Maintenance is a routine part of keeping your home safe and in good shape, but did you know that your home insurance provider is also concerned about your house maintenance? Insurers love a well-maintained house, while a poorly kept one may lead to higher premiums and an increased risk of denied insurance claims.

What kind of maintenance does your home need? How often should you perform maintenance tasks? Does your home’s maintenance affect your home insurance premiums? Read on to learn about why house maintenance is important, along with an easy-to-follow checklist that details what maintenance tasks you should be performing and how often.

Why Your Insurer Cares About House Maintenance

When you purchase a home insurance policy, you’re agreeing with the insurance company to keep risks in your home as low as possible. Insurers factor in your home’s condition when they decide your home insurance premiums, or whether they’ll even insure you. If your house is poorly maintained, that means you’re at a high risk of filing claims, which can lead to higher premiums, reduced coverage, or even denial of coverage.

Can You Be Denied a Claim for Poor House Maintenance?

Yes, your insurance claim can be denied if your home is poorly maintained. Most home insurance policies have clauses regarding “wear and tear” or “preventable damage”. This means that if your roof was leaking for months and you didn’t take any action to address the issue, your insurance may not cover the damage when you file a roof insurance claim.

The same goes for mould, foundation cracks, pest damage, or even a house fire that starts because your chimney hasn’t been cleaned in years. If your insurer determines that you ignored clear warning signs or that you didn’t perform routine maintenance, any claims you make might be denied based on neglecting maintenance.

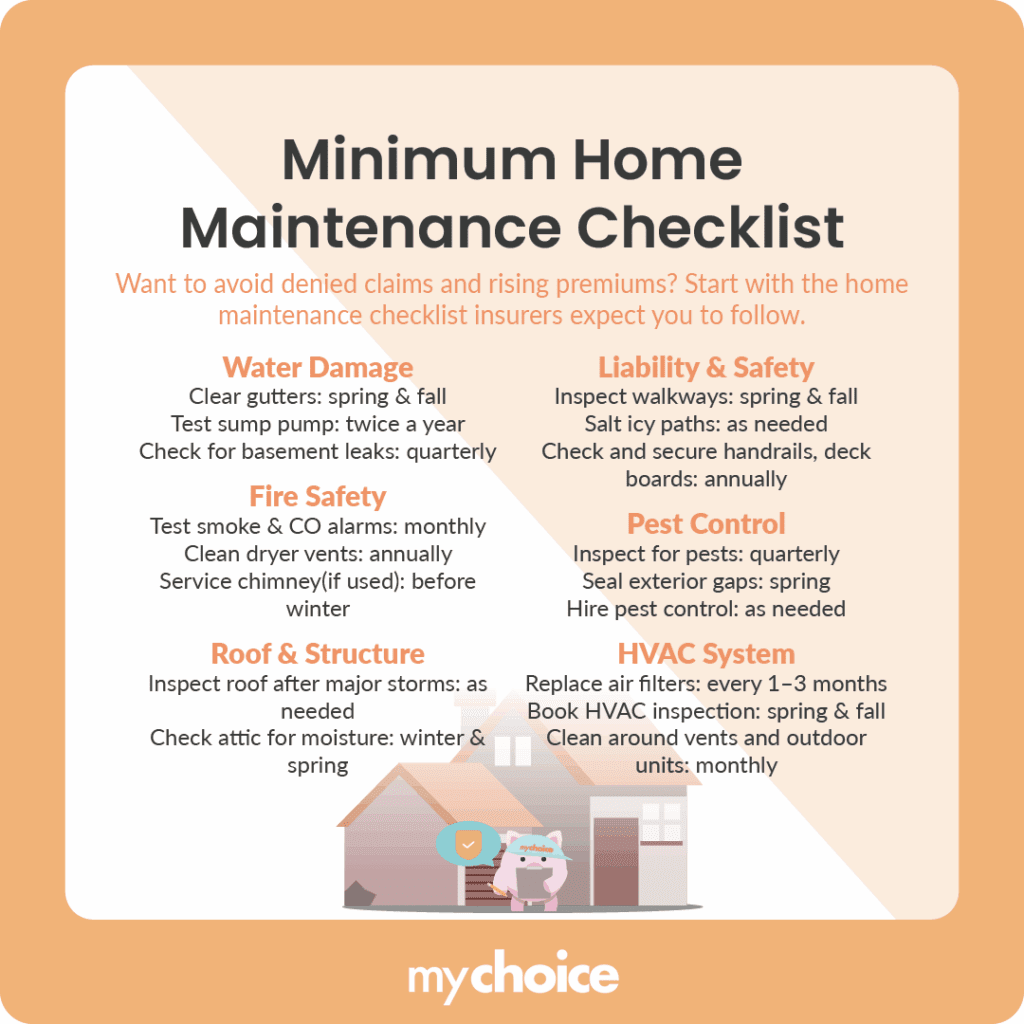

Maintenance Checklist to Prevent Claims by Category

Key Advice from MyChoice

- Review the home maintenance checklist and schedule a date on your calendar for each maintenance task in advance. This will help you remember to do them when you need to.

- Insurance companies will often require a home inspection before selling you a home insurance policy. Use the inspection report to identify areas in your home that require regular maintenance.

- Document your home maintenance to help support any claims you may need to make. Take photos, save receipts, and keep any documents related to maintaining your home.