Many Canadian homeowners assume their standard home insurance policy covers household appliances, such as furnaces, refrigerators, and air conditioning units. However, this isn’t always the case, and you might find yourself stuck with a hefty repair bill.

To keep this from happening, consider home equipment breakdown coverage as an endorsement to your policy. Discover how this endorsement can complement your standard home insurance and how it can save you money in the long run.

Most Canadians Don’t Know They’re Underinsured for Equipment Failures

Equipment breakdown is one of the most common uninsured home claims, as many homeowners don’t realize a basic home policy won’t cover repair or replacement.

Here’s an example to put things into perspective. Suppose your aging water heater finally gives out and leaks. Your home insurance policy will cover the damage it causes, but it won’t cover the cost of repairing or replacing your heater. On average, it takes between $5,000 and $12,000 to replace a heating and cooling system – a significant out-of-pocket cost.

Homeowners are also prone to overestimating the coverage of their base policy, leaving them underinsured. Unfortunately, breakdowns aren’t rare, and adopting an “it won’t happen to me” mindset also keeps homeowners from anticipating potential issues.

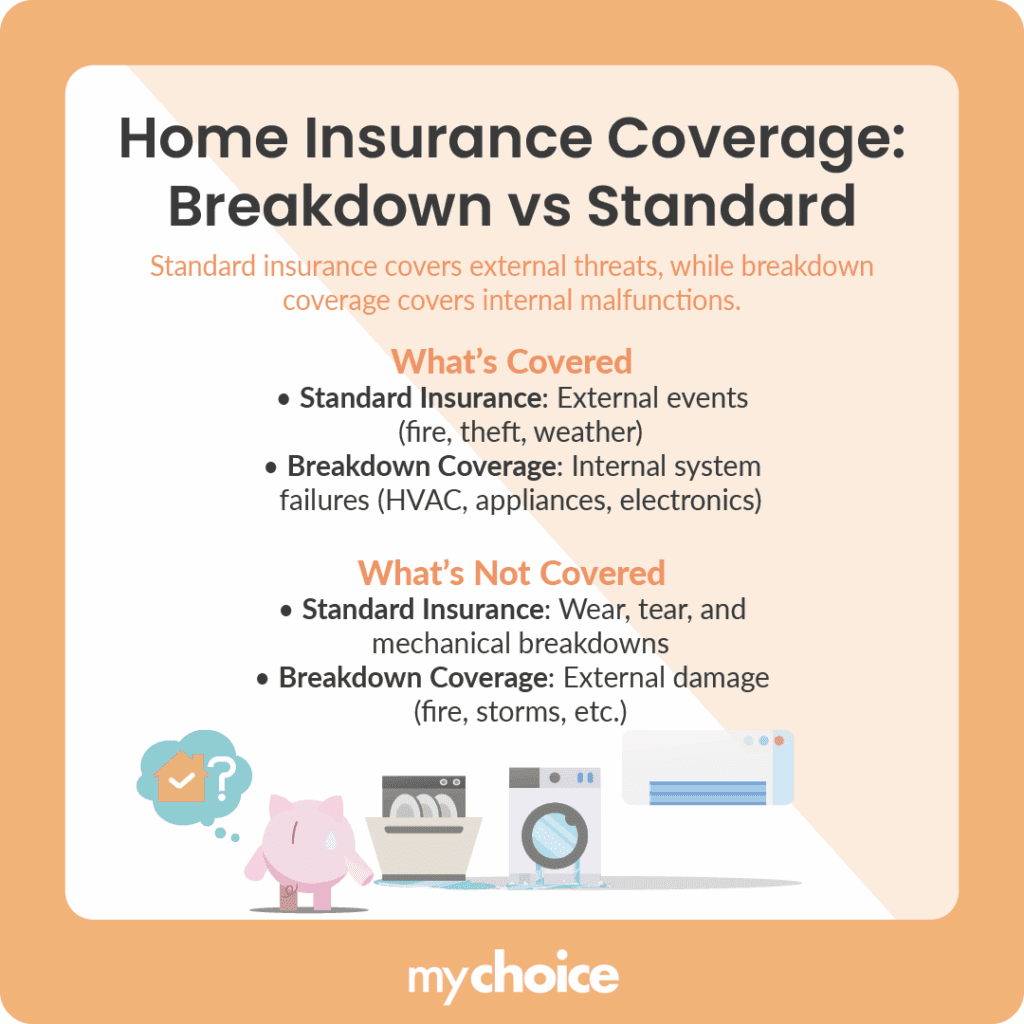

Home Insurance Breakdown Coverage vs Standard Home Insurance

The primary difference between home insurance breakdown coverage and standard home insurance is the risks they cover. Standard home insurance covers external events, also known as “perils,” such as fire, theft, vandalism, and natural disasters. It doesn’t cover:

- Wear and tear

- Age-related failure

- Internal malfunctions

Conversely, home insurance breakdown covers sudden and accidental mechanical failures of household systems like:

- Heating and cooling systems

- Kitchen and laundry appliances (i.e. dishwasher, laundry machine)

- Hot water heaters

- Electrical panels

- Home electronics

- Sump pumps

This insurance add-on isn’t tied to the age of your appliances or wear and tear. If a home system fails because of an internal issue, it will simply provide the coverage you need to replace it.

How Do I Add Home Insurance Breakdown Coverage to My Policy?

Adding home insurance breakdown coverage to your policy is straightforward. Just follow these steps:

Equipment Breakdown vs. Extended Warranty: Which Saves You More?

Getting equipment breakdown coverage is an excellent way to protect against system failures. But is an extended warranty cheaper?

Remember, extended warranties only apply to one specific device or appliance. Suppose you purchase a 5-year extended warranty on your fridge – it won’t cover anything else. On the other hand, equipment breakdown insurance covers all your major home appliances without requiring individual plans for each one.

Additionally, extended warranties in Canada are expensive. It’s not uncommon to pay up to 20% of the appliance’s original cost for a multi-year extended warranty. By comparison, equipment breakdown coverage won’t cost you more than $50 per year.

Duration-wise, extended warranties cover appliances for fixed periods, typically ranging from one to five years. After that, your appliance will be unprotected, unless you repurchase another extension. Equipment breakdown coverage lasts as long as you keep your policy active. It won’t “expire” as your individual appliances age.

Finally, you must consider payout and limits. Extended warranties will repair or replace the product, often with additional service call fees. Equipment insurance coverage will also cover repair and replacement costs, though they’ll do so up to your policy limit, which can be as high as $50,000 or more per incident.

Overall, extended warranties aren’t without merit. If you have a high-end appliance that requires specific protection, getting an extended warranty may be worth it. However, for the average Canadian homeowner, adding equipment breakdown coverage to your regular insurance will save you more money and eliminate the hassle of managing multiple extended warranties.

Why High-Tech Homes Need Equipment Breakdown Insurance

Modern homes are equipped with technology, which comes with the risk of equipment failures. As such, equipment breakdown insurance can go a long way if your home is filled with sensitive electronics.

Consider today’s smart refrigerators and app-controlled lights. While these high-tech features can make your life convenient, they are also prone to power surges and electrical disturbances. While fridges decades ago were primarily mechanical, their intelligent counterparts can shut down from a single voltage spike. Smart home systems are also often interconnected, and a single electrical incident can cause multiple failures.

Climate plays a significant role in how your home system works. With Canada’s winters becoming less cold, summers becoming hotter, and the overall increase in precipitation, the extreme temperatures can cause stress on advanced systems, causing voltage fluctuations and damage.

In addition, higher-tech home features have a higher replacement cost. You can avoid the budget-busting expenses of up to $5,000 by paying a small premium each year.

Key Advice from MyChoice

- While insurance can cover unexpected failures, regular home maintenance is still essential to prevent issues caused by neglect.

- Double-check the coverage limits and deductibles associated with your policy to ensure they meet your needs.

- Maintain an updated home inventory list, including purchase dates and maintenance records. Providing your insurer with proper documentation can ensure you get continued, adequate protection.