Rising climate risk also means your home is more likely to suffer climate-related damage. If your house is at higher risk of climate-related damage, your home insurance rates will likely increase. But will home insurance become a luxury product if this keeps happening?

Home Insurance Premiums Are Increasing Faster Than the Average Income

As climate change leads to more natural disasters, the increased occurrence of disasters also impacts your finances. The Insurance Bureau of Canada (IBC) recorded a whopping 228,000 insurance claims in the summer of 2024, meaning these disasters are heavily impacting homes and cars.

Unfortunately, with the increasing likelihood of your home becoming damaged by climate factors, you’re more likely to pay more for your home insurance. Let’s take a look at the increase in home insurance premiums in the past decade compared to the increase in wages.

| Province | Home Insurance Inflation (2014-2024) | Median Annual Income Increase (2014-2024) |

|---|---|---|

| Quebec | 46.53% | 14.4% |

| Ontario | 84.24% | 10.1% |

| New Brunswick | 74.68% | 8.6% |

| Nova Scotia | 78.70% | 7.5% |

| Newfoundland and Labrador | 76.08% | 0.5% |

| Prince Edward Island | 57.19% | 11.2% |

| Alberta | 90.32% | -6.7% |

| British Columbia | 78.44% | 17.5% |

| Manitoba | 65.47% | 5% |

| Saskatchewan | 106.32% | -3.4% |

| Canada | 76.04% | 9.9% |

As you can see, the percentage increase in insurance premiums far outweighs the percentage increase in annual income in every Canadian province. Some provinces even experienced annual income decreases, which means affording home insurance may be harder.

Pressure on Insurance Companies to Raise Their Premiums

If we want to learn more about why home insurance rates are increasing, we need to trace the cause back to its roots. Many factors pressure insurance companies to raise home insurance premiums, so let’s take a look at some of them:

- The increasing frequency of severe weather events, which cause billions of dollars in damage annually, results in an increasingly large number of home insurance claims.

- High inflation rates that drive price increases.

- The increasing cost of home construction and repair is due to supply and labour shortages.

Since these critical factors all hit at the same time, home insurance prices get higher and higher as time passes, meaning you need to pay more for your home’s protection.

What’s Happening in the Global Reinsurance Market?

According to AON’s 2025 Insurance Market Report in Canada, the global reinsurance market is on the rise. Reinsurers essentially keep insurance companies from suffering huge losses by transferring part or all of their insurance policy risk to another company.

How does this affect you as a customer? Since insurance companies in Canada had to seek a safety net in the form of reinsurers to protect themselves from the many insurance claims throughout 2024, these companies may end up adjusting their underwriting practices and pricing. Those changes may lead to stricter requirements for insurance qualification and higher premiums.

What’s Being Done in Response to Climate Risk?

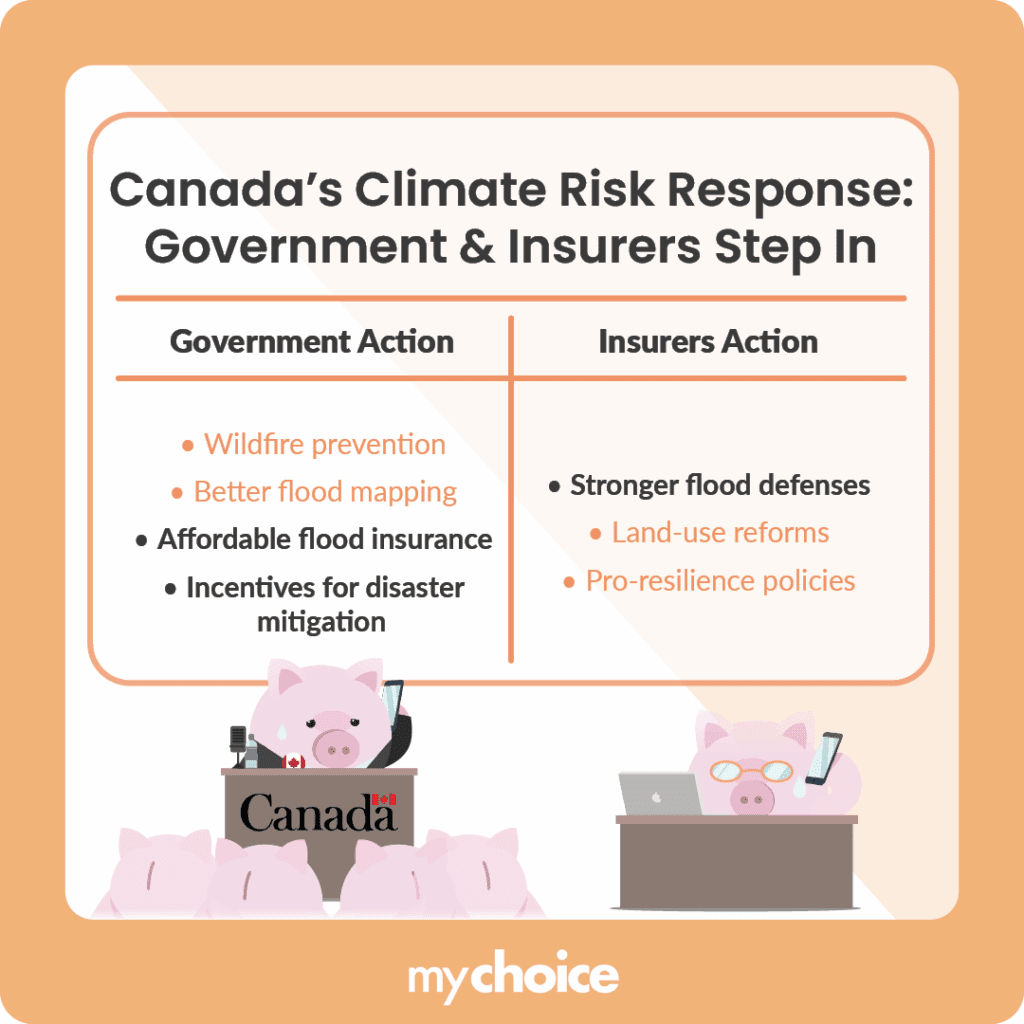

Since climate risk affects more than just the insurance market, people are doing something to address the issue. Let’s take a look at what the Canadian government and insurers did in response to the climate crisis.

How You Can Save Money on Home Insurance

If severe weather incidents continue to be a problem, home insurance rates will rise even more as the years pass, and it may become less and less affordable since history says it’s outpaced earnings increases. To help you save money on home insurance, let’s take a look at great ways you can keep your rates down:

Key Advice from MyChoice

- The rise of Canadian home insurance premiums in the past decade has been very high, making home insurance very expensive.

- Increased climate risk makes homes more vulnerable and riskier to insure, so installing protective measures is a good idea to drive home insurance premiums down.

- You can consider bundling home and auto policies and shopping around to get policies with lower premiums.