Ontario homes differ in many ways, such as their age, condition, and size. While many homeowners know how these differences affect their home’s price on the real estate market, there’s another important value they affect: your home insurance premiums.

If your home is deemed high-risk, you may not be able to get standard home insurance and will have to look to specialized high-risk insurers to get coverage. Read on to learn what factors insurers consider when assessing your risk profile and how to improve insurability to qualify for standard home insurance.

What Factors Might Make My Home Considered High-Risk?

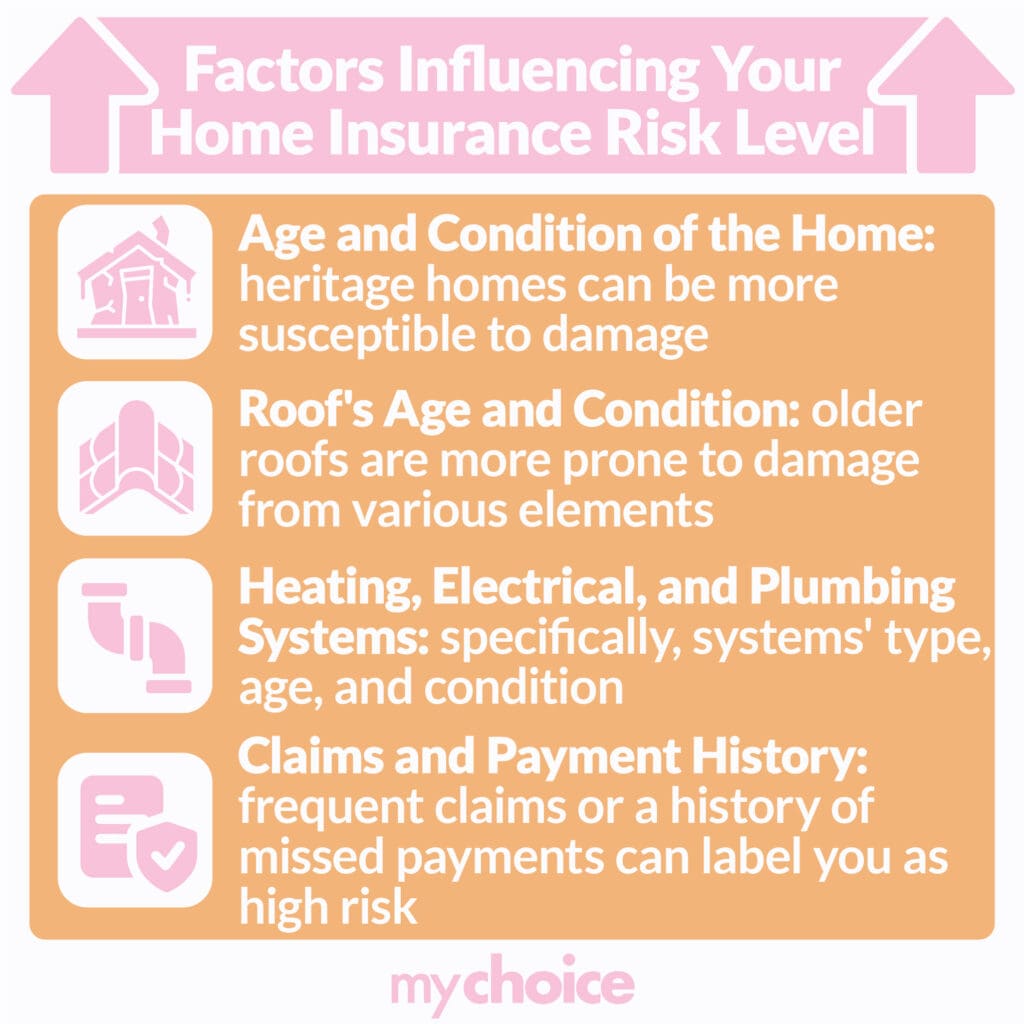

Several factors can make Ontario home insurers deem your home a high-risk property. Understanding these factors is critical for Ontario homeowners, as they greatly affect your coverage options and home insurance costs. Here are some key elements that insurers look at to determine if a home is high-risk:

- Age and condition of the home: Older or poorly maintained homes are more susceptible to damage and may be seen as high-risk by home insurers. Condition-related issues such as deteriorating roofing, and outdated plumbing can lead to higher premiums or denial of coverage under a standard policy.

- Location and environmental factors: Homes in areas prone to natural disasters or regions experiencing extreme weather events due to climate change may be viewed as high-risk.

- History of missed payments and/or multiple claims: If you have a lapse in coverage, miss multiple premium payments, or file many claims in a short period, this increases a home insurer’s perceived risk of insuring your property.

- Home usage: Homes that aren’t regularly occupied by their owners can be considered high-risk, such as vacation homes. Vacant homes are also considered high-risk because no one is regularly monitoring the property, making it susceptible to theft, vandalism, and damage from a lack of home maintenance.

- Crime rate: Homes in neighbourhoods with high crime rates may be deemed high-risk because of the increased likelihood of crimes resulting in damage to or loss of the home and the homeowner’s belongings.

The Impact of Climate Change on Home Insurance

Climate change has significantly affected the home insurance market through the increased frequency and severity of natural disasters like storms and floods. The Insurance Bureau of Canada reported $3.1 billion in insured damages from natural catastrophes in 2023, making it the fourth-worst year to date for insured losses in Canada.

Extreme weather events once considered rare are now rising in incidence, making Canadian homes riskier to insure and causing serious financial fallout. Here are some of the ways that adjustments for assessing climate change can impact premiums and coverage options for Ontario home insurance:

- Limited coverage options: Because of rising risks, some insurers may limit the types of coverage they offer. Some policies may exclude weather-related risks such as overland flooding or wildfire damage, especially in areas where their incidence and historical damage have gone up. This may leave homeowners vulnerable when these events strike.

- Higher home insurance premiums: Insurers may also increase premiums to cover increased losses, making it harder for homeowners to find affordable policies.

- Withdrawal of coverage: In some cases, the risk may be so high in some locations that insurers will withdraw property coverage or even avoid insuring specific risks altogether. This trend leaves homeowners exposed, forcing them to either relocate or accept policies with uninsurable risks.

Expect reduced accessibility to affordable home insurance as severe weather events become more common. To navigate these new challenges in protecting your property, stay informed about risks in your area and explore ways to make your home more weather-resilient.

How to Reduce Your Risk Levels for Lower Home Insurance Quotes

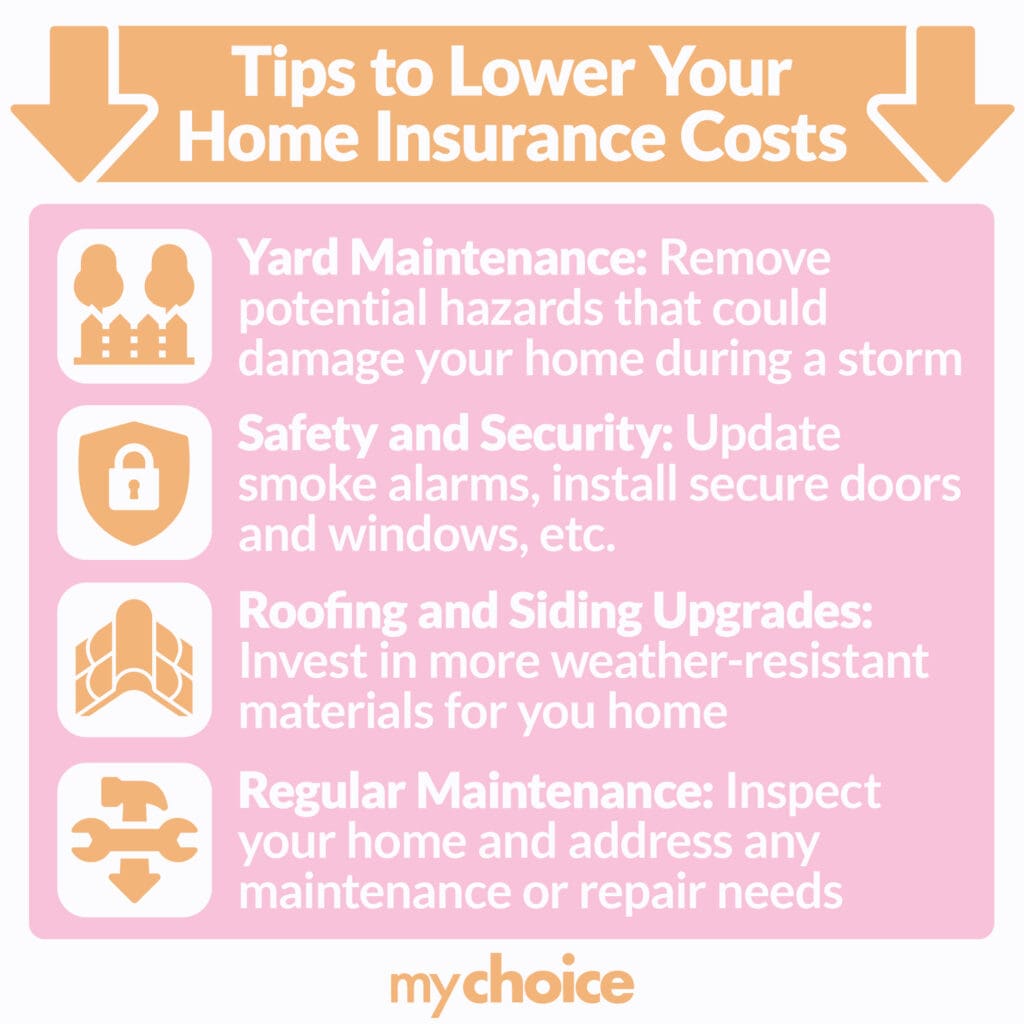

Regular maintenance and updates to your home can reduce your home’s risks, helping you transition from high-risk homeowners insurance to standard home insurance for more affordable coverage. Here are some measures you can take to make this happen:

- Reinforce your roof: Replace old shingles with sturdier, more impact-resistant materials to reduce the risk of leaks and prevent storm damage.

- Conduct regular home maintenance: Regularly checking for issues and repairing them ASAP can prevent minor issues from causing significant damage that may lead to insurance claims.

- Enhance your home security: Many home insurers offer discounts if you implement home security measures to deter theft and vandalism, such as deadbolt locks, security cameras, and burglar alarm systems.

- Add fire safety improvements: Installing fire safety features such as smoke detectors and sprinkler systems reduces the risk of fire-related claims and may persuade your insurer to offer a discount on your premiums.

- Upgrade your plumbing, electrical, and heating systems: Old systems can increase the risk of incidents like fires and water damage. Upgrading to newer, more efficient systems not only makes your home safer, it also leads to lower home insurance premiums.

- Maintain proper yard upkeep: Maintain landscaping, improve drainage, and keep walkways neat. Regularly trim your trees to prevent the risk of branches falling during a storm and damaging your home. These measures will reduce the risk of damage related to risks like flooding and storms.

Key Advice from MyChoice

- Compare quotes from multiple insurers to find the most affordable policy for your needs. Remember that different companies have different underwriting processes and come up with different risk profiles for exactly the same property. Some insurers may deem your home high-risk, but you may qualify for standard insurance with others.

- Even if your home is well-maintained and in an area less exposed to weather hazards, you will still have higher quotes if you have a history of missed payments or several recent claims. Make it a point to pay your insurance premiums regularly and avoid filing multiple claims in a short timeframe, if possible.

- Living close to hazardous areas like floodplains or earthquake zones increases your home’s risk level. Consider getting additional coverage for these risks if they’re excluded from your standard policy to protect your property.