Whether you’re a first-time home buyer or settling into your next house, you may have considered getting home insurance to protect your property and belongings from different risks. Two types of home insurance you can choose from are broad home insurance and comprehensive home insurance.

Depending on your budget, home, and financial obligations, one may offer better value. But what’s the difference between broad and comprehensive home insurance, and which type should you get? Read on to learn more about these two types of home insurance policies.

What’s the Coverage Difference Between Comprehensive and Broad Home Insurance?

Comprehensive and broad home insurance both protect your home and personal property, but differ in their covered risks and exclusions. Here’s a comparison table showing their key differences:

| Coverage | Comprehensive home insurance | Broad home insurance |

|---|---|---|

| Coverage for your house | Covers your house against all perils that aren’t excluded in your policy, which is why it’s also known as “all-risks” insurance | Covers your house against all perils that aren’t excluded in your policy |

| Coverage for the contents of your house | Covers your personal belongings against all perils that aren’t excluded in your policy | Covers your personal belongings only against named perils, a.k.a. only risks specifically listed in the policy |

| Usual covered risks | Fire; Personal liability, in the event someone is accidentally injured on your property; Damage from wind or hail; Smoke damage; Vandalism; Theft; Burglary | Same covered risks as comprehensive home insurance for your house; Only specifically named risks are covered for your personal belongings |

Broad vs Comprehensive Home Insurance

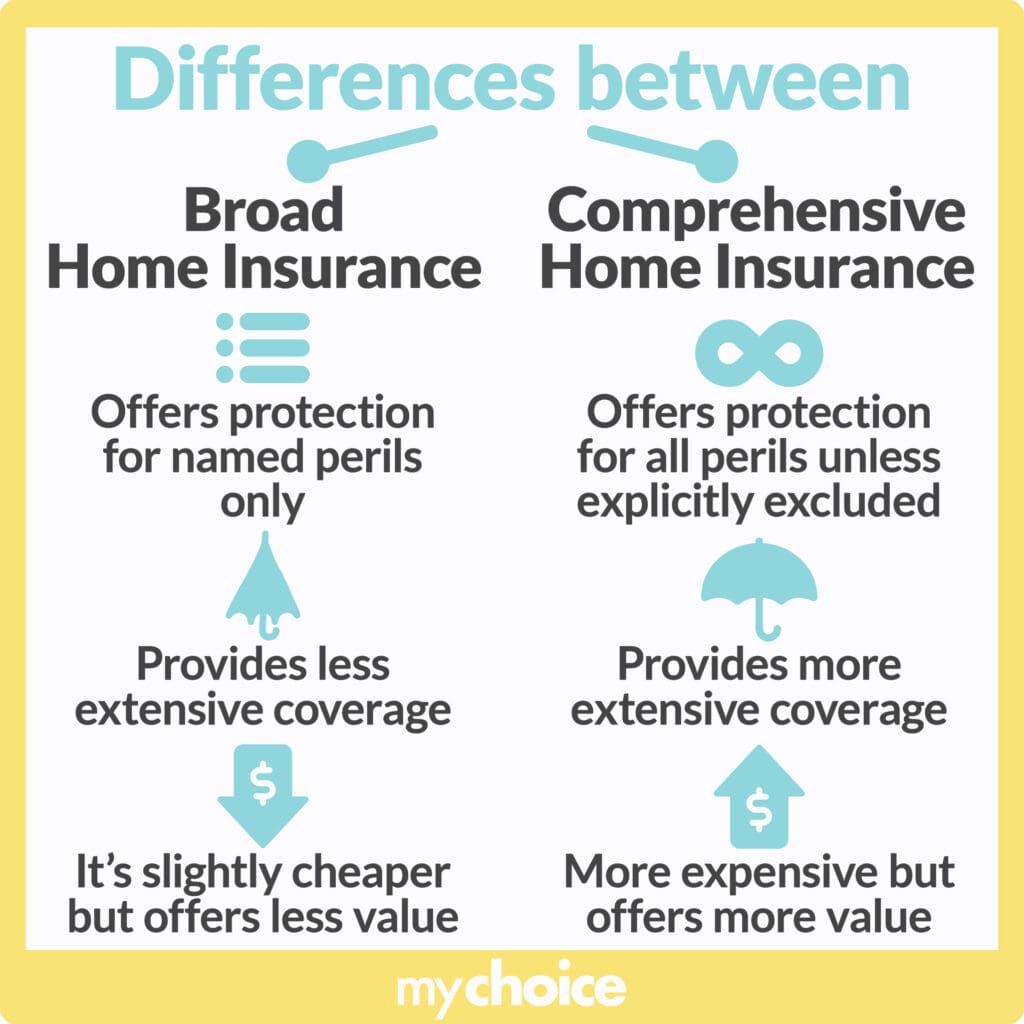

Broad and comprehensive home insurance policies both offer protection for your home and personal belongings from various risks, but they aren’t the same. Here, we break down every major difference between broad and comprehensive home insurance:

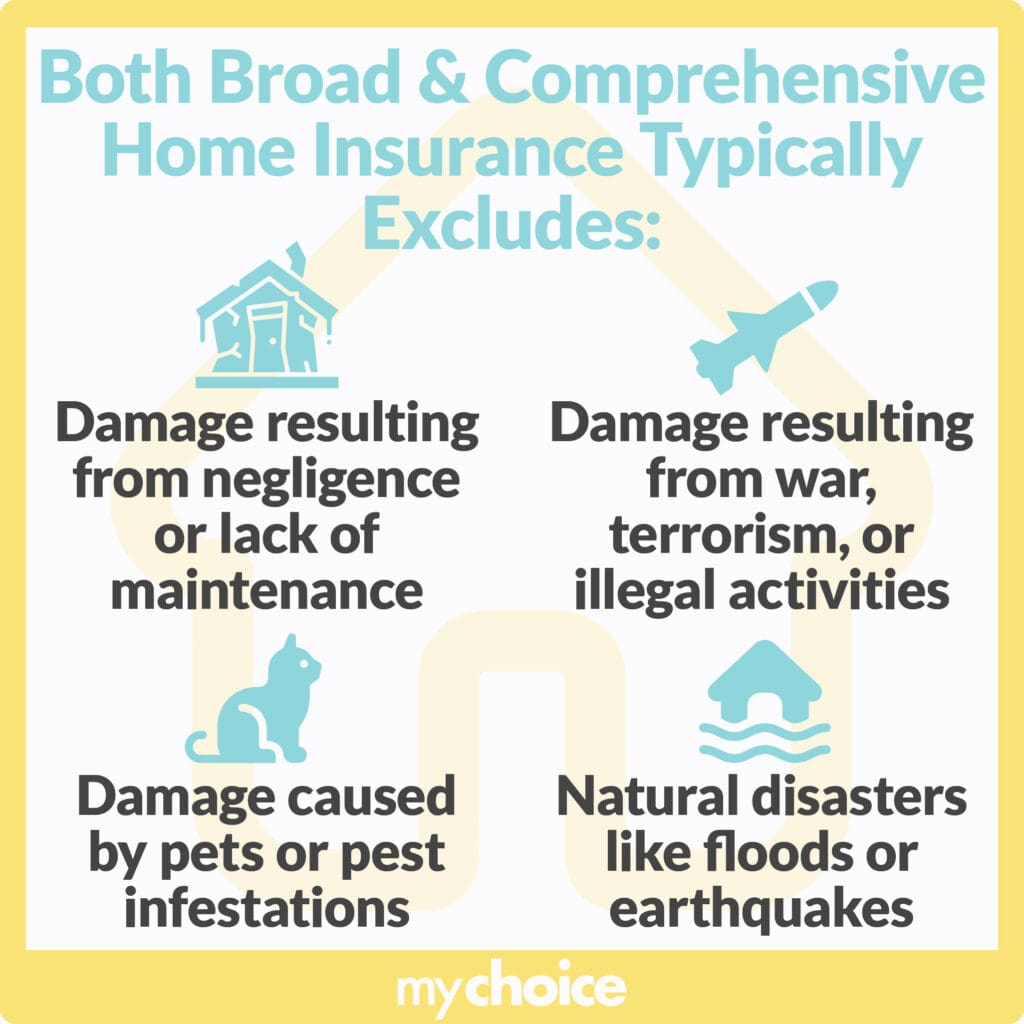

Risks and Perils Excluded From Broad and Comprehensive Home Insurance

Comprehensive home insurance may offer greater coverage than broad home insurance, but there are still certain perils that are usually excluded from this type of policy by insurers. Here are some of the most commonly excluded risks:

- Mould

- Damage from acts of terrorism

- Damage caused by negligence or lack of property maintenance

- Damage caused by pets or pests

There are some risks that you can be protected from by purchasing additional coverage. Examples of these are:

- Flooding or overland water

- Earthquakes

- Home sharing

- Vacant dwelling risks

- Mass evacuation

- Sewer/wastewater back-up

- Credit and debit card forgery

Not all home insurers have the same add-ons, riders, and exclusions. Talk to your home insurance provider in Canada to see what’s covered in case of loss or damage.

Should I Get Broad or Comprehensive Home Insurance?

Now that you know the major differences between each type of home insurance, which one you should get? Here are some tips that will help you decide which type of home insurance is best for you:

- Assess your needs: Consider the value of your belongings and the potential risks to your property. This will help guide whether you need the more encompassing protection of comprehensive insurance or the specified coverage of broad insurance.

- Shop and compare: Different insurers have different underwriting processes, and some companies may provide lower quotes for the same type of coverage. Compare premiums from different home insurers using MyChoice to find the deal that offers the best value for your money.

- Consider your budget: Comprehensive insurance typically costs more but offers wider coverage. Decide what fits your financial plan without compromising too much on protection.

- Review your plan regularly: As you acquire more valuables or if your living circumstances change, your insurance needs might change too. Regularly reviewing your policy ensures it aligns with your current situation.

Key Advice from MyChoice

- If you have a lot of collectibles or expensive items, you may benefit from getting more coverage from comprehensive home insurance. But if you’re a first-time homeowner or on a budget, broad home insurance may make more sense.

- Review your home insurance policy regularly as your needs will change. Homeowners who start with broad home insurance may want to switch to a comprehensive policy or purchase riders for additional coverage, especially when they accumulate more valuables.

- Older homes that require more maintenance may need the increased protection of comprehensive home insurance.

- Note that comprehensive home insurance may still have exclusions for certain types of losses or damage despite being “all-risks”. Check your policy’s terms and conditions and see if you need additional coverage, especially if you live in an area prone to natural disasters that are excluded from your policy.