Traditionally, Atlantic Canada is protected from the major climate shocks seen in places like British Columbia or Alberta. However, that hasn’t been the case in recent years, as climate risk has been on the rise. With higher climate risk, your homes are more vulnerable to extreme weather events and natural disasters, meaning your home insurance risk also grows with it. Keep reading to learn more about why home insurance risk is rising in Atlantic Canada.

The Shift From ‘Low-Risk Region’ to Climate Hotspot

The traditional belief is that Atlantic Canada sees fewer wildfires, heatwaves, and floods than BC and Alberta. Unfortunately, shifts in climate due to rising ocean temperatures, increasing greenhouse gas levels, and other factors may have changed that.

According to the National Wildland Fire Situation Report, as of September 2025, over 700 wildland fires have been reported during the year’s wildfire season. In Newfoundland and New Brunswick specifically, the number of fires reported this year exceeded the provinces’ ten-year average, indicating a trend of rising wildfires.

Since fires are hazardous to homes, there’s a good chance that the rise in wildfire incidents will lead to increased home insurance risk.

Hurricane Risks Are Rising Fast

The Atlantic provinces are no strangers to hurricanes, with the first recorded one being the Newfoundland hurricane in 1775 that killed over 4,000 people. However, most hurricanes that hit Atlantic Canada are relatively weak due to the cooler waters off its shores.

Unfortunately, rising ocean temperatures are changing that, and hurricane risk in Atlantic Canada is steadily increasing. A notable example of how hurricanes can impact Atlantic Canada is Hurricane Fiona in 2022, which was the most costly weather event recorded in the region, causing at least $800 million in damage.

We’re referring to Hurricane Fiona in 2022, a major disaster that affected a significant number of people. However, there doesn’t have to be a major disaster to put your home at risk. Any hurricane impacting Atlantic Canada is a risk to your home, and with the odds of hurricanes making landfall in the region rising, so does your home insurance risk.

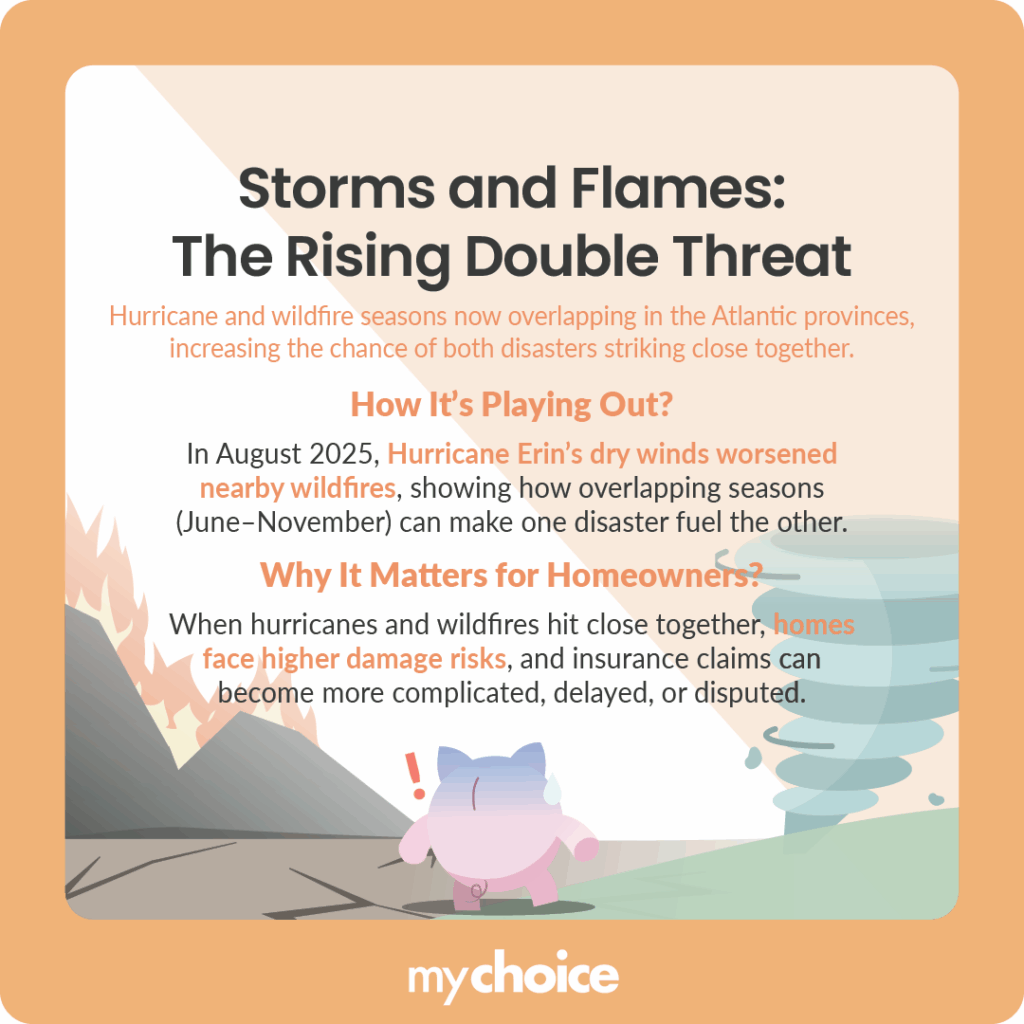

The Double Season Threat Explained (Hurricanes + Wildfires)

Wildfires and hurricanes are destructive enough on their own. If your home is in the path of a hurricane or wildfire, there’s a good chance your home might suffer considerable damage, which may lead to insurers having to pay out a lot of money to repair the damage.

However, when these two events work in tandem, they may pose an even greater threat to your home than either would individually. A good recent example of this is Hurricane Erin in August 2025. While the hurricane itself didn’t make landfall, its strong, dry winds were expected to fan the wildfires and worsen conditions for nearby communities and firefighters.

This poses an even greater risk, as hurricane season in Atlantic Canada typically runs from June to November. Meanwhile, wildfire seasons can extend into November, as we’ve seen with the 2023 and 2024 wildfires. The longer hurricane and wildfire seasons overlap, the higher the chances they can “team up” to make matters worse for people in nearby communities.

In terms of home insurance, the issue isn’t just about your home being more vulnerable to damage from either of these causes. Your claims are likely going to become more complex as insurers may not be prepared for these compound risk events. Essentially, your insurer may be split when classifying the damage source in more ambiguous cases, meaning it might not be clear which peril clause you’re covered under, leading to longer claims processing and potential insurance payment disputes.

How These Climate Risks Translate into Increased Costs for Homeowners

Climate risks like severe storms and wildfires don’t just put your home at more risk. Some cost-related issues may arise when your home is located in areas with frequent severe weather incidents. Let’s take a look:

What Homeowners Can Do to Stay Protected

When living in an area that’s prone to wildfires, hurricanes, and other severe weather incidents, it pays to be prepared. Here are three key tips to keep your home protected:

Key Advice from MyChoice

- To get the most value out of your insurance policy in Atlantic Canada, learn what risks are common in your area and get the proper insurance coverage options to counter them.

- Protect your home from extensive damage by implementing weather-resistant measures and materials.

- Keep a close eye on local news and alerts so you’re not caught off guard when an extreme weather incident is about to occur.