MyChoice Reveals the Top 15 Cities With Best and Worst Kept Homes in Ontario

As of December 2023, the financial landscape for homeowners has seen drastic changes. With HELOC rates now exceeding 7.5% – a stark increase from the historical low of 2.35% in 2021, households are finding it increasingly challenging to manage maintenance costs. Moreover, with the Bank of Canada showing little sign of reducing rates in Q1 of 2024, Ontarians are cautioned that the reduced capacity for minor repairs could lead to more significant issues in their homes.

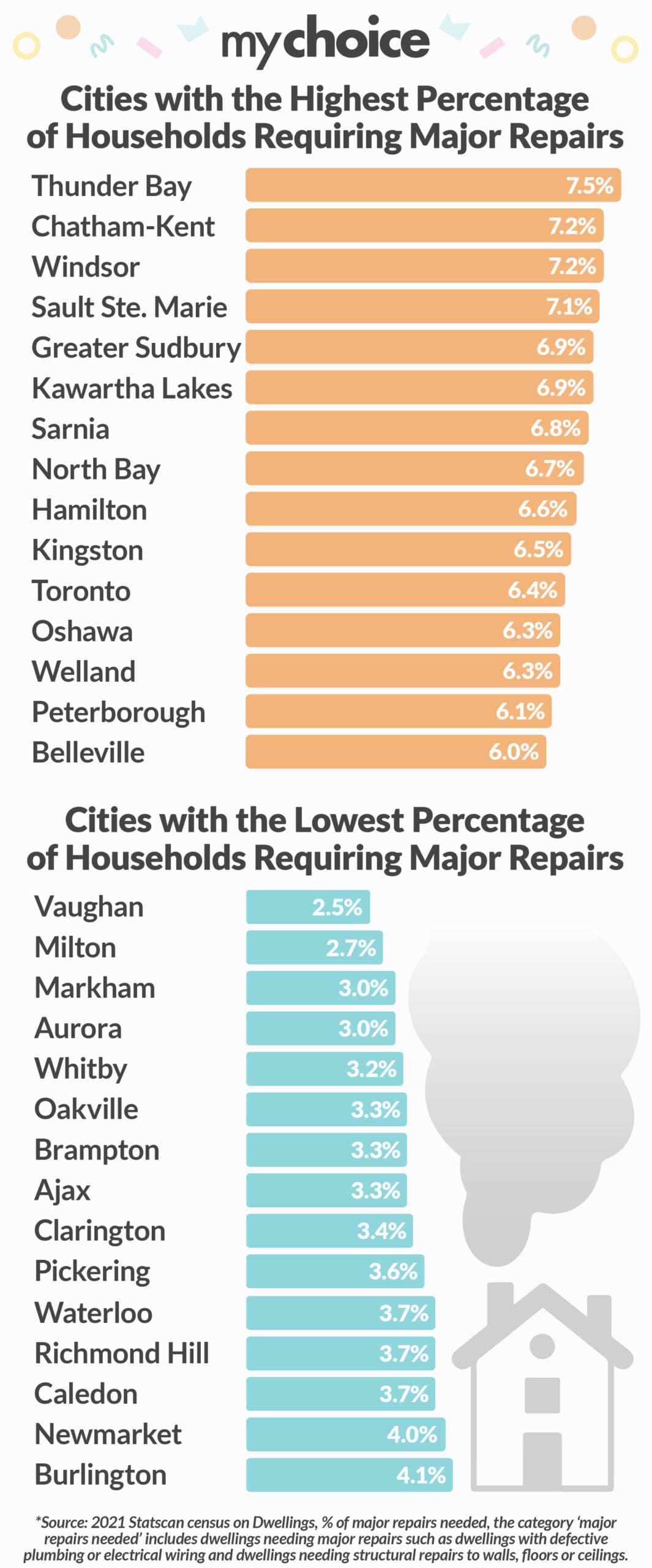

The disparities in home maintenance across Ontario cities might affect home insurance rates in the province. Here at MyChoice, we conducted an internal study, drawing from the 2021 Census data, which revealed that 7.5% of households in Thunder Bay report the need for major repairs, the highest in the province, while Vaughan is at the opposite end of the spectrum with only 2.5%. “Major repairs needed” refers to significant issues such as defective plumbing, electrical wiring, or structural repairs.

Aren Mirzaian, CEO of MyChoice, comments on the broader economic context: “The upsurge in HELOC rates is just one piece of the puzzle. We’re seeing the inflation of home insurance rates in Canada, which, according to the Q3 Consumer Price Index, home and mortgage insurance rates have increased by 8.6% in 2023. The largest contributor to this would be rising home replacement costs due to inflation of building materials.”

This inflationary pressure on home insurance rates also coincides with a period of heightened natural disasters in Canada, contributing to an increase in claims and subsequent rise in premiums. Homeowners are encouraged to mitigate claims risk in general by maintaining their homes to prevent minor issues from evolving into larger, more costly repairs.

“The connection between the state of home repairs and insurance costs cannot be overstated,” Mirzaian adds. “If interest rates stay higher for longer in 2024, we could see a surge in insurance claims, which may contribute to the rising insurance premiums. It’s imperative for homeowners to stay vigilant about their home’s condition and make sure they have the appropriate level of insurance coverage.”

Raw Data for study:

| City | % of Homes with Major Repairs Required |

|---|---|

| Thunder Bay | 7.5 % |

| Chatham-Kent | 7.2 % |

| Windsor | 7.2 % |

| Sault Ste. Marie | 7.1 % |

| Greater Sudbury | 6.9 % |

| Kawartha Lakes | 6.9 % |

| Sarnia | 6.8 % |

| North Bay | 6.7 % |

| Hamilton | 6.6 % |

| Kingston | 6.5 % |

| Toronto | 6.4 % |

| Oshawa | 6.3 % |

| Welland | 6.3 % |

| Peterborough | 6.1 % |

| Belleville | 6.0 % |

| Brantford | 6.0 % |

| Norfolk County | 5.8 % |

| St. Catharines | 5.8 % |

| London | 5.5 % |

| Niagara Falls | 5.4 % |

| Ottawa | 5.4 % |

| Cambridge | 5.2 % |

| Mississauga | 4.8 % |

| Guelph | 4.7 % |

| Kitchener | 4.7 % |

| Barrie | 4.6 % |

| Halton Hills | 4.4 % |

| Burlington | 4.1 % |

| Newmarket | 4.0 % |

| Caledon | 3.7 % |

| Richmond Hill | 3.7 % |

| Waterloo | 3.7 % |

| Pickering | 3.6 % |

| Clarington | 3.4 % |

| Ajax | 3.3 % |

| Brampton | 3.3 % |

| Oakville | 3.3 % |

| Whitby | 3.2 % |

| Aurora | 3.0 % |

| Markham | 3.0 % |

| Milton | 2.7 % |

| Vaughan | 2.5 % |

*Source: 2021 Statscan census on Dwellings, % of major repairs needed, The category ‘major repairs needed’ includes dwellings needing major repairs such as dwellings with defective plumbing or electrical wiring and dwellings needing structural repairs to walls, floors or ceilings.