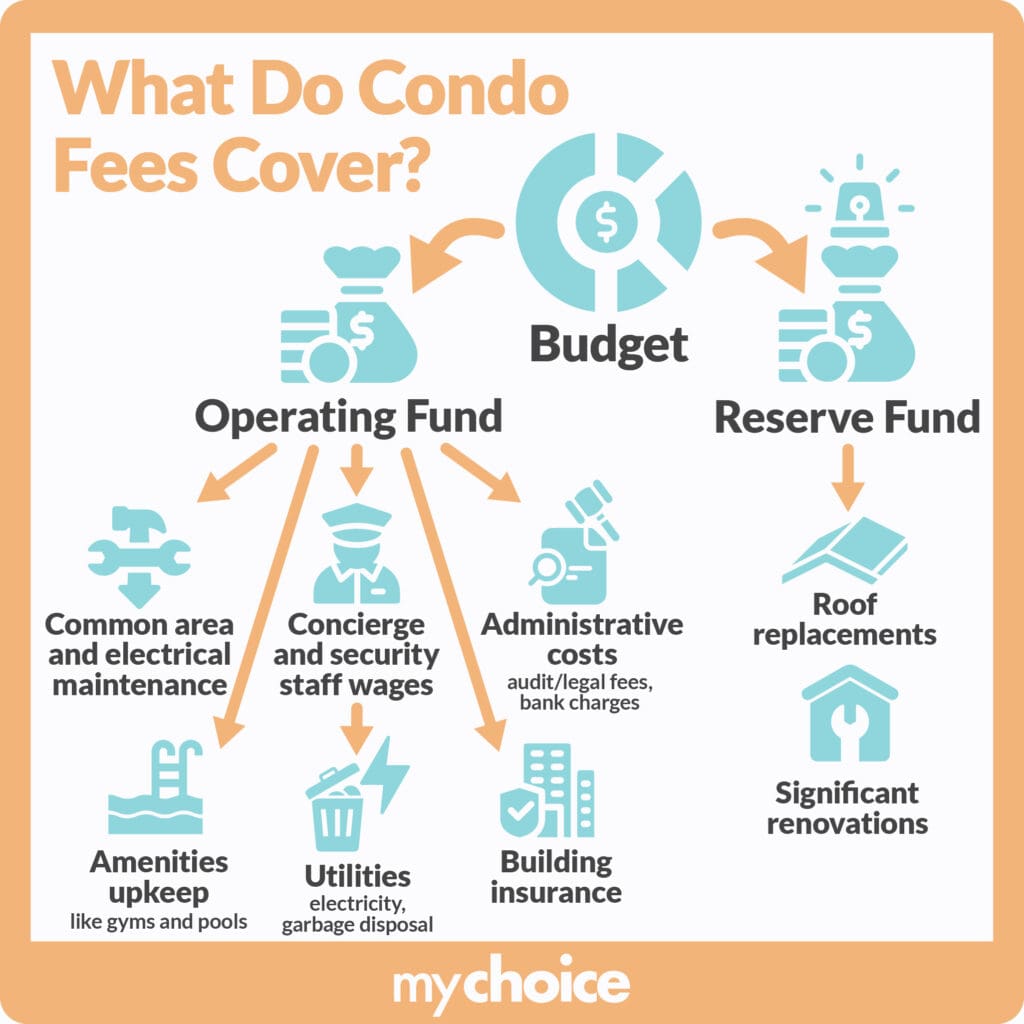

Part of making responsible financial decisions is knowing exactly where your money goes, and delving deeper into your condo fees is part of the process. Here’s what generally is included in your condo fee:

- (Potentially) utilities: While not every building includes utilities like hydro and heat in their condo fee breakdown, some do – especially if you have a unit in a condominium that doesn’t install individual meters. If you’re unsure before purchasing a condo, check in with building administration before you commit to anything.

- Reserve fund: A large part of your condo fees go toward something called a reserve fund, which is a pool of money that the administration keeps for major repairs or emergencies. This can include roof replacements, or water or heating system repairs.

- Special Assessment: Sometimes big repairs can cost more than the reserve fund is able to cover. In this case, unit owners would have to contribute toward a special assessment to cover the remaining costs. During a special assessment, every unit is given a specific amount to pay toward financial goals proportionate to their property size.

- Operating costs for shared spaces: Every condominium has shared spaces, and upkeep is necessary even if you don’t live in a building with a swanky gym or recreation center. Beyond maintenance and repairs, operating costs can include the electricity used in lobbies and elevators or seasonal necessities like preparing walkways during the snowy winter months.

- Staff and administration: Included in your condo fees is a percentage of every staff member’s monthly salary. After all, without them, hallways and common areas wouldn’t be cleaned, you wouldn’t have someone to call if there’s an issue, and nobody would physically keep the building in order.

Everything outside of this, like condo insurance, taxes on personal property, and other personal expenditures are not included in your condo fees.

Condo Fees: Comparison Between Provinces

Every Canadian province has its own rules and regulations concerning condo ownership, meaning that condo fees can vary quite wildly depending on where you plan to purchase a condo. As a result, each province has a different set of financial considerations that you need to be aware of. Namely:

- British Columbia: BC is notorious for high living costs, and this is reflected in its condo fees. Additionally, they have specific rules due to the Strata Property Act and fees generally tend to include repair and maintenance costs of common areas.

- Alberta: Alberta tends to have more straightforward condo fee plans, with many condo associations needing to adhere to the province’s laws. Generally speaking, monthly fees include only the basics: a reserve fund, maintenance costs, and insurance. Furthermore, fees are greatly impacted by the overall local housing market.

- Quebec: Quebec’s condo fees are on the higher side like British Columbia, though local legislation does mandate that a bigger portion of your monthly contribution goes toward the reserve fund over most other considerations.

- Ontario: Unlike other provinces, condo fees in Ontario usually cover utilities – which can be quite nice for keeping costs more stable in hotter or colder months. Naturally, the average condo fees in Toronto are also much higher than other cities, which is something you need to consider when finding the right place for you.

Key Advice from MyChoice

Here are some key takeaways from MyChoice:

- Condo fees are mandatory monthly expenses paid toward the condominium administration that cover operating costs, a reserve fund, and maintenance.

- Different units within a building pay different amounts for their condo fees, but it comes down to your building’s age, where you live, and the size of your unit.

- Failing to pay your condo fees can have serious financial repercussions like interest rates and foreclosure on your title.

- Every province has different laws and legislations that determine how condo fees are calculated, so ensure you ask before committing to a property.