Renovating your home can be an exciting endeavour, whether you’re updating an older property, expanding your living space, or enhancing its energy efficiency. But beyond the aesthetic and functional improvements, many homeowners wonder: are home renovations tax-deductible in Canada? The answer? Sometimes, but there’s a little more to it than that.

In this comprehensive guide, we delve into the nuances of Canadian tax laws to provide you with a clear understanding of when and how home renovations may be eligible for tax deductions.

What Expenses Can I Claim?

Not all renovations are created equal – and therefore, not every adjustment you make will result in a tax credit. So if you’re looking to save a little bit of money on home renovations in Canada, it’s crucial to distinguish between expenses that are eligible for tax relief and those that are not. Generally, expenses related to personal home renovations aimed at improving comfort or aesthetics are not tax-deductible. However, there are specific categories where deductions or credits may apply:

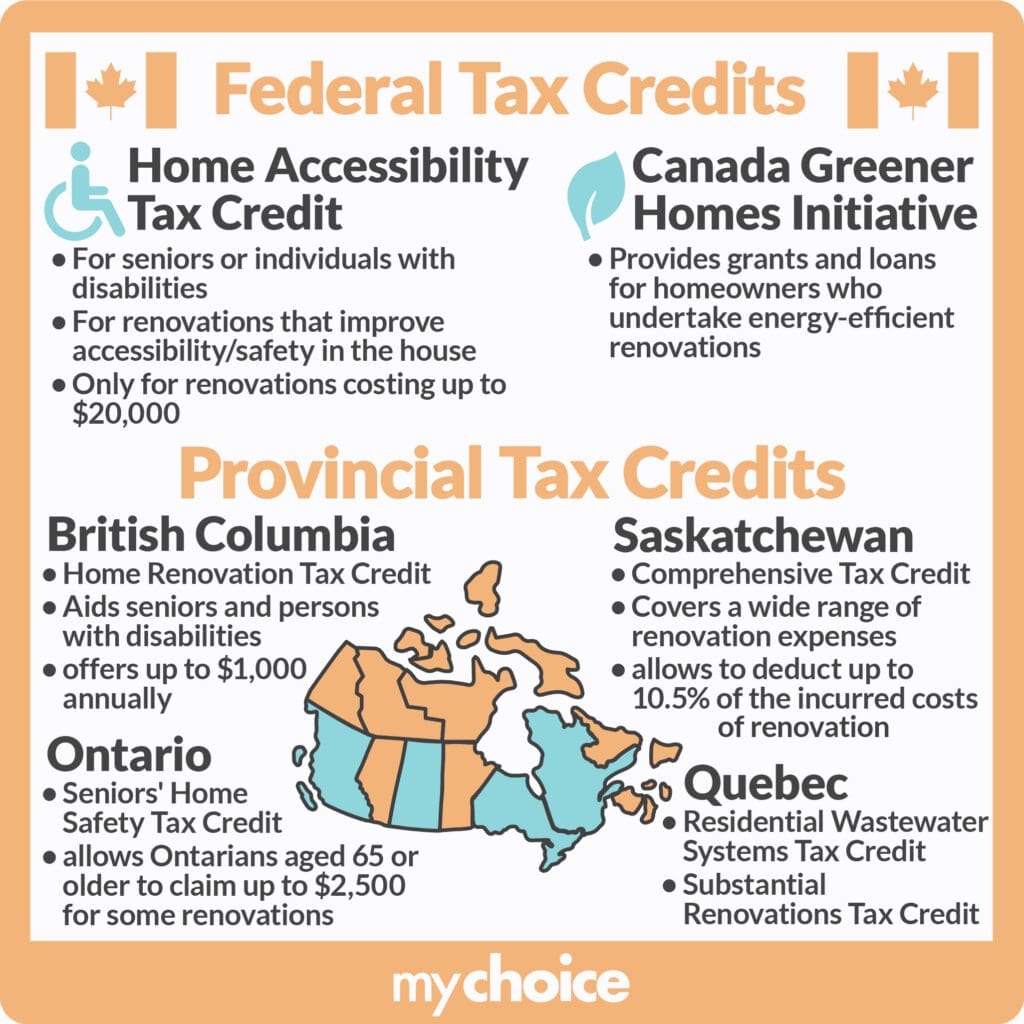

- Mobility and ease of use-related renovations: Canadians have access to the Home Accessibility Tax Credit (HATC), which can be used to claim expenses incurred for making their home more accessible. Modifications like wheelchair ramps, widened doorways, and accessible bathrooms are all covered under the HATC for up to $10,000 tax credit.

- Multi-generational home renovations: If you’re planning to renovate your home or add an extension to your existing property with the aim of accommodating a family member, you may be able to claim a bit of a tax credit through the Multigenerational Home Renovation Tax Credit or MHRTC for up to $50,000.

- Renovations made for senior citizens: In the same vein as modifications made for mobility aids and accessibility, any renovations completed to accommodate senior citizens may be eligible for a little bit of tax credit. Generally speaking, this includes anything meant to enhance their quality of life or avoid injury.

- Sustainable housing renovations: As Canada pushes toward a cleaner and greener future, residents are entitled to a bit of a tax incentive when converting their home’s existing infrastructure to a renewable alternative. Solar panels, heat pumps, and other upgrades are all eligible for a tax-free loan from the Canada Greener Homes Initiative.

- Energy Efficiency Renovations: While not typically tax-deductible, energy efficiency renovations may qualify for rebates or incentives from federal, provincial, or municipal programs. These incentives aim to promote sustainable building practices and may include rebates for installing energy-efficient windows, insulation, or heating systems.

- Rental property renovations: Current rental home expenses, such as minor repairs and maintenance, can be deducted in the year they are incurred. Capital expenses, which improve the property or extend its useful life, are typically claimed as capital cost allowance (CCA) over several years.

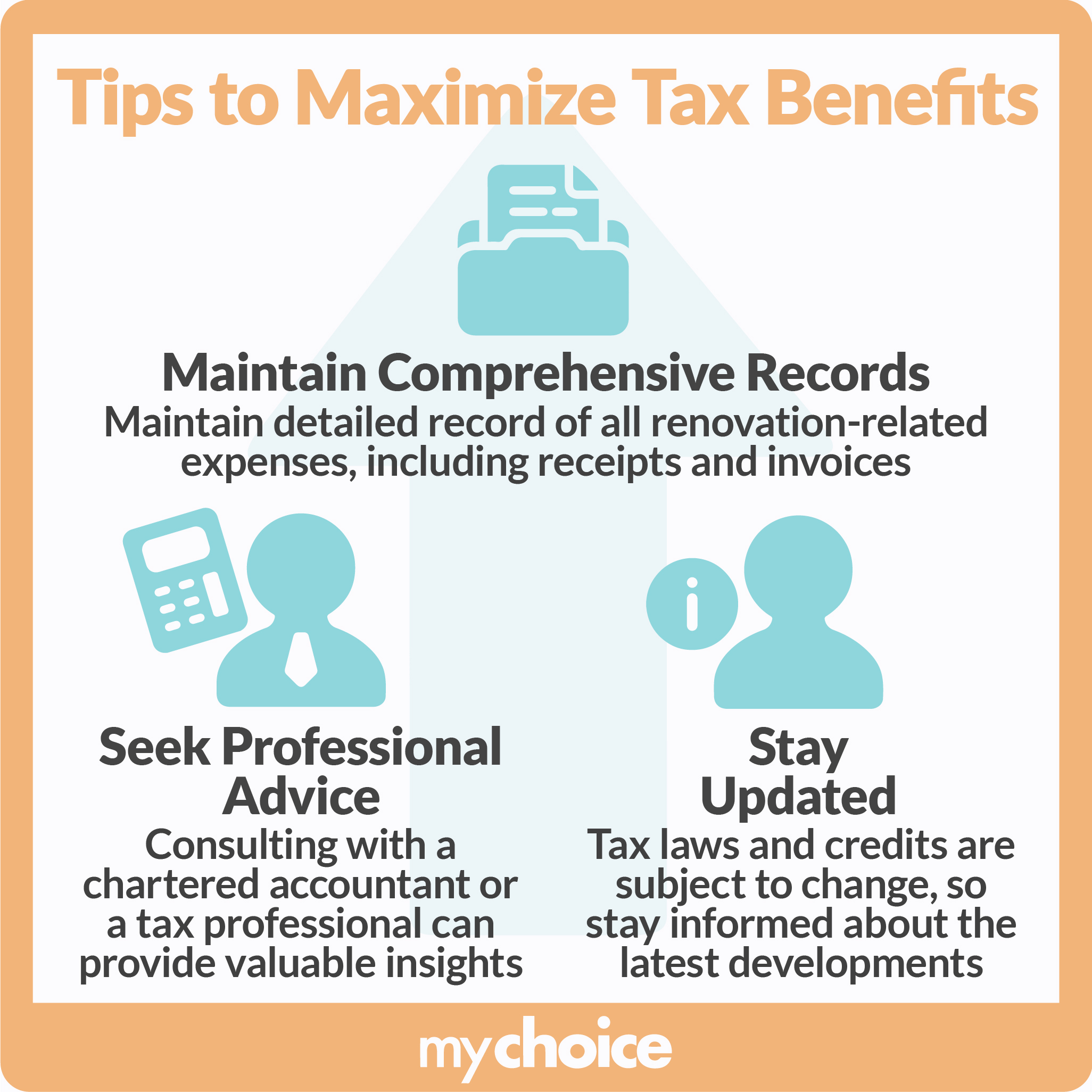

To maximize deductions and credits, it’s essential to keep detailed records of all renovation expenses, including invoices, receipts, and contracts. Consult with a tax professional to ensure compliance with CRA guidelines and to determine the eligibility of specific expenses for deductions or credits.

Incentives For Home Renovations

In addition to tax deductions, there are various incentives and rebates available across Canada to encourage home renovations that improve energy efficiency, accessibility, and sustainability. These incentives are often provided by federal, provincial, or municipal governments and can vary widely depending on your location. Here are some common types of incentives:

- Energy Efficiency Rebates: Many provinces offer rebates or grants for homeowners who make energy-efficient upgrades to their homes. These upgrades can include insulation, windows, doors, heating systems, and renewable energy installations. Examples include the Home Energy Loan Program (HELP) in Ontario and Efficiency Nova Scotia programs.

- Green Building Certifications: Some municipalities offer incentives for achieving green building certifications, such as LEED (Leadership in Energy and Environmental Design) or ENERGY STAR®. These certifications require homes to meet specific standards for energy efficiency and environmental impact.

- Property Tax Incentives: In certain jurisdictions, homeowners who undertake significant renovations to improve property values or energy efficiency may qualify for property tax incentives or rebates. These incentives aim to offset the costs of renovations and encourage sustainable building practices.

- Historic Preservation Grants: For homeowners of heritage properties, grants or tax credits may be available for renovations that preserve or restore the historic character of the home. These programs often require adherence to preservation guidelines and approval from heritage authorities.

- Accessibility Grants: Some provinces provide grants or funding assistance for renovations that improve accessibility for seniors or individuals with disabilities. These grants may cover expenses like installing ramps, accessible bathrooms, or lifts within the home.

All of this said, incentives and rebates vary per province, so we recommend homeowners do their own research to gain a handle on the particulars.

Home Renovation Tax Credit – By Province

Beyond renovating for family and mobility, some provinces offer their own credits or incentives to encourage home improvements. Here’s an overview of notable provincial programs:

- Ontario: Vying for a home renovation tax credit in Ontario may be easier than other provinces. The Ontario Renovates program provides financial assistance to low-income homeowners and landlords for accessibility modifications and essential repairs.

- British Columbia: Getting a home renovation tax credit in BC may be simple for homeowners as they could be eligible for rebates and incentives through programs like the BC Home Energy Coach and CleanBC Home Efficiency Rebates for energy-efficient upgrades.

- Alberta: The Alberta Home Improvement Rebate offers rebates for energy-efficient upgrades such as insulation, windows, and appliances.

- Quebec: RénoVert is a provincial tax credit for eco-friendly home renovations aimed at improving energy efficiency or using renewable energy sources.

- Nova Scotia: Efficiency Nova Scotia offers rebates and financing options for energy-efficient upgrades, including insulation, heating systems, and solar installations.

Each province’s program has specific eligibility requirements, application processes, and funding limits. Homeowners should consult provincial government websites or local energy efficiency agencies for detailed information on available programs, deadlines, and how to apply.

By taking advantage of these provincial incentives, homeowners can offset the costs of renovations while contributing to energy conservation and sustainability goals in their communities.

Key Advice From MyChoice

In conclusion, while most home renovations for personal use are not tax-deductible in Canada, there are specific circumstances where expenses may qualify for tax relief. Understanding these exceptions can help homeowners maximize potential tax benefits and plan renovations strategically.

- If you’re considering renovations that may have tax implications, it’s advisable to consult with a qualified tax professional or accountant. They can provide personalized guidance based on your individual circumstances and ensure compliance with Canadian tax laws.

- While tax deductions for home renovations are limited, the benefits of improving your home’s comfort, functionality, and accessibility can be invaluable. By staying informed and understanding your options, you can make informed decisions about your home renovations and financial planning.

Remember, each province may have specific rules and nuances regarding tax deductions, so it’s essential to consider regional variations when assessing your eligibility. Stay informed, plan carefully, and enjoy the journey of enhancing your home!