Short-term rentals can be a great source of extra income, but they also introduce added insurance risks that many condo owners don’t fully understand. A recent B.C. court ruling has made it harder for insurers to go after Airbnb guests who cause damage — a legal shift that could drive up condo insurance premiums, increase liability for hosts, and change how condo buildings and insurers approach short-term stays across Canada.

It’s a lot to take in, so let’s break down what happened, what it means for you, and how to protect yourself.

Understanding Short-Term Rentals & Condo Insurance

Insurance companies already see short-term rentals as higher risk. Guests may not always treat your space like home, which increases the chances of damage and creates more grey areas when it comes to who’s responsible when something goes wrong.

Condo insurance usually has two layers of protection working together:

- Your condo insurance policy, which covers your unit and liability

- The building’s master policy, which covers common areas, shared structures, and sometimes original fixtures within units (depending on the condo bylaws)

One of the main issues in short-term rentals is subrogation, which is the insurer’s legal right to recover the cost of a claim from whoever actually caused the damage. When guests cause serious damage, this right becomes a major factor in determining who ultimately pays.

For example, if a guest floods your unit, your condo insurance may cover interior damage, while the building’s master policy would cover damage to shared plumbing or hallways. But if the cause is traced to the guest, both insurers may look to recover costs from them. You could even be held responsible, especially if your policy excludes damages caused by your guest or if you failed to disclose short-term rental use.

The Schappert Ruling Explained

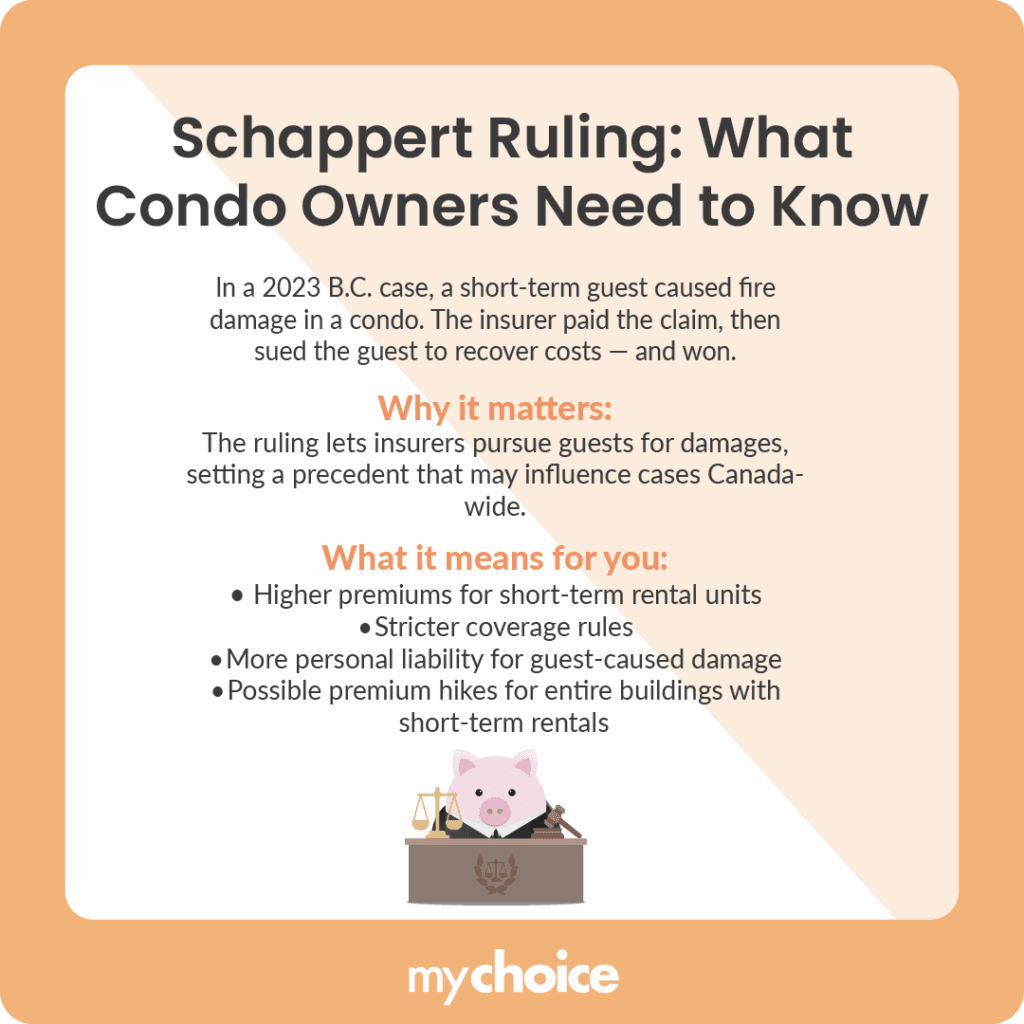

Here’s the case that reshaped how insurers approach short-term rentals. Strata Plan VR 2213 v Schappert, a 2023 decision by the B.C. Supreme Court, involving a condo unit rented out for a short-term stay. During the guest’s visit, they caused significant damage through a kitchen fire that set off the building’s sprinkler system. The condo owner’s insurance covered the claim.

The insurer attempted to recover the costs from the guest through subrogation. However, the B.C. court ruled that the guest was effectively an insured under the condo’s policy and could not be pursued. This clarified that in some cases, short-term guests may be shielded from subrogation claims — a decision that could shift how insurers handle short-term rental risks.

This ruling set a precedent in British Columbia, limiting insurers’ ability to pursue short-term renters for damage in certain situations — especially when the guest qualifies as an insured under the building’s policy. While the ruling is specific to B.C.’s legal framework, it may influence how insurers in other provinces assess risk and draft future policies related to short-term rentals.

How This Ruling Could Impact Your Condo Insurance Costs

Insurers have always had subrogation rights, but what changed here was the legal interpretation of who qualifies as an “insured person,” which determines whether subrogation is allowed. As insurers reevaluate these risks, you could see changes like:

- Higher premiums for condos used as short-term rentals

- Reduced coverage or tougher screening before approval

- Greater personal liability for damages caused by guests

If insurers start viewing short-term rentals as higher risk, they’ll adjust the pricing and coverage rules, which could affect the hosts and the entire building. Even if you’re not hosting, a building with frequent short-term rentals could see collective premium hikes or policy changes.

Could You Be Personally Liable for Damage Caused by Airbnb Guests?

While insurance can offer protection, it doesn’t always guarantee you’re off the hook financially. Depending on your policy and how you use your unit, liability might fall back on you, even if the damage was caused by someone else. Here’s how personal liability can come into play:

- Your guest causes major property damage or injury

- The building’s master policy pays the claim, but the condo board or insurer comes after you

- You didn’t disclose the rental use or get the right type of insurance

Even if your guest is at fault, you might still get pulled into the legal process, which can get expensive fast.

Proactive Steps to Protect Yourself

The good news is that there are practical ways to reduce your risk and avoid common pitfalls. With the right coverage and a clear understanding of the rules, you can host with more confidence. Start with these steps to help you avoid surprise costs or gaps in coverage:

- Review your condo policy for short-term rental coverage.

- Talk to your insurer before listing.

- Confirm with your condo board that rentals are allowed.

- Set clear guest rules and keep a paper trail.

- Use platform tools to screen guests, require security deposits, and consider limiting bookings to users with verified reviews.

- Look into landlord insurance coverage if you host often.

What to Ask Your Condo Corporation & Insurance Provider

Short-term rentals can be a great way to earn extra income if you’re covered. Before listing your condo, you should do some homework. Speaking directly with your condo corporation and insurance provider can easily clarify what is and isn’t allowed. Here are a few questions to ask that can save you from future stress:

- Are short-term rentals allowed in the building bylaws?

- Who’s liable if a guest damages shared areas?

- Does my personal policy cover short-term guests, or can I add that coverage?

- Will hosting affect the building’s insurance rates or claims history?

Talk to your insurer and strata so you can better protect your condo investment and your money.

Key Advice from MyChoice

- Some condo corporations allow short-term rentals with conditions, while others ban them outright. Always ask for the latest bylaws or amendments in writing.

- Tell your insurer if you plan to rent or host the place; undisclosed rentals could lead to denied claims or policy cancellations.

- Read through the fine print, ask the right questions, and make sure your coverage aligns with how you use your property.